Question

QUESTION: Cost of Goods Manufactured and Sold LeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information

QUESTION:

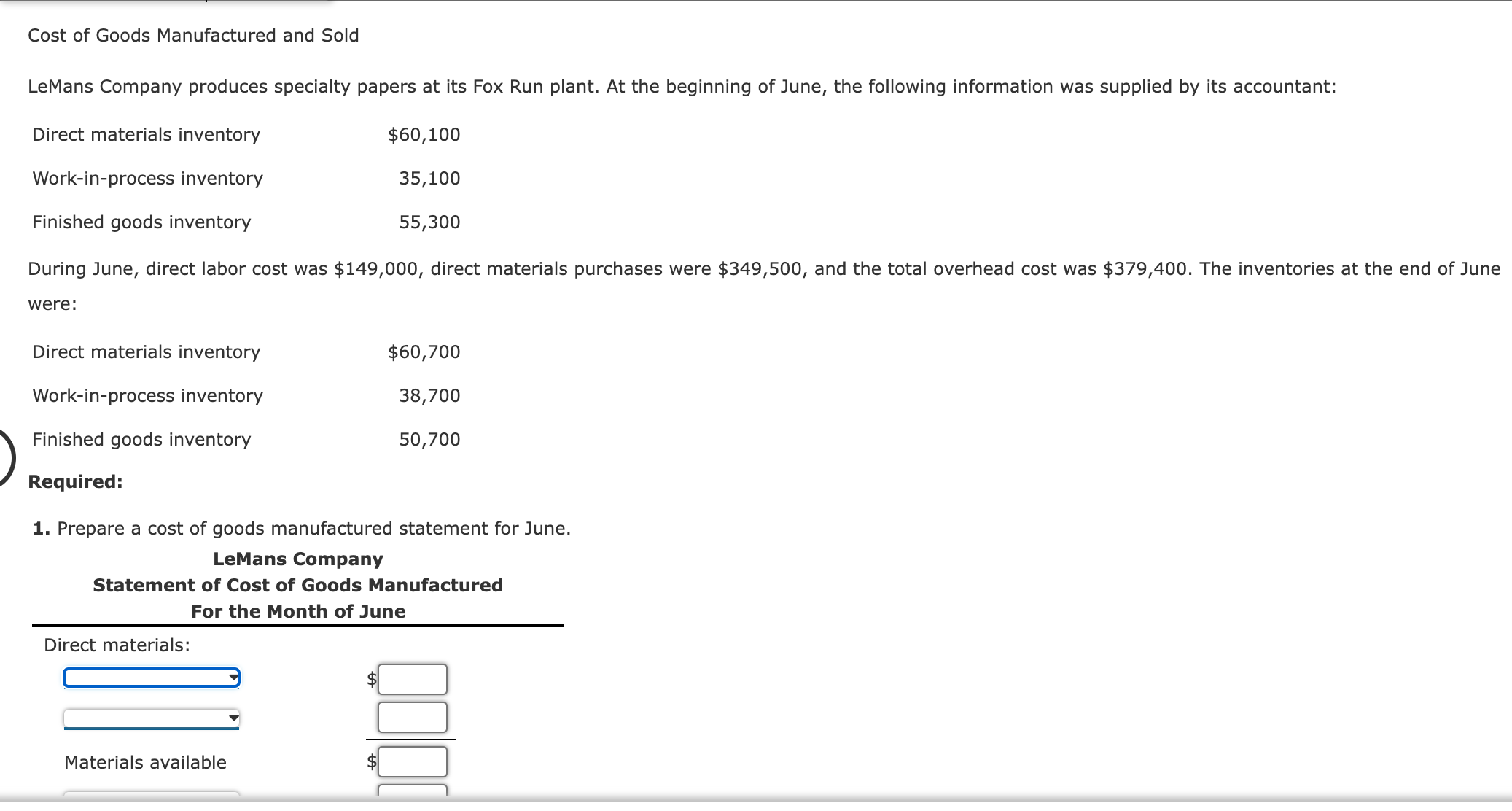

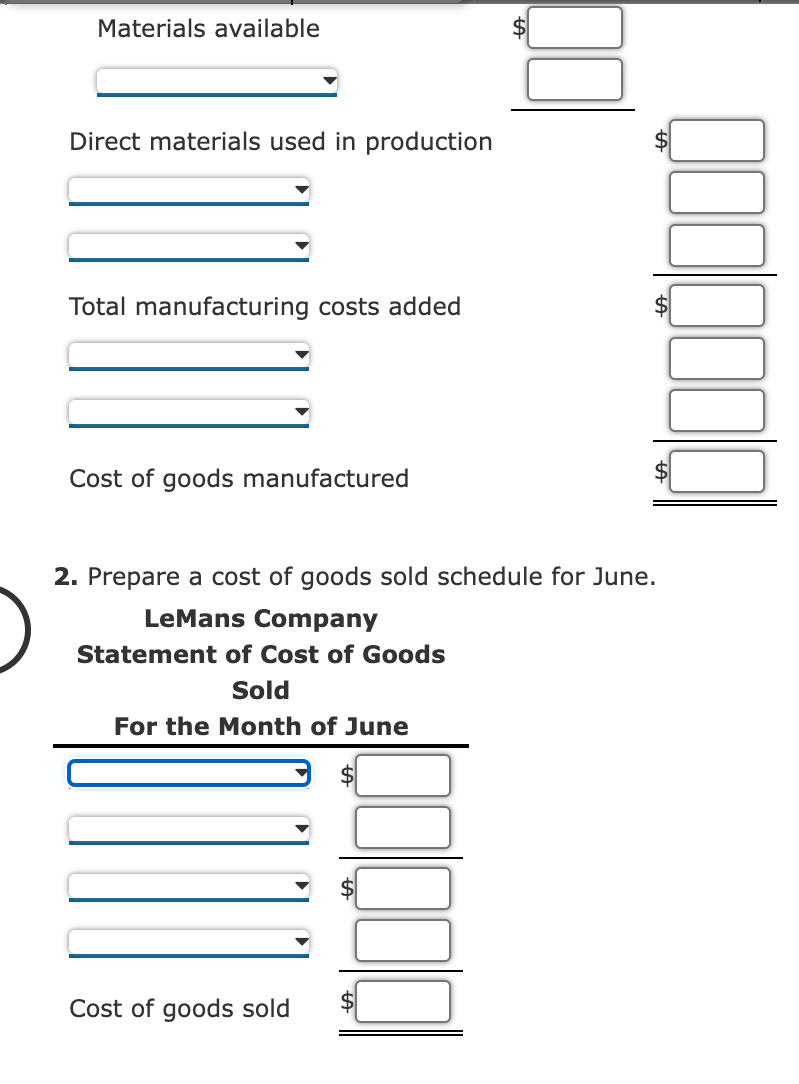

