Question: Clean-Soap (M) Sdn. Bhd. produces a special type of chicken sausage for its customers in Malaysia. The following information was provided by the company

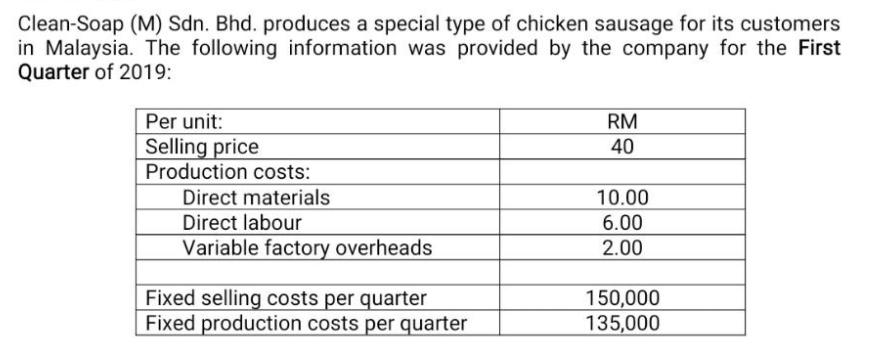

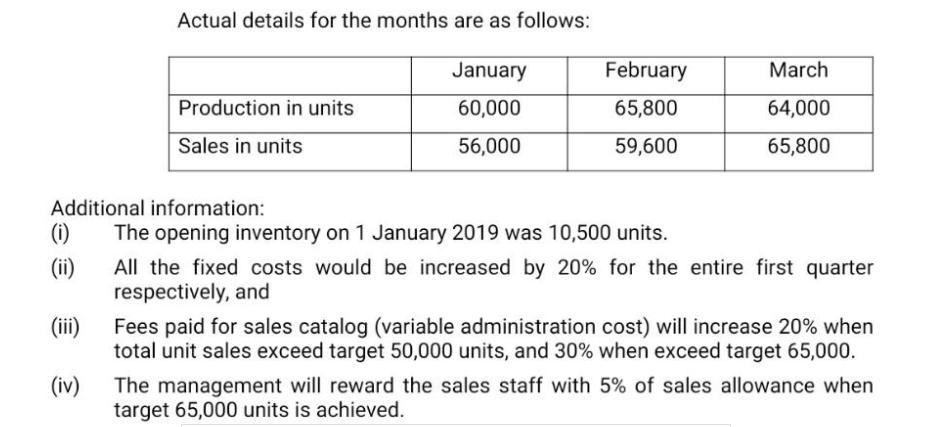

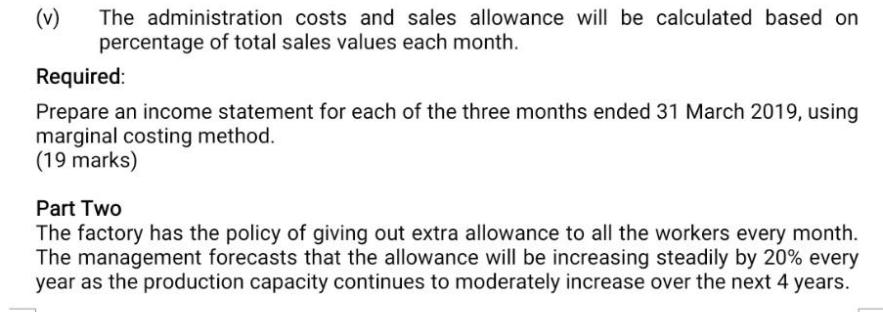

Clean-Soap (M) Sdn. Bhd. produces a special type of chicken sausage for its customers in Malaysia. The following information was provided by the company for the First Quarter of 2019: Per unit: RM Selling price Production costs: 40 Direct materials 10.00 Direct labour 6.00 Variable factory overheads 2.00 Fixed selling costs per quarter Fixed production costs per quarter 150,000 135,000 Actual details for the months are as follows: January February March Production in units 60,000 65,800 64,000 Sales in units 56,000 59,600 65,800 Additional information: (i) The opening inventory on 1 January 2019 was 10,500 units. (ii) All the fixed costs would be increased by 20% for the entire first quarter respectively, and (iii) Fees paid for sales catalog (variable administration cost) will increase 20% when total unit sales exceed target 50,000 units, and 30% when exceed target 65,000. (iv) The management will reward the sales staff with 5% of sales allowance when target 65,000 units is achieved. (v) The administration costs and sales allowance will be calculated based on percentage of total sales values each month, Required: Prepare an income statement for each of the three months ended 31 March 2019, using marginal costing method. (19 marks) Part Two The factory has the policy of giving out extra allowance to all the workers every month. The management forecasts that the allowance will be increasing steadily by 20% every year as the production capacity continues to moderately increase over the next 4 years. Required: Identify and describe the type of cost behavior of the allowance in both short term and long term with simple chart(s). (6 marks)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts