Answered step by step

Verified Expert Solution

Question

1 Approved Answer

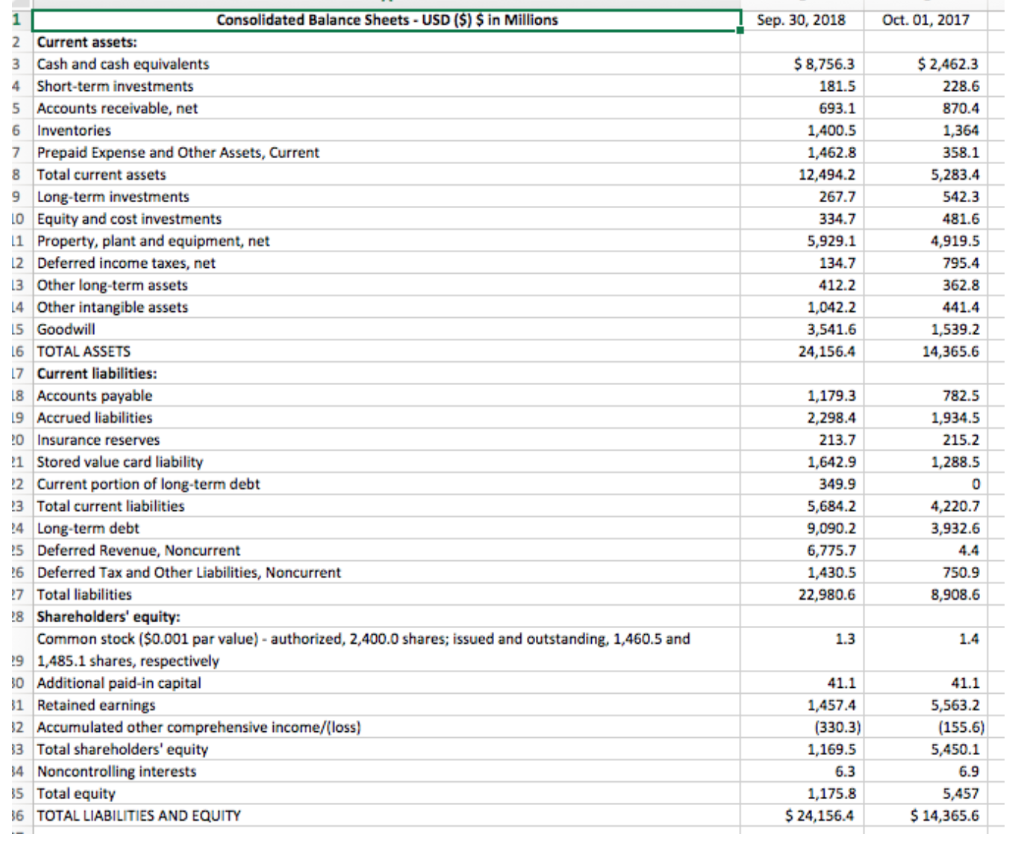

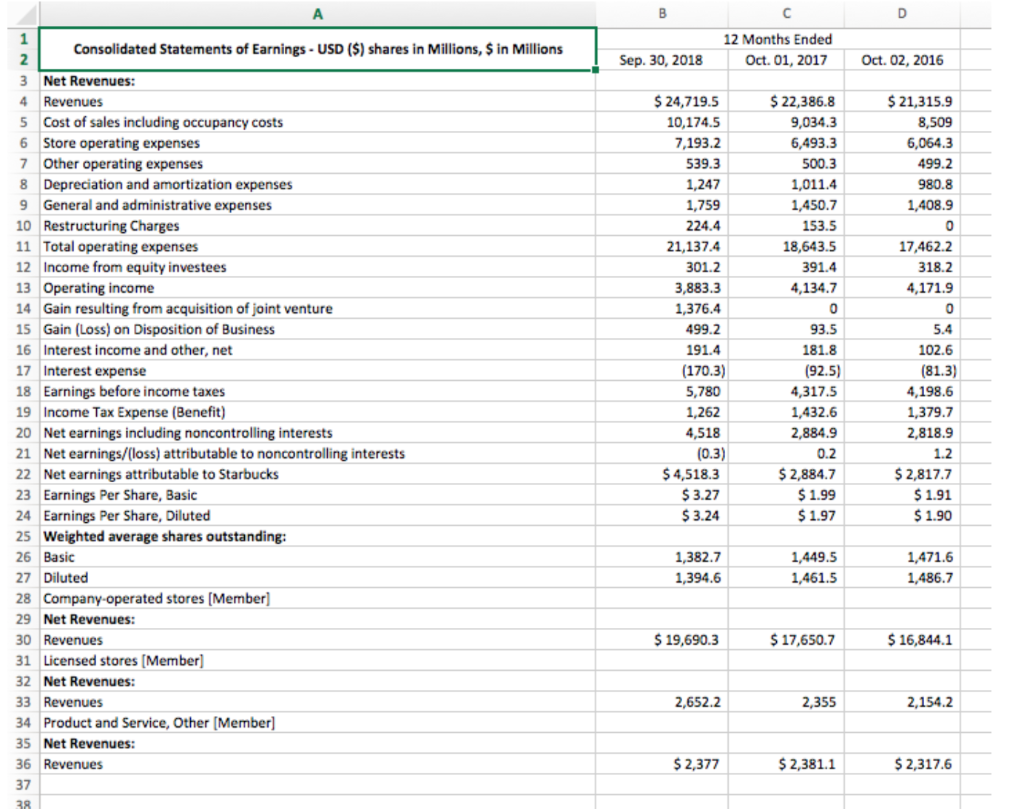

Question: Compute only the percentage change from 2017 to 2018 for each account on the balance sheet. * these are the balance sheet and income

Question: Compute only the percentage change from 2017 to 2018 for each account on the balance sheet.

Question: Compute only the percentage change from 2017 to 2018 for each account on the balance sheet.

* these are the balance sheet and income statement*

Sep. 30, 2018 Oct. 01, 2017 $ 8,756.3 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 $ 2,462.3 228.6 870.4 1,364 358.1 5,283.4 542.3 481.6 4,919.5 795.4 362.8 441.4 1,539.2 14,365.6 Consolidated Balance Sheets - USD ($) $ in Millions 2 Current assets: 3 Cash and cash equivalents 4 Short-term investments 5 Accounts receivable, net 6 Inventories 7 Prepaid Expense and Other Assets, Current 8 Total current assets 9 Long-term investments LO Equity and cost investments 11 Property, plant and equipment, net L2 Deferred income taxes, net 13 Other long-term assets 14 Other intangible assets 15 Goodwill L6 TOTAL ASSETS 17 Current liabilities: 18 Accounts payable 19 Accrued liabilities !0 Insurance reserves 11 Stored value card liability !2 Current portion of long-term debt 13 Total current liabilities 14 Long-term debt 15 Deferred Revenue, Noncurrent !6 Deferred Tax and Other Liabilities, Noncurrent 17 Total liabilities 18 Shareholders' equity: Common stock ($0.001 par value) - authorized, 2,400.0 shares; issued and outstanding, 1,460.5 and 19 1,485.1 shares, respectively 30 Additional paid-in capital 31 Retained earnings 12 Accumulated other comprehensive income/(loss) 33 Total shareholders' equity 34 Noncontrolling interests 35 Total equity 36 TOTAL LIABILITIES AND EQUITY 782.5 1,934.5 215.2 1,288.5 1,179.3 2,298.4 213.7 