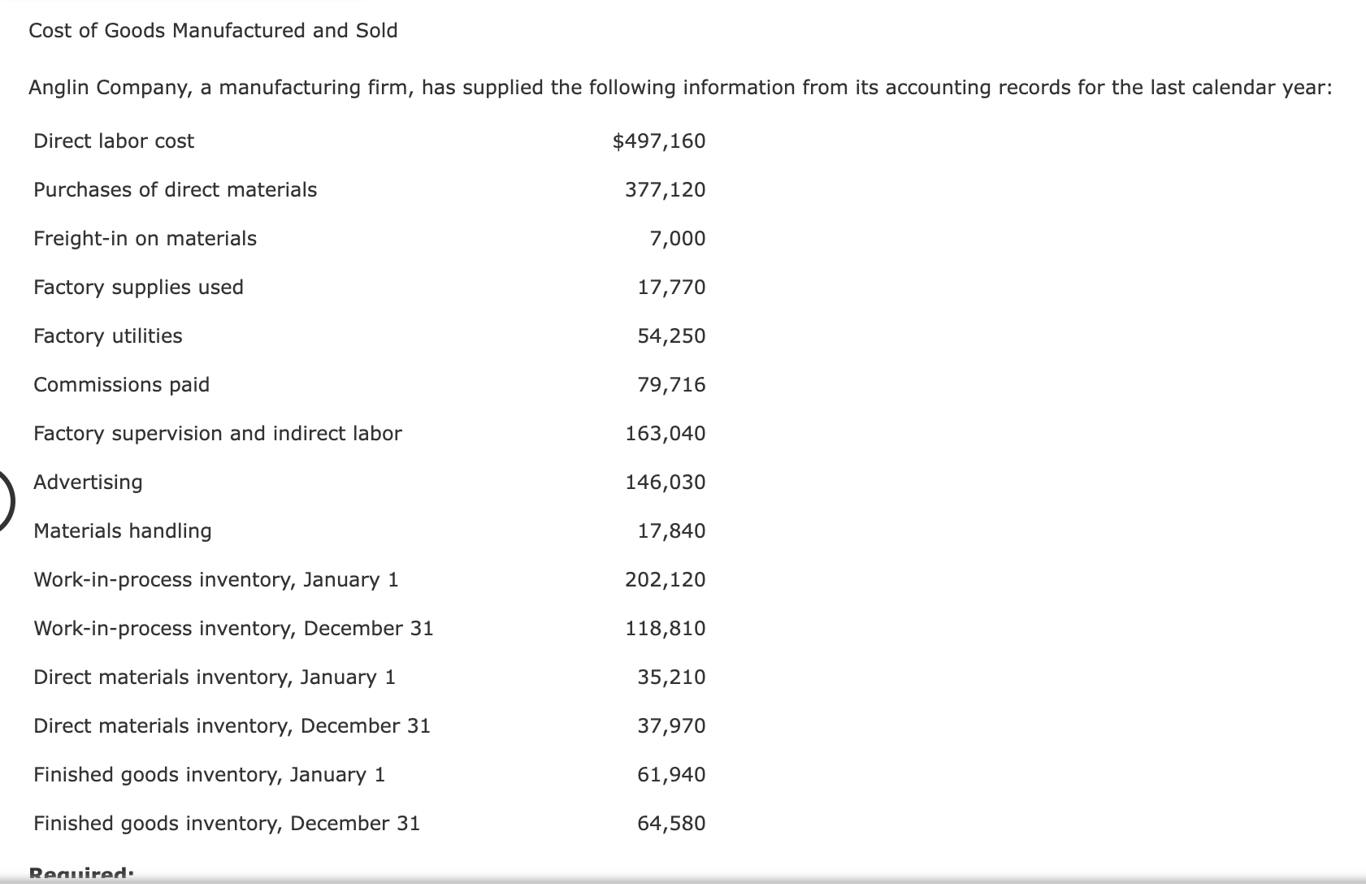

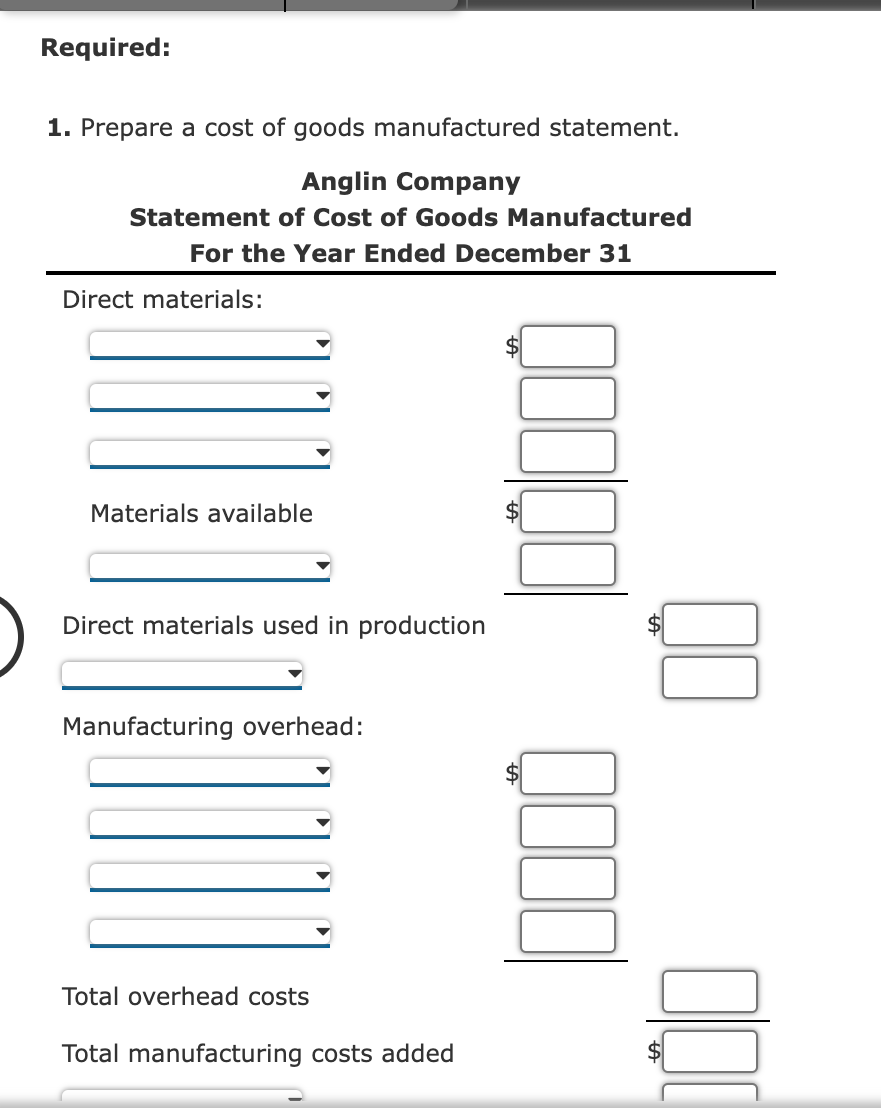

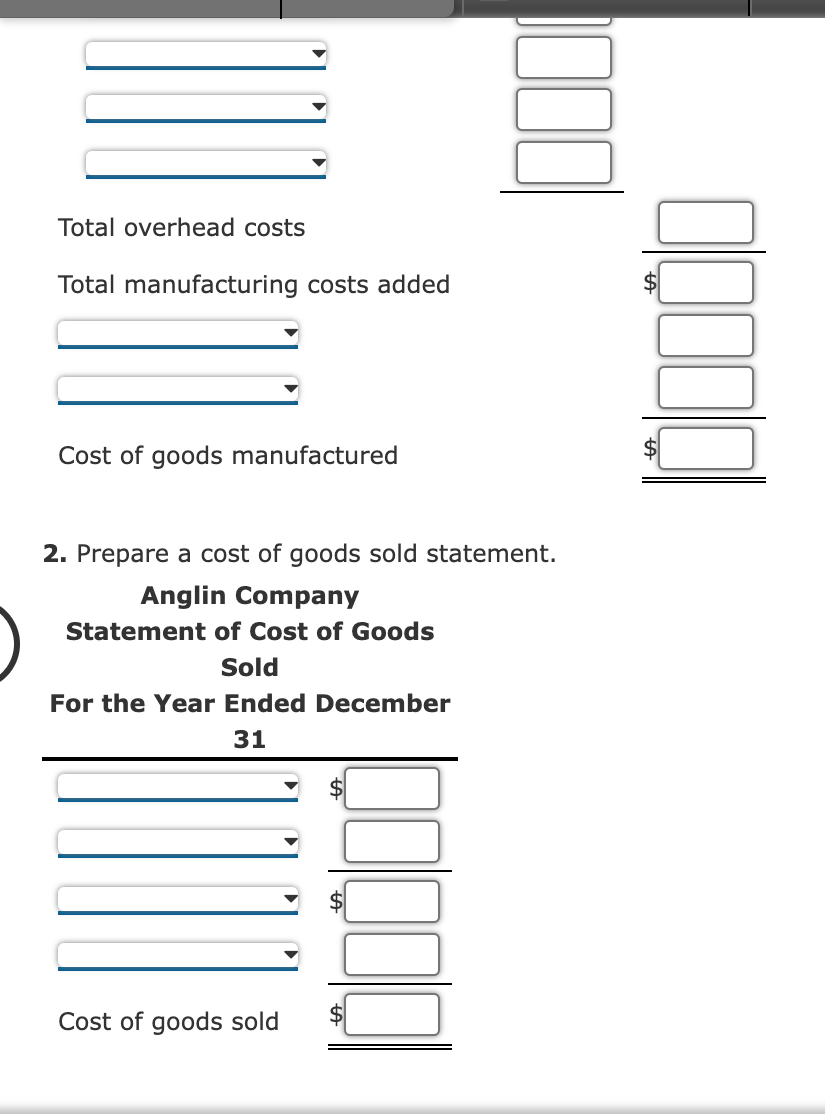

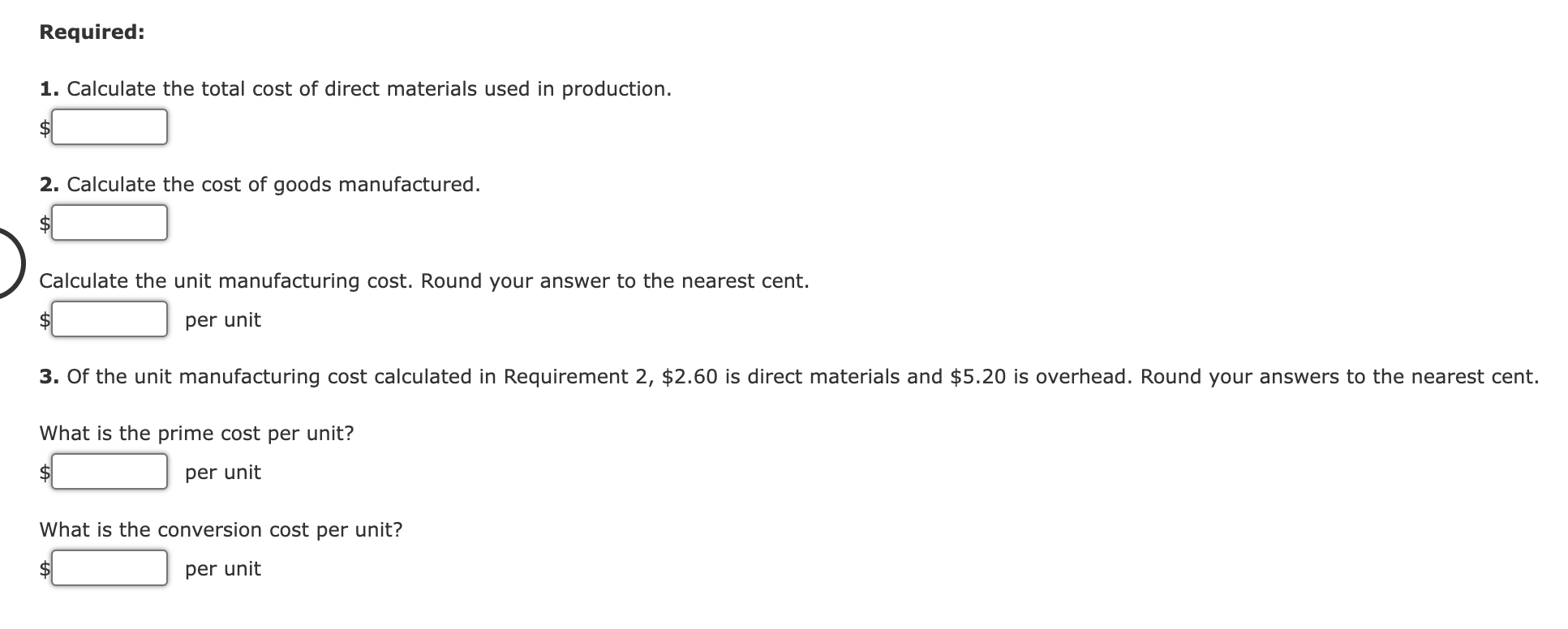

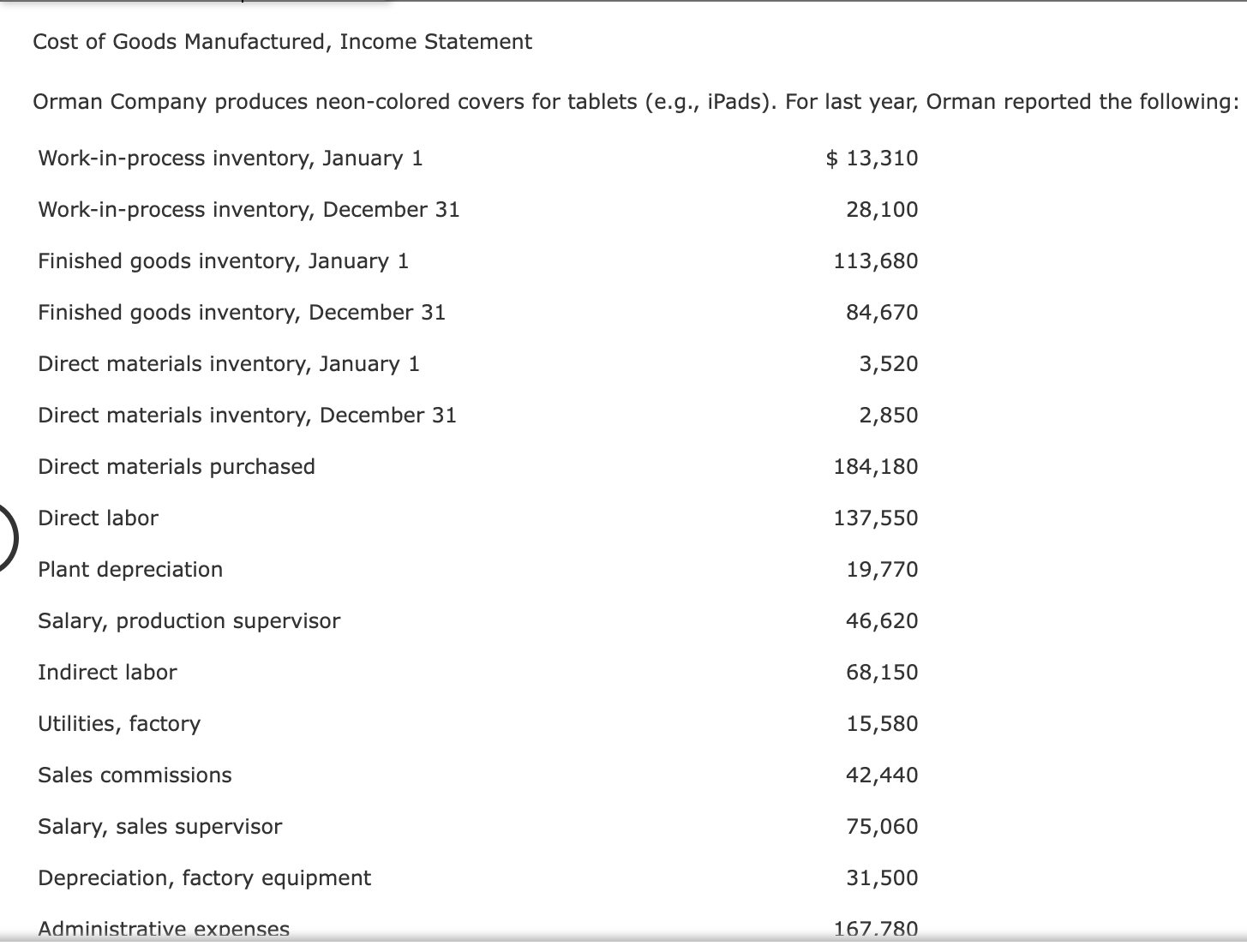

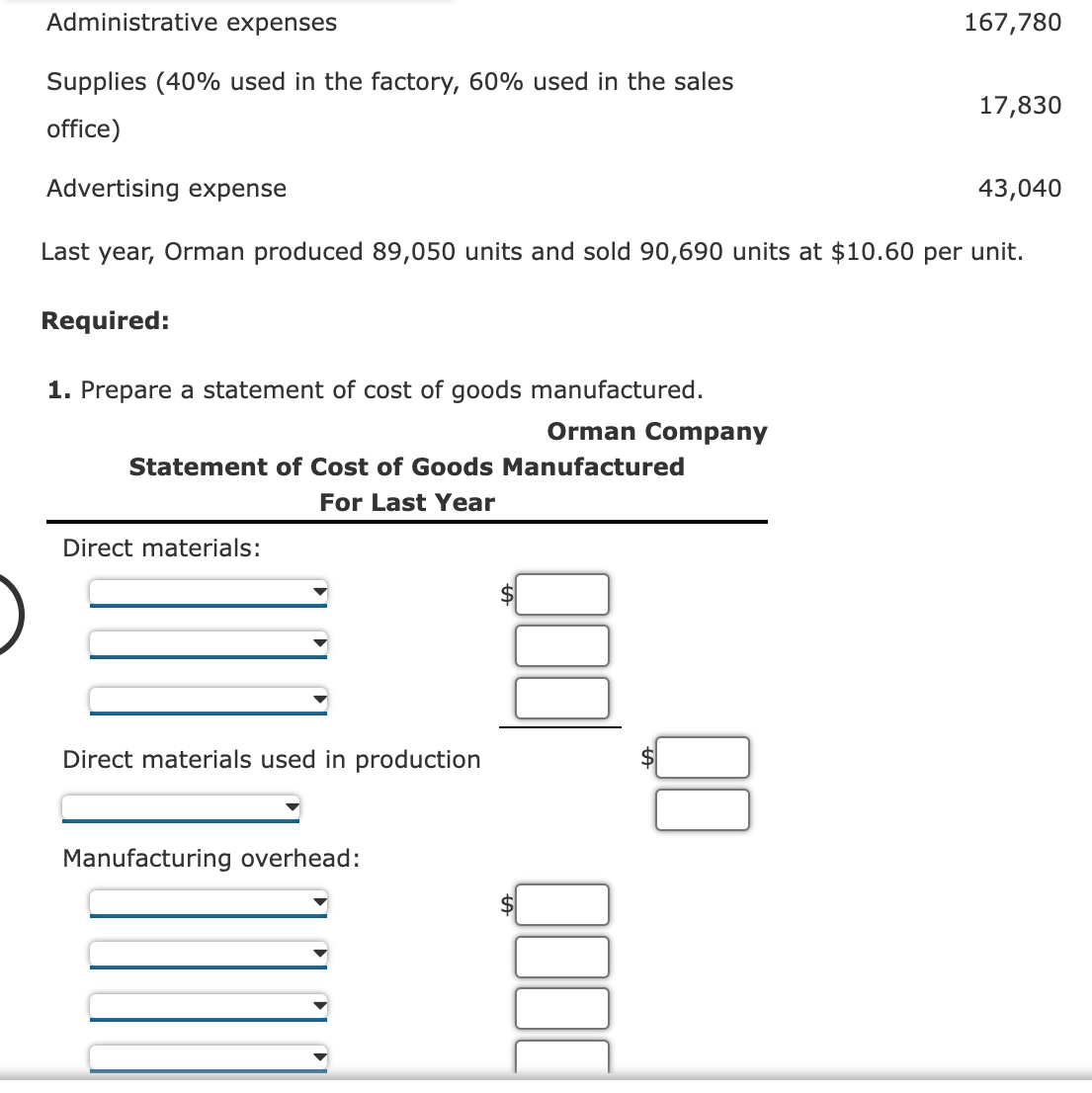

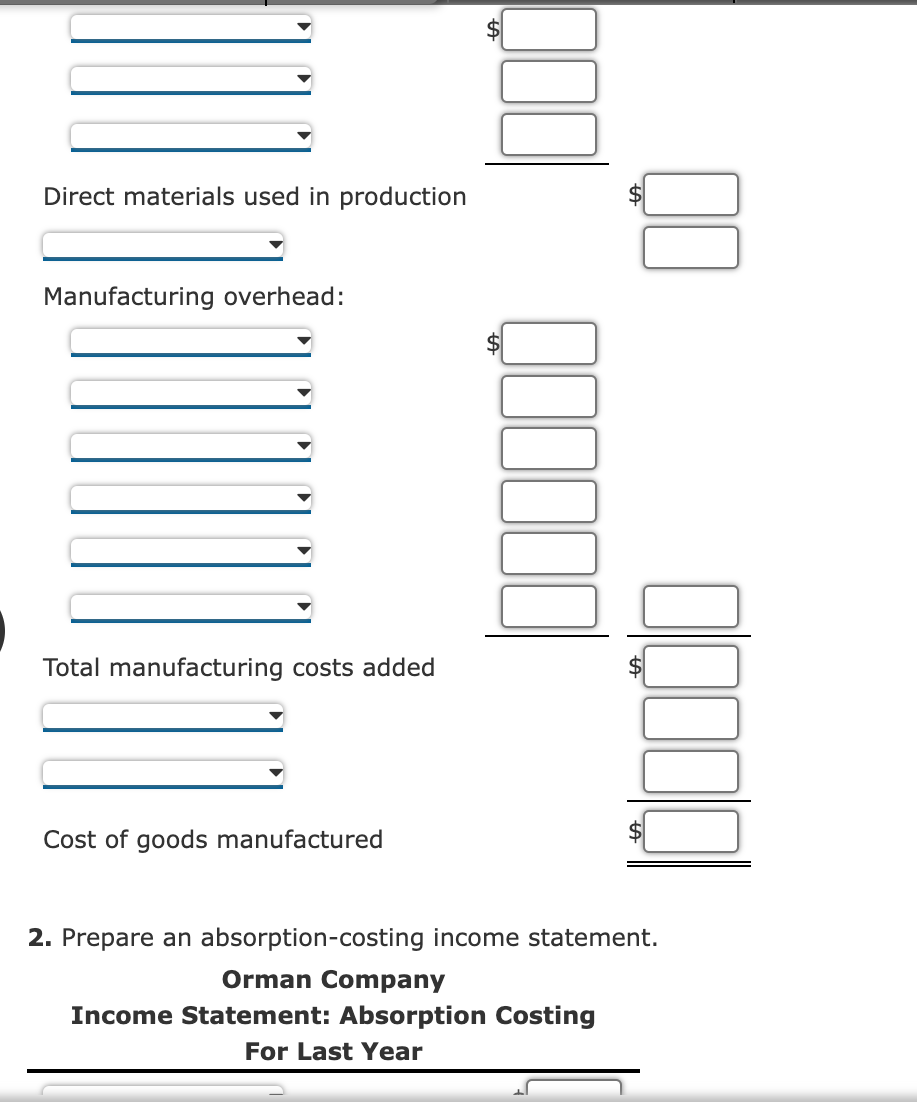

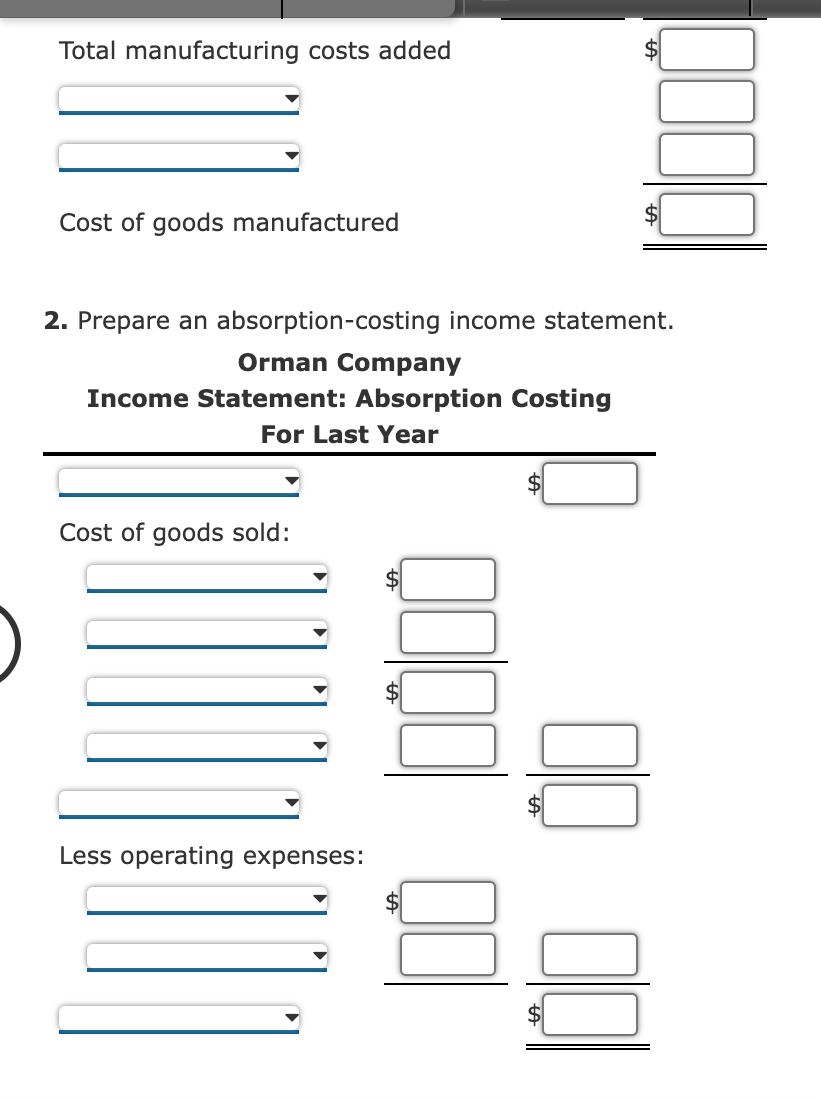

Cost of Goods Manufactured and Sold LeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: Direct materials inventory $60,100 Work-in-process inventory Finished goods inventory 35,100 55,300 During June, direct labor cost was $149,000, direct materials purchases were $349,500, and the total overhead cost was $379,400. The inventories at the end of June were: Direct materials inventory $60,700 Work-in-process inventory 38,700 Finished goods inventory 50,700 Required: 1. Prepare a cost of goods manufactured statement for June. LeMans Company Statement of Cost of Goods Manufactured For the Month of June Direct materials: Materials available $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones Of Cost Management

