Question D

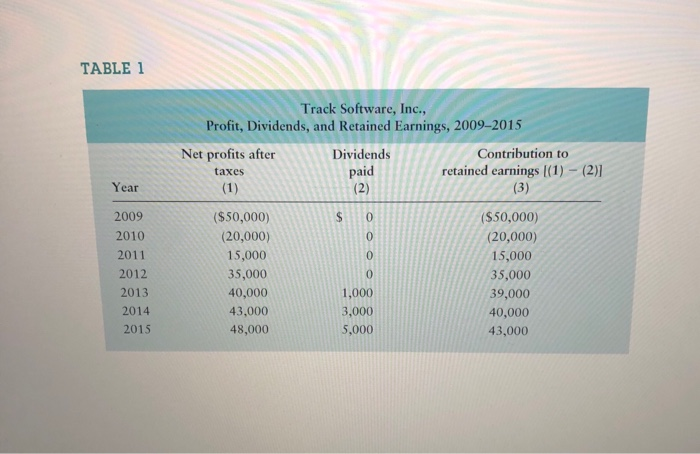

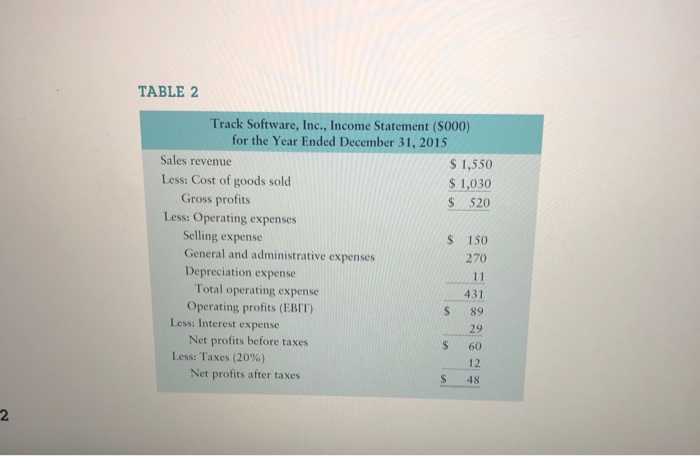

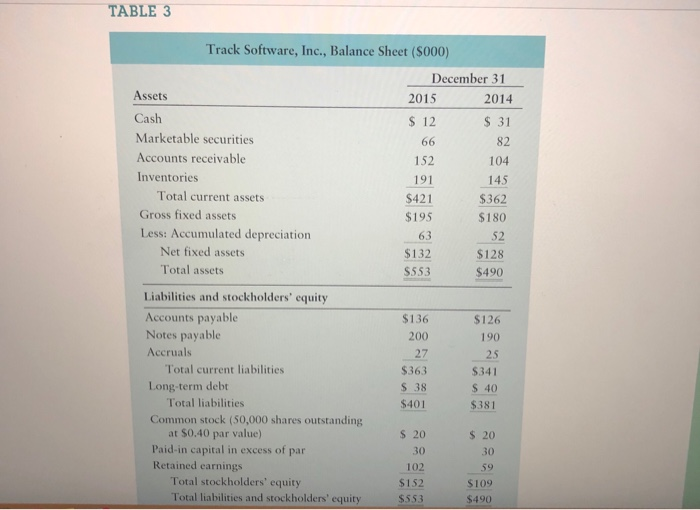

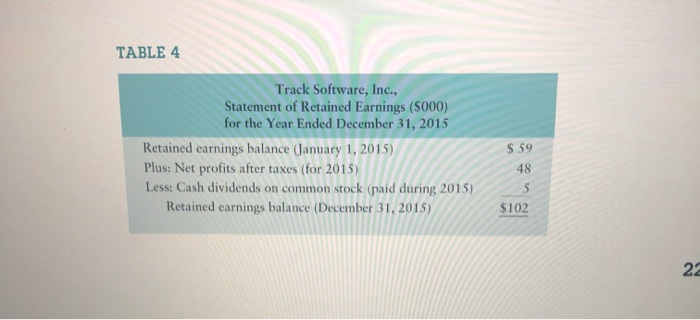

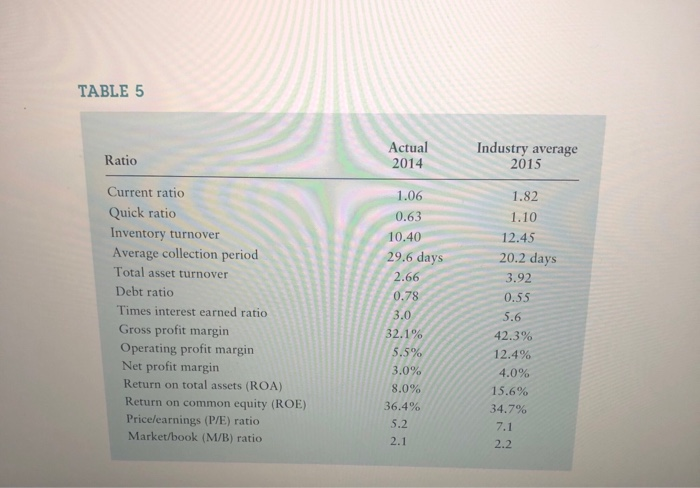

Integrative Case 2 Track Software, Inc. even years ago, after 15 years in public accounting, Stanley Booker, CPA, resigned his position as manager of cost systems for Davis, Cohen, and O'Brien Public Accountants and started Track Software, Inc. In the 2 years preceding his departure from Davis, Cohen, and O'Brien, Stanley had spent nights and weekends developing a sophisticated cost-accounting software program that became Track's initial product offering. As the firm grew, Stanley planned to develop and expand the software product offerings, all of which would be related to streamlining the accounting processes of medium- to large-sized manufacturers. Although Track experienced losses during its first 2 years of ope and 2010-its profit has increased steadily from 2011 to the present (2015). The firm's profit history, including dividend payments and contributions to retained earnings, is summarized in Table 1. Stanley started the firm with a $100,000 investment: his savings of $50,000 as equity and a $50,000 long.-term loan from the bank. He had hoped to maintain his initial 100 percent ownership in the corporation, but after experiencing a $s0,000 loss during the first year of operation (2009), he sold 60 percent of the stock to a group of investors to obtain needed funds. Since then, no other stock transactions have taken place. Although he owns only 40 percent of the firm, Stanley actively manages all aspects of its activities; the other stockholders are not active in manage- ment of the firm. The firm's stock was valued at $4.50 per share in 2014 and at S5.28 per share in 2015 TABLE 1 Track Software, Inc Profit, Dividends, and Retained Earnings, 2009-2015 Net profits after Contribution to Dividends retained earnings [(1)-(2) taxes paid Year 2009 ($50,000) ($50,000) (20,000) 15,000 2010 (20,000) 2011 0 15,000 2012 35,000 35,000 2013 1,000 40,000 39,000 2014 43,000 3,000 5,000 40,000 2015 48,000 43,000 Stanley has just prepared the firm's 2015 income statement, balance sheet, and statement of retained earnings, shown in Tables 2, 3, and 4, along with the 2014 balance sheet. In addition, he has compiled the 2014 ratio values and industry average ratio values for 2015, which are applicable to both 2014 and 2015 and are summarized in Table S. He is quite pleased to have achieved record earnings of $48,000 in 2015, but he is concerned about the firm's cash flows. Specifically, he is finding it more and more difficult to pay the firm's bills in a timely manner and generate cash flows to investors, both creditors and owners. To gain insight into these cash flow problems, Stanley is planning to determine the firm's 2015 operating cash flow (OCF) and free cash flow (FCF). Stanley is further frustrated by the firm's inability to afford to hire a software developer to complete development of a cost estimation package that is believed to have "blockbuster" sales potential. Stanley began development of this package 2 years ago, but the firm's growing