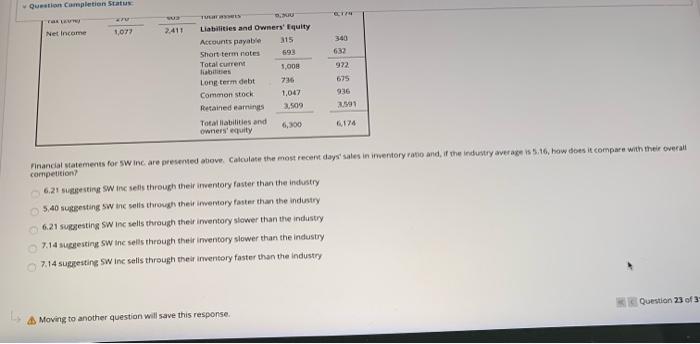

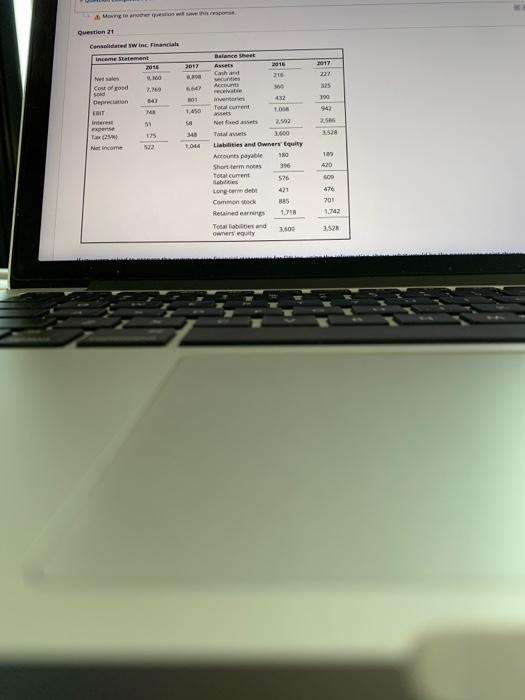

Question completion Status w 1,073 Net Income 2,411 340 632 TURIN U Liabilities and Owners' Equity Accounts payable 315 Short term notes Total current 1,000 labies Long term debt Common stock Retained earnings 3.509 Total liabilities and 6.300 owners' equity 736 1.047 922 675 936 174 Financial statements for swing are presented above. Calculate the most recent days' sales in inventory ano and, if the industry average is 5.16, how does it compare with their overall competition? 6.2 Sting SW in sets through their inventory faster than the industry 5.40 sugesting Swine sells through their inwertery Poster than the industry 6.21 sustine SW in sells through their inventory slower than the industry 7.14 sugestiny SW Ine sells through their inventory slower than the industry 7.14 suggesting SW in sells through their inventory faster than the industry Question 23 of 3 Moving to another question will save this response. Assets Cash and seus 2016 210 227 Question 21 Cenalidated w Int. Financial income Statement 2016 2017 et sales Costood Z. SO Depan 10 OS EDIT 14 51 Tax 34 Netcome 104 cevi 790 25 2528 Total current ws Neted 2.592 Tales 3.600 Liabilities and Owners Equity 10 Accounts payable Short termos 356 Total current Babe Long terme debe Common stock Retained earnings 1.718 Tosal abilities and 3.100 owners equity 19 420 con 700 1.72 3.52 Question completion Status w 1,073 Net Income 2,411 340 632 TURIN U Liabilities and Owners' Equity Accounts payable 315 Short term notes Total current 1,000 labies Long term debt Common stock Retained earnings 3.509 Total liabilities and 6.300 owners' equity 736 1.047 922 675 936 174 Financial statements for swing are presented above. Calculate the most recent days' sales in inventory ano and, if the industry average is 5.16, how does it compare with their overall competition? 6.2 Sting SW in sets through their inventory faster than the industry 5.40 sugesting Swine sells through their inwertery Poster than the industry 6.21 sustine SW in sells through their inventory slower than the industry 7.14 sugestiny SW Ine sells through their inventory slower than the industry 7.14 suggesting SW in sells through their inventory faster than the industry Question 23 of 3 Moving to another question will save this response. Assets Cash and seus 2016 210 227 Question 21 Cenalidated w Int. Financial income Statement 2016 2017 et sales Costood Z. SO Depan 10 OS EDIT 14 51 Tax 34 Netcome 104 cevi 790 25 2528 Total current ws Neted 2.592 Tales 3.600 Liabilities and Owners Equity 10 Accounts payable Short termos 356 Total current Babe Long terme debe Common stock Retained earnings 1.718 Tosal abilities and 3.100 owners equity 19 420 con 700 1.72 3.52