Authors: Don R. Hansen, Maryanne M. Mowen

3rd Edition

9781305147102, 1285751787, 1305147103, 978-1285751788

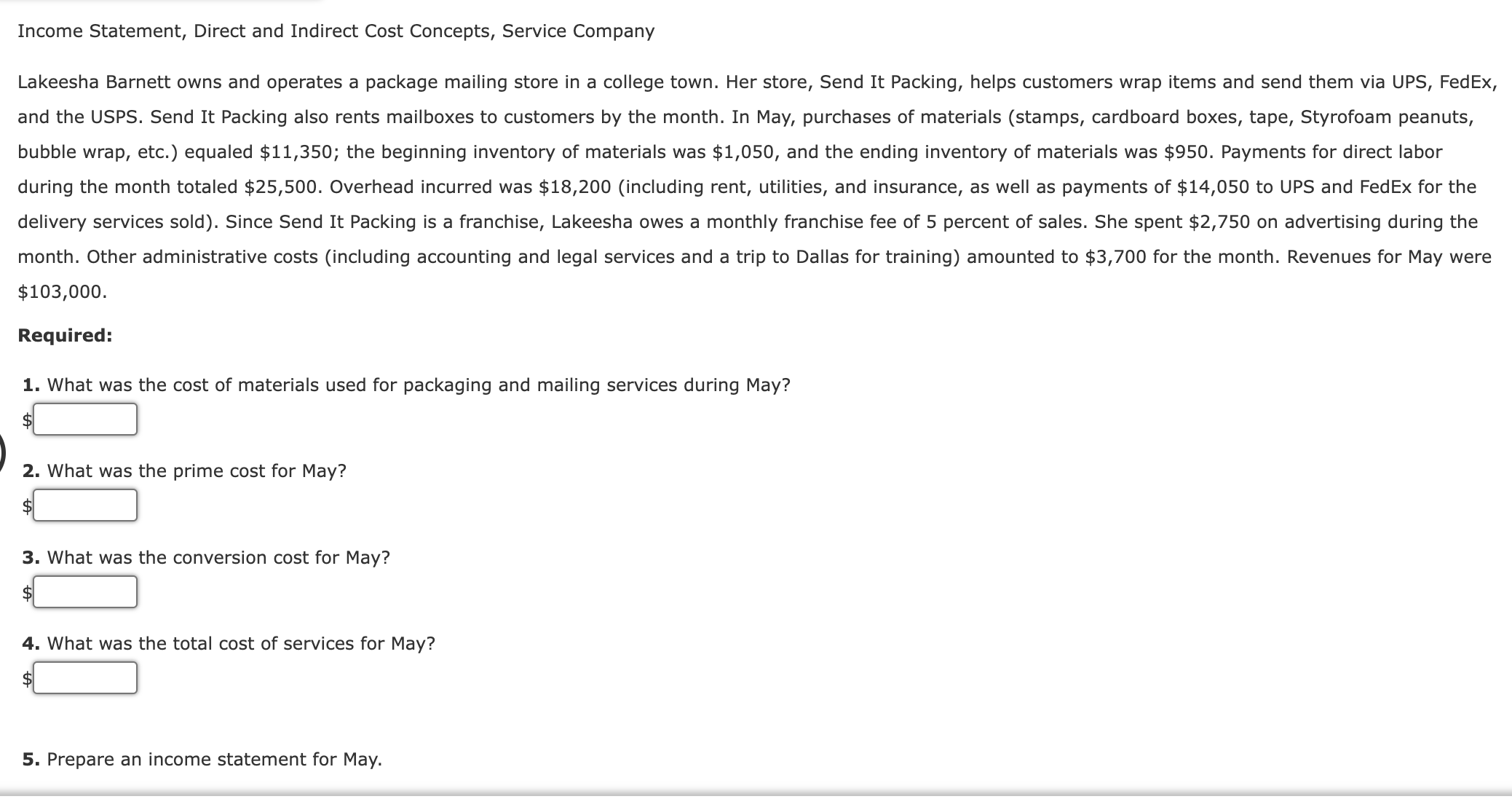

