Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Curvey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, to keep clerical and

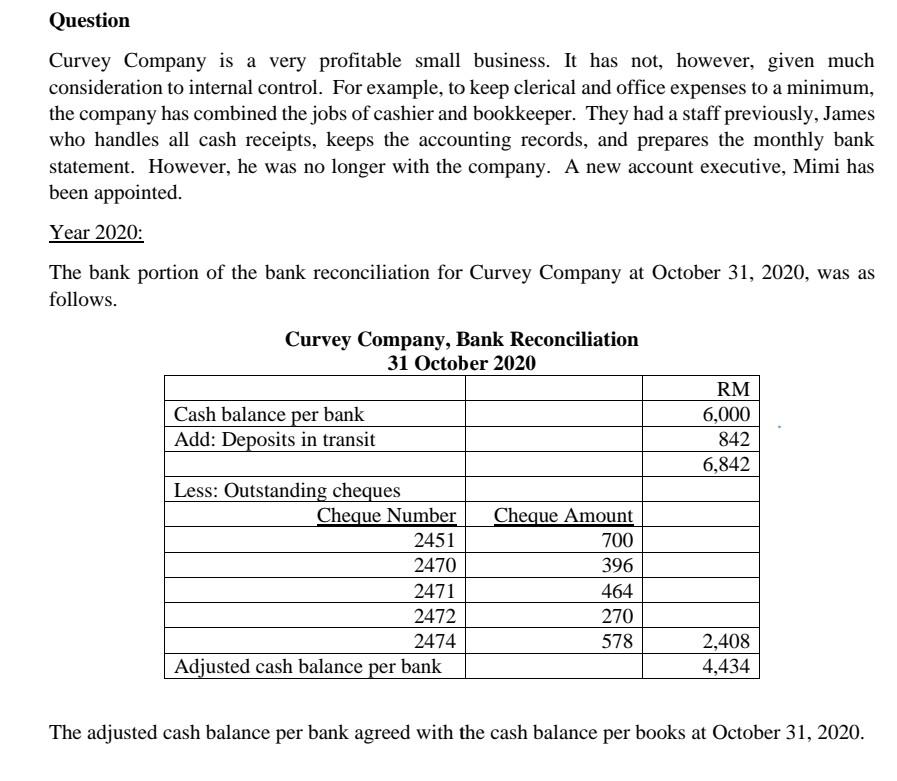

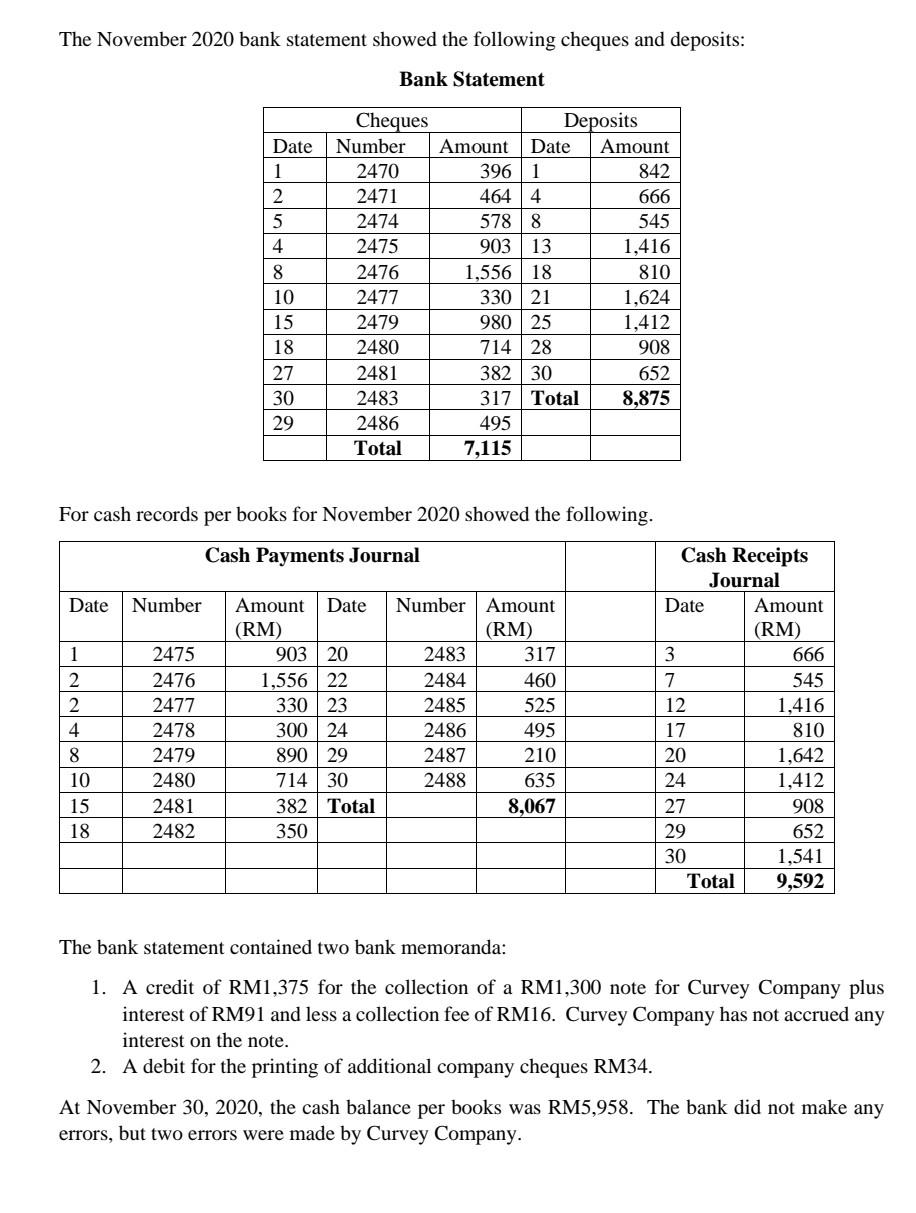

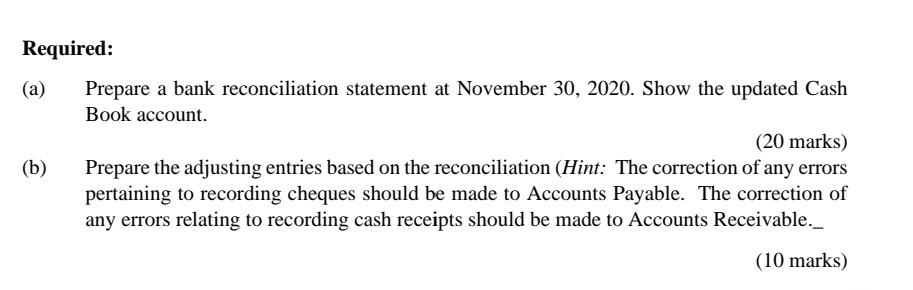

Question Curvey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. They had a staff previously, James who handles all cash receipts, keeps the accounting records, and prepares the monthly bank statement. However, he was no longer with the company. A new account executive, Mimi has been appointed. Year 2020: The bank portion of the bank reconciliation for Curvey Company at October 31, 2020, was as follows. Curvey Company, Bank Reconciliation 31 October 2020 Cash balance per bank Add: Deposits in transit RM 6,000 842 6,842 Less: Outstanding cheques Cheque Number 2451 2470 2471 2472 2474 Adjusted cash balance per bank Cheque Amount 700 396 464 270 578 2,408 4,434 The adjusted cash balance per bank agreed with the cash balance per books at October 31, 2020. The November 2020 bank statement showed the following cheques and deposits: Bank Statement Date 1 2 5 4 8 10 15 18 27 30 29 Cheques Deposits Number Amount Date Amount 2470 3961 842 2471 4644 666 2474 5788 545 2475 90313 1,416 2476 1,556 18 810 2477 330 21 1,624 2479 980 25 1,412 2480 714 28 908 2481 382 30 652 2483 317 Total 8,875 