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 4,220.7 3,932.6 750.9 8,908.6 1.3 1.4 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 $ 24,156.4 41.1 5,563.2 (155.6) 5,450.1 6.9 5,457 $ 14,365.6 A Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions Sep 30, 2018 12 Months Ended Oct. 01, 2017 Oct. 02, 2016 $ 22,386.8 9,034.3 6,493.3 500.3 1,011.4 1,450.7 153.5 18,643.5 391.4 4,134.7 $ 21,315.9 8,509 6,064.3 499.2 980.8 1,408.9 17,462.2 318.2 4,171.9 3 Net Revenues: Revenues 5 Cost of sales including occupancy costs 6 Store operating expenses 7 Other operating expenses 8 Depreciation and amortization expenses 9 General and administrative expenses 10 Restructuring Charges 11 Total operating expenses 12 Income from equity investees 13 Operating income 14 Gain resulting from acquisition of joint venture 15 Gain (Loss) on Disposition of Business 16 Interest income and other, net 17 Interest expense 18 Earnings before income taxes 19 Income Tax Expense (Benefit) 20 Net earnings including noncontrolling interests 21 Net earnings/(loss) attributable to noncontrolling interests 22 Net earnings attributable to Starbucks 23 Earnings Per Share, Basic 24 Earnings Per Share, Diluted 25 Weighted average shares outstanding: 26 Basic 27 Diluted 28 Company-operated stores (Member) 29 Net Revenues: 30 Revenues 31 Licensed stores (Member) 32 Net Revenues: 33 Revenues 34 Product and Service, Other (Member) 35 Net Revenues: 36 Revenues $ 24,719.5 10,174.5 7,193.2 539.3 1,247 1,759 224.4 21,137.4 301.2 3,883.3 1,376.4 499.2 191.4 (170.3) 5,780 1,262 4,518 (0.3) $ 4,518.3 $ 3.27 $ 3.24 93.5 181.8 (92.5) 4,317.5 1,432.6 2,884.9 0.2 $ 2,884.7 $ 1.99 $ 1.97 5.4 102.6 (81.3) 4,198.6 1,379.7 2,818.9 1.2 $ 2,817.7 $ 1.91 $ 1.90 1,382.7 1,394.6 1,449.5 1,461.5 1,471.6 1,486.7 $ 19,690.3 $ 17,650.7 $ 16,844.1 2,652.2 2,355 2,154.2 $ 2,377 $ 2,381.1 $ 2,317.6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started