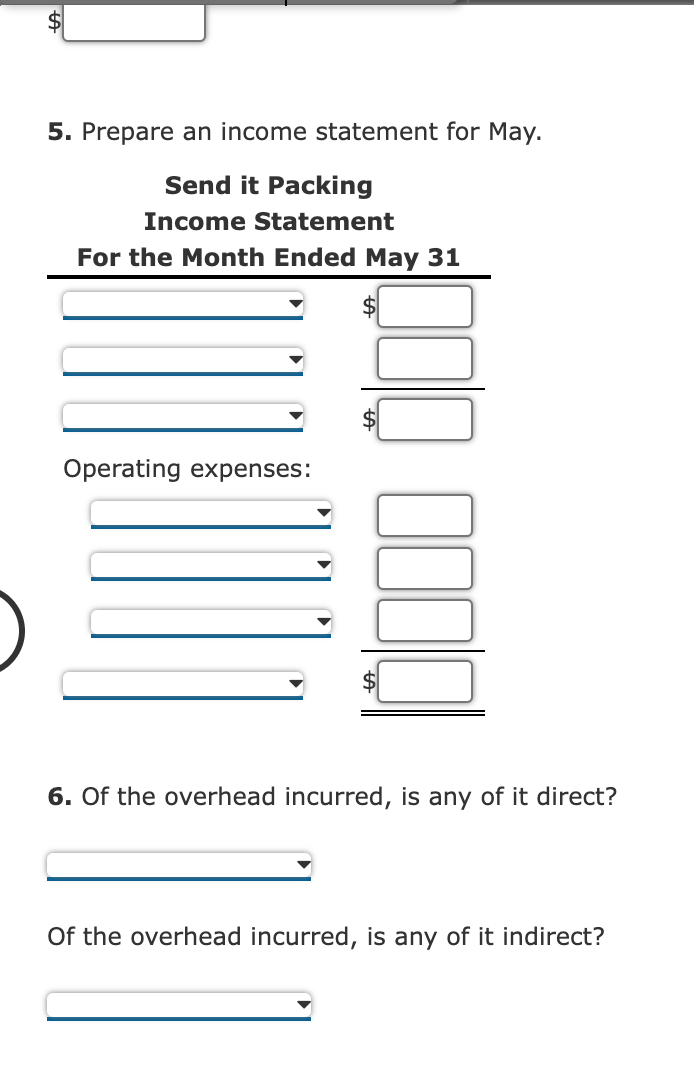

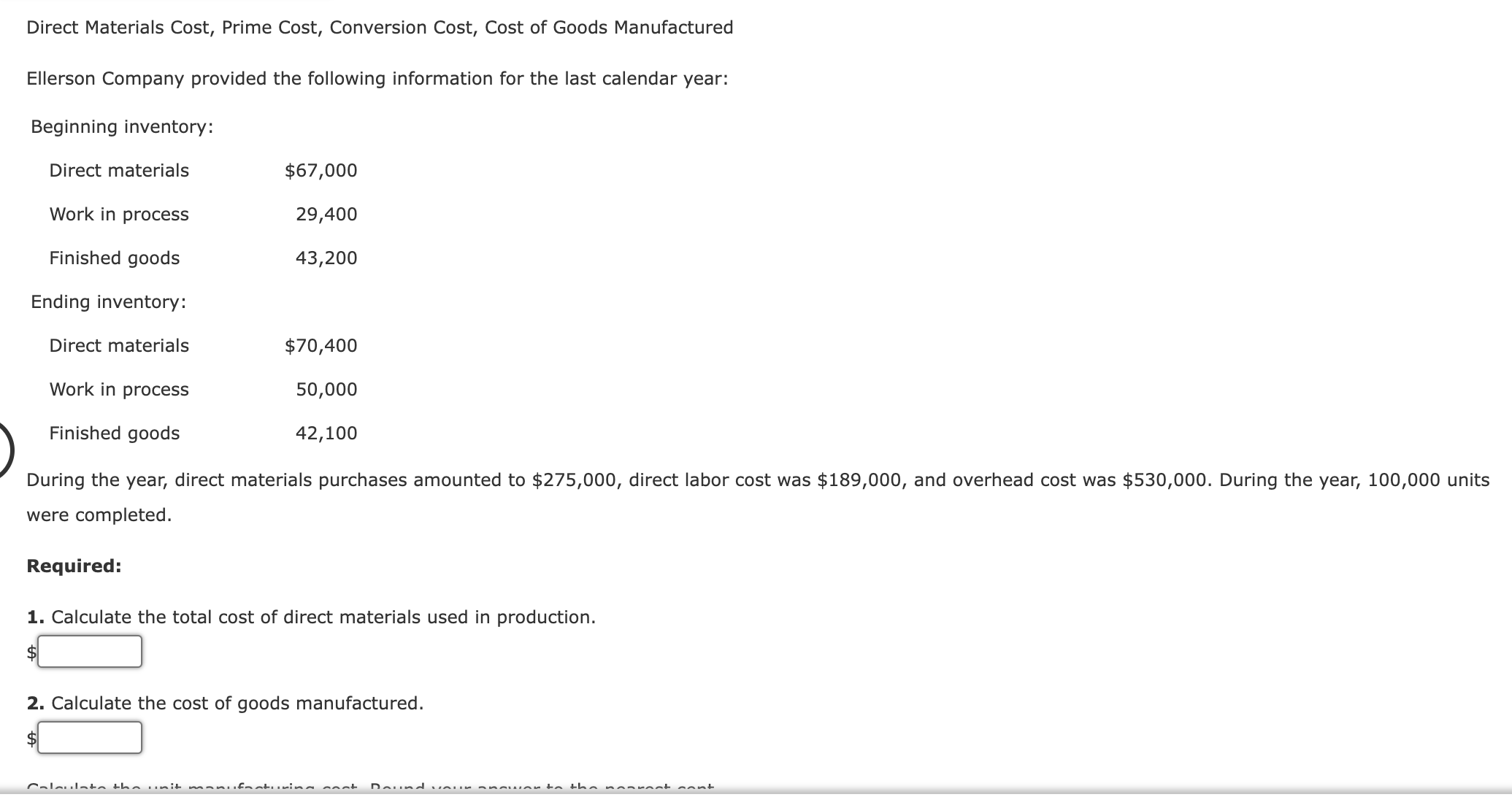

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App