Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question E and F thx:) Series A Venture Capital Financing: Live Deliciously is a start-up firm in need of financing after surviving to this point

Question E and F thx:)

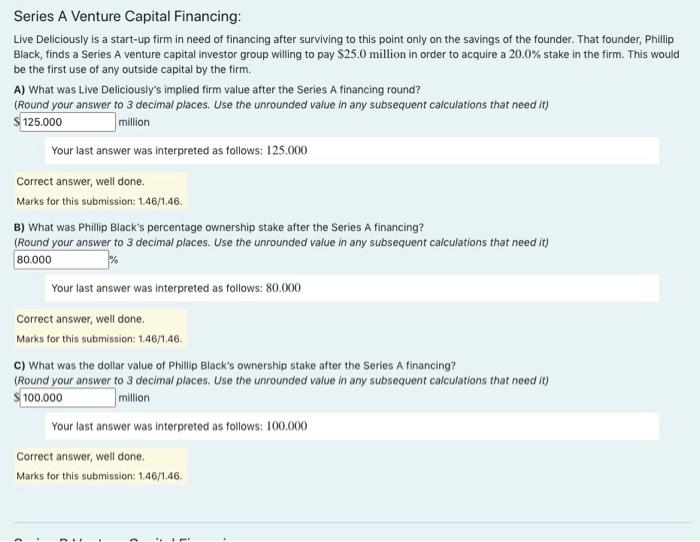

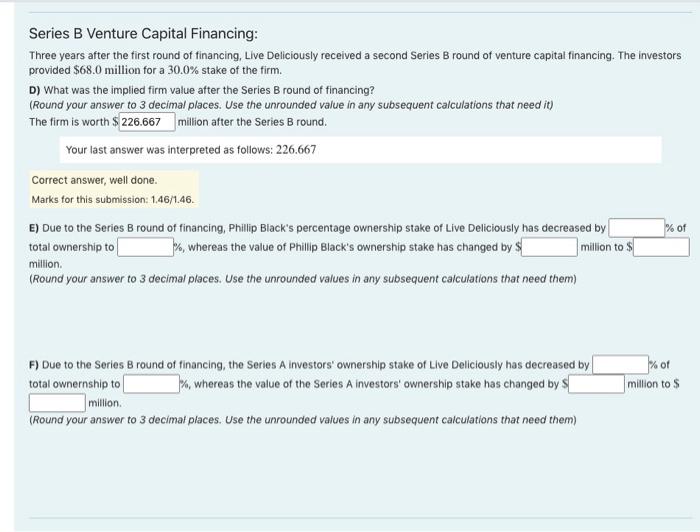

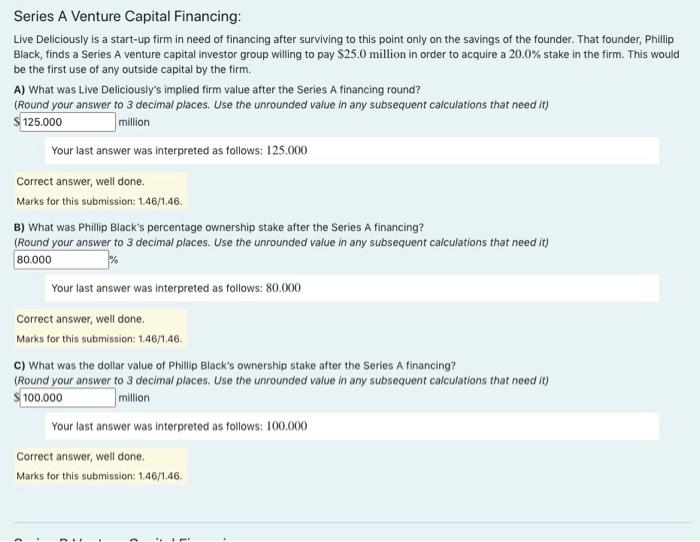

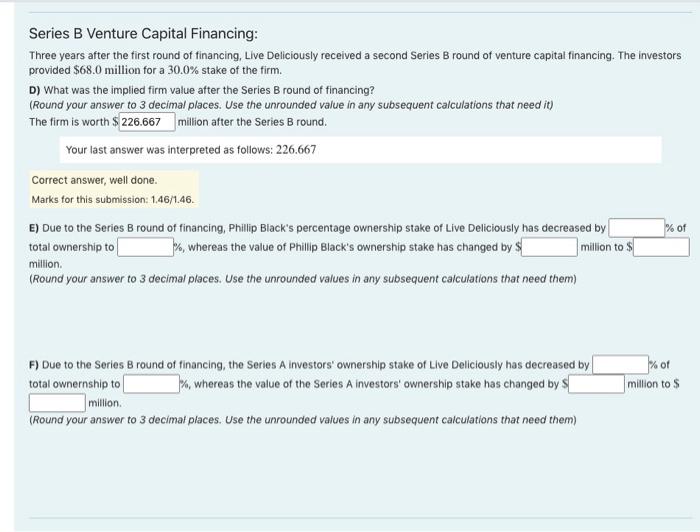

Series A Venture Capital Financing: Live Deliciously is a start-up firm in need of financing after surviving to this point only on the savings of the founder. That founder, Phillip Black, finds a Series A venture capital investor group willing to pay $25.0 million in order to acquire a 20.0% stake in the firm. This would be the first use of any outside capital by the firm. A) What was Live Deliciously's implied firm value after the Series A financing round? (Round your answer to 3 decimal places. Use the unrounded value in any subsequent calculations that need it) S 125.000 million Your last answer was interpreted as follows: 125.000 Correct answer, well done. Marks for this submission: 1.46/1.46. B) What was Phillip Black's percentage ownership stake after the Series A financing? (Round your answer to 3 decimal places. Use the unrounded value in any subsequent calculations that need it) 80.000 Your last answer was interpreted as follows: 80.000 Correct answer, well done Marks for this submission: 1.46/1.46. C) What was the dollar value of Phillip Black's ownership stake after the Series A financing? (Round your answer to 3 decimal places. Use the unrounded value in any subsequent calculations that need it) $100.000 million Your last answer was interpreted as follows: 100,000 Correct answer, well done. Marks for this submission: 1.46/1.46. Series B Venture Capital Financing: Three years after the first round of financing, Live Deliciously received a second Series B round of venture capital financing. The investors provided $68.0 million for a 30.0% stake of the firm. D) What was the implied firm value after the Series B round of financing? (Round your answer to 3 decimal places. Use the unrounded value in any subsequent calculations that need it) The firm is worth $ 226.667 million after the Series B round. Your last answer was interpreted as follows: 226.667 Correct answer, well done. Marks for this submission: 1.46/1.46. E) Due to the Series B round of financing, Phillip Black's percentage ownership stake of Live Deliciously has decreased by total ownership to J%, whereas the value of Phillip Black's ownership stake has changed by s milion to million (Round your answer to 3 decimal places. Use the unrounded values in any subsequent calculations that need them) % of % of million to S F) Due to the Series B round of financing, the Series A Investors' ownership stake of Live Deliciously has decreased by total ownership to 1%, whereas the value of the Series A investors' ownership stake has changed by $ million (Round your answer to 3 decimal places. Use the unrounded values in any subsequent calculations that need them)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started