2486 495 Total 7,115 For cash records per books for November 2020 showed the following. Cash Payments Journal Cash Receipts Journal Date Number Amount Date Number Amount Date Amount (RM) (RM) (RM) 1 2475 903 | 20 2483 317 3 666 2 2476 1,55622 2484 460 7 545 2 2477 330 23 2485 525 12 1,416 4 2478 300 24 2486 495 17 810 8 2479 890 29 2487 210 20 1,642 10 2480 714 30 2488 635 24 1,412 15 2481 382 Total 8,067 27 908 18 2482 350 29 652 30 1,541 Total 9,592 The bank statement contained two bank memoranda: 1. A credit of RM1,375 for the collection of a RM1,300 note for Curvey Company plus interest of RM91 and less a collection fee of RM16. Curvey Company has not accrued any interest on the note. 2. A debit for the printing of additional company cheques RM34. At November 30, 2020, the cash balance per books was RM5,958. The bank did not make any errors, but two errors were made by Curvey Company. Required: (a) Prepare a bank reconciliation statement at November 30, 2020. Show the updated Cash Book account. (20 marks) (b) Prepare the adjusting entries based on the reconciliation (Hint: The correction of any errors pertaining to recording cheques should be made to Accounts Payable. The correction of any errors relating to recording cash receipts should be made to Accounts Receivable._ (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started