complexity has forced him to devote more of his time to administrative duties, thereby halting the development of this product Stanley's reluctance to fill this position stems from his concern that the added $80,000 per year in salary and benefits for the position would certainly lower the firm's earnings per share (EPS) over the next couple of years. Although the project's success is in no way guaranteed, Stanley believes that if the money were spent to hire the software developer, the firm's sales and carnings would significantly rise once the 2- to 3-year development, production, and marketing process was completed With all these concerns in mind, Stanley set out to review the various data to develop strategies that would help ensure a bright future for Track Software. Stanley believed that as part of this process, a thorough ratio analysis of the firm's 2015 sults would provide important additional insights. TABLE 2 Track Software, Inc., Income Statement ($000) for the Year Ended December 31, 2015 Sales revenue $ 1,550 Less: Cost of goods sold Gross profits 1,030 S 520 Less: Operating expenses Selling expense General and administrative expenses Depreciation expense Total operating expense Operating profits (EBIT) Less: Interest expense Net profits before taxes Less: Taxes (20%) s 150 270 431 $ 89 29 S 60 12 Net profits after taxes S 48 2 TABLE 3 Track Software, Inc., Balance Sheet ($000) December 31 Assets 2015 2014 Cash S 12 S 31 Marketable securities 82 Accounts receivable 104 Inventories 191 $421 145 Total current assets 5362 Gross fixed assets $195 $180 Less: Accumulated depreciation 63 52 Net fixed assets $132 S128 Total assets S553 $490 Liabilities and stockholders' equity Accounts payable Notes payable $136 $126 200 190 Accruals 27 25 Total current liabilities $363 $341 Long-term debt Total liabilities S 38 S 40 401 5381 Common stock (50,000 shares outstanding at $0.40 par value) Paid-in capital in excess of par Retained earnings s 20 s 20 30 30 102 59 Total stockholders' equity Total liabilities and stockholders' equity $152 S109 $553 $490 TABLE 4 Track Software, Inc. Statement of Retained Earnings (S000) for the Year Ended December 31, 2015 Retained earnings balance (January 1, 2015) Plus: Net profits after taxes (for 2015) Less: Cash dividends on common stock (paid during 201s) Retained earnings balance (December 31, 201S) S 59 48 $102 TABLE 5 Actual 2014 Industry average 2015 Ratio Current ratio 1.06 1.82 Quick ratio Inventory turnover Average collection period 0.63 1.10 10.40 12.45 29.6 days 20.2 days Total asset turnover 2.66 3.92 Debt ratio 0.7 0.55 Times interest earned ratio .0 5.6 Gross profit margin Operating profit margin Net profit margin Return on total assets (ROA) Return on common equity (ROE) Price/earnings (P/E) ratio Market/book (M/B) ratio 42.3% 12.4% 3.0% 4.0% 8.0% 15.6% 36.4% 34.7% 5.2 2.1 2.2 ent Cash TIOW CTTIlCuities. d. Analyze the firm's financial condition in 2015 as it relates to (1) liquidity, (2) ac- tivity, (3) debt, (4) profitability, and (5) market, using the financial statements provided in Tables 2 and 3 and the ratio data included in Table 5. Be sure to evaluate the firm on both a cross-sectional and a time-series basis