Question:

Example:

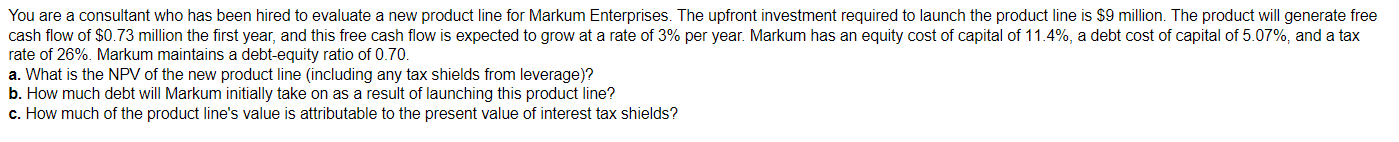

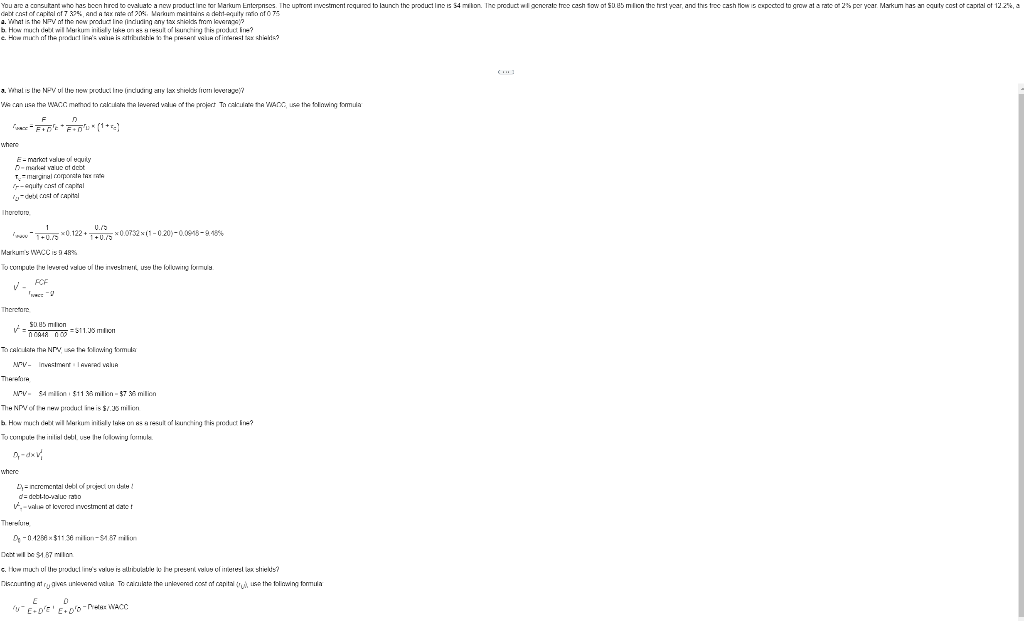

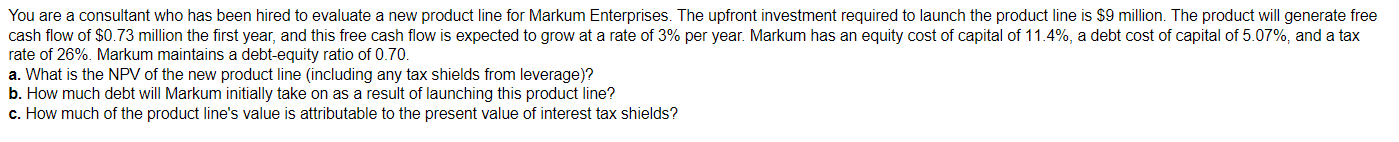

