Answered step by step

Verified Expert Solution

Question

1 Approved Answer

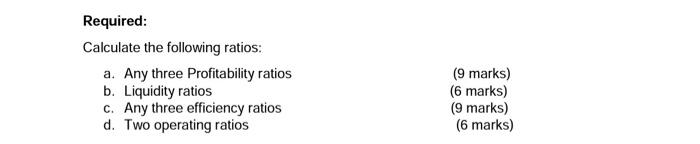

question d is calculate Financial leverage ratios please show cal calculation 2018 The financial statements of ABC LIMITED are given below ABC limited: Profit and

question d is calculate Financial leverage ratios

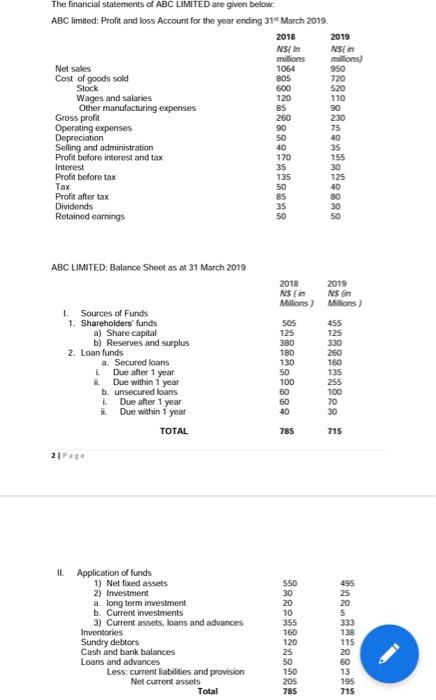

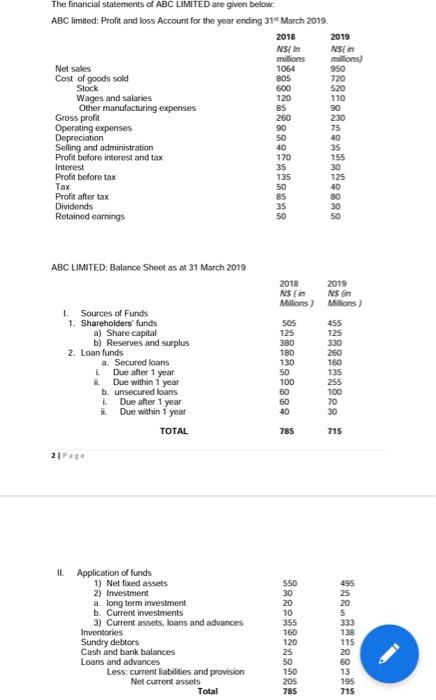

2018 The financial statements of ABC LIMITED are given below ABC limited: Profit and loss Account for the year ending 314 March 2019. 2019 NSC In NST in millions millions) Net sales 1064 950 Cost of goods sold 805 720 Stock 600 520 Wages and salaries 120 110 Other manufacturing expenses 85 90 Gross profit 230 Operating expenses 90 75 Depreciation 50 40 Selling and administration Profit before interest and tax 170 155 Interest 35 30 Profit before tax 125 Tax 50 40 Profit after tax 85 80 Dividends 30 Retained earnings 50 50 888888888888 8888888888888888 135 ABC LIMITED: Balance Sheet as at 31 March 2012 2018 2019 NS (in NS in Millions) Millions) 505 455 125 125 330 180 260 130 50 135 255 60 100 60 70 40 30 380 Sources of Funds 1. Shareholders' funds a) Share capital b) Reserves and surplus 2. Loan funds a. Secured loans Due after 1 year Due within 1 year b. unsecured loans Due after 1 year Due within 1 year TOTAL 160 100 785 715 21 Fare IL Application of funds 1) Net fixed assets 2) Investment a long term investment b. Current investments 3) Current assets, koans and advances Inventories Sundry debtors Cash and bank balances Loans and advances Less: current liabilities and provision Net current assets Total 550 30 20 10 355 160 120 25 50 150 205 785 333 139 115 20 60 13 195 715 Required: Calculate the following ratios: a. Any three Profitability ratios b. Liquidity ratios c. Any three efficiency ratios d. Two operating ratios (9 marks) (6 marks) (9 marks) (6 marks) please show cal calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started