Question

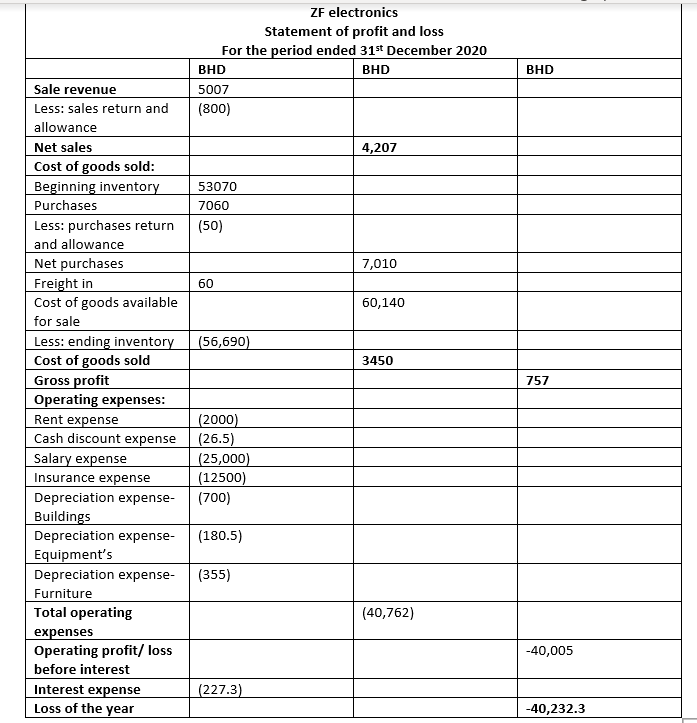

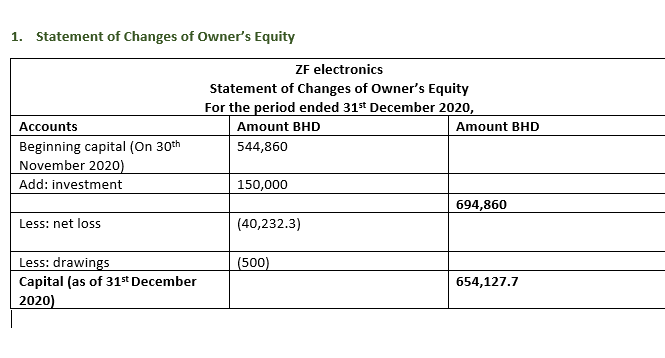

Question: Do think ZF Electronics are presenting their financial statements faithfully? Explain your answer. Your explanation should include illustrative accounting examples from part A and

Question: Do think ZF Electronics are presenting their financial statements faithfully? Explain your answer. Your explanation should include illustrative accounting examples from part A and secondary references, where appropriate. Word count: (800 words +/-10%)

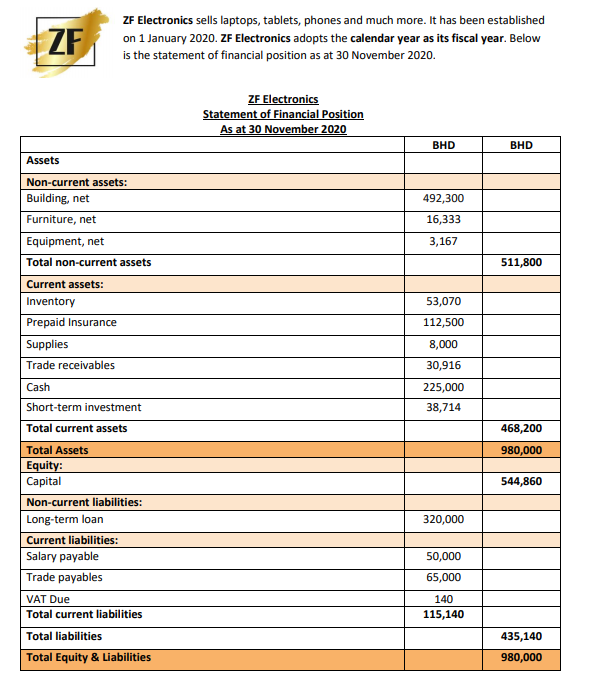

- Balance Sheet

| ZF electronics Statement of financial position As of 31st December 2020, | |||

|

| BHD | BHD |

|

| Non-current assets: |

|

|

|

| Land | 200,000 |

|

|

| Fixtures | 700 |

|

|

| Equipments | 4327 |

|

|

| Less: Accumulated depreciation-equipments | (180.5) |

|

|

| Book value equipments |

| 4146.5 |

|

| Furniture | 17,656 |

|

|

| Less: Accumulated depreciation-furniture | (355) |

|

|

| Book value furniture |

| 17,301 |

|

| Buildings | 492,300 |

|

|

| Less: Accumulated depreciation-buildings | (700) |

|

|

| Book value buildings |

| 491,600 |

|

| Total non-current assets |

| 713,747.5 |

|

| Current assets: |

|

|

|

| Accounts receivable | 33,499.8 |

|

|

| Other receivables | 3.7 |

|

|

| Supplies | 8172.5 |

|

|

| Short-term investment | 88,714 |

|

|

| Prepaid insurance | 100,000 |

|

|

| Prepaid insurance-B1 | 100,000 |

|

|

| Prepaid rent | 22,000 |

|

|

| Inventory | 56,690 |

|

|

| Cash | 171,126.5 |

|

|

| Total current assets |

| 580,206.5 |

|

| Total assets |

|

| 1,293,954 |

| Equity: |

|

|

|

| Capital |

| 654,128 |

|

| Non-current liabilities |

|

|

|

| Long-term loan | 320,000 |

|

|

| Mortgage payable | 150,000 |

|

|

| Total non-current liabilities | 470,000 |

|

|

| Current liabilities |

|

|

|

| Short-term loan payable | 50,000 |

|

|

| Salary payable | 50,000 |

|

|

| Accounts payable | 69,600.5 |

|

|

| Interest payable | 227.3 |

|

|

| Total current liabilities | 169,828 |

|

|

| Total liabilities |

| 639,828 |

|

| Total equity and liabilities |

|

| 1,293,956.8 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started