Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Completion Status: Rebecca and Michael have gross incomes of $80,000 and $108,000 respectively. What is their combined gross income? If they have no adjustments,

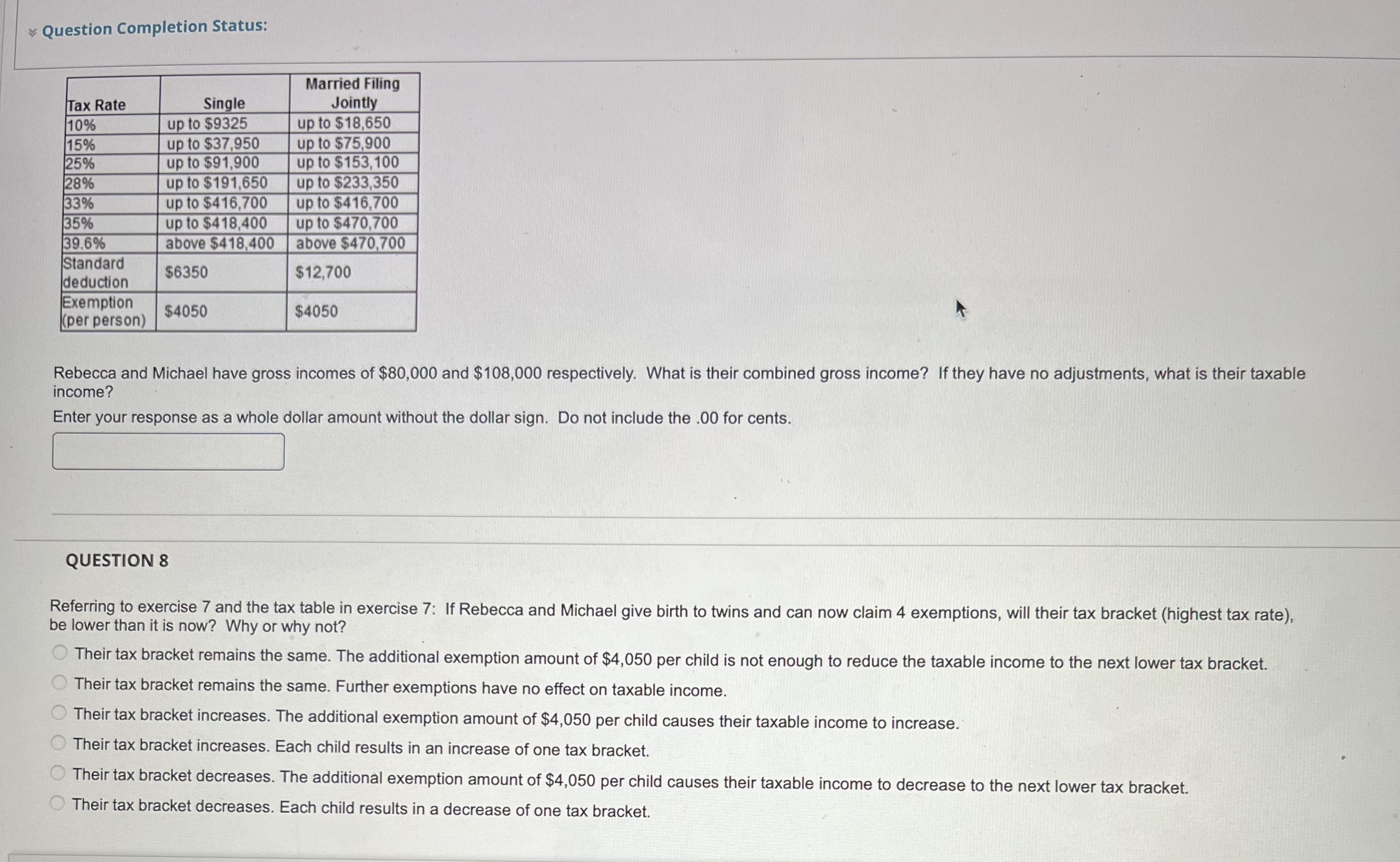

Question Completion Status: Rebecca and Michael have gross incomes of $80,000 and $108,000 respectively. What is their combined gross income? If they have no adjustments, what is their taxable income? Enter your response as a whole dollar amount without the dollar sign. Do not include the .00 for cents. QUESTION 8 Referring to exercise 7 and the tax table in exercise 7: If Rebecca and Michael give birth to twins and can now claim 4 exemptions, will their tax bracket (highest tax rate), be lower than it is now? Why or why not? Their tax bracket remains the same. The additional exemption amount of $4,050 per child is not enough to reduce the taxable income to the next lower tax bracket. Their tax bracket remains the same. Further exemptions have no effect on taxable income. Their tax bracket increases. The additional exemption amount of $4,050 per child causes their taxable income to increase. Their tax bracket increases. Each child results in an increase of one tax bracket. Their tax bracket decreases. The additional exemption amount of $4,050 per child causes their taxable income to decrease to the next lower tax bracket. Their tax bracket decreases. Each child results in a decrease of one tax bracket

Question Completion Status: Rebecca and Michael have gross incomes of $80,000 and $108,000 respectively. What is their combined gross income? If they have no adjustments, what is their taxable income? Enter your response as a whole dollar amount without the dollar sign. Do not include the .00 for cents. QUESTION 8 Referring to exercise 7 and the tax table in exercise 7: If Rebecca and Michael give birth to twins and can now claim 4 exemptions, will their tax bracket (highest tax rate), be lower than it is now? Why or why not? Their tax bracket remains the same. The additional exemption amount of $4,050 per child is not enough to reduce the taxable income to the next lower tax bracket. Their tax bracket remains the same. Further exemptions have no effect on taxable income. Their tax bracket increases. The additional exemption amount of $4,050 per child causes their taxable income to increase. Their tax bracket increases. Each child results in an increase of one tax bracket. Their tax bracket decreases. The additional exemption amount of $4,050 per child causes their taxable income to decrease to the next lower tax bracket. Their tax bracket decreases. Each child results in a decrease of one tax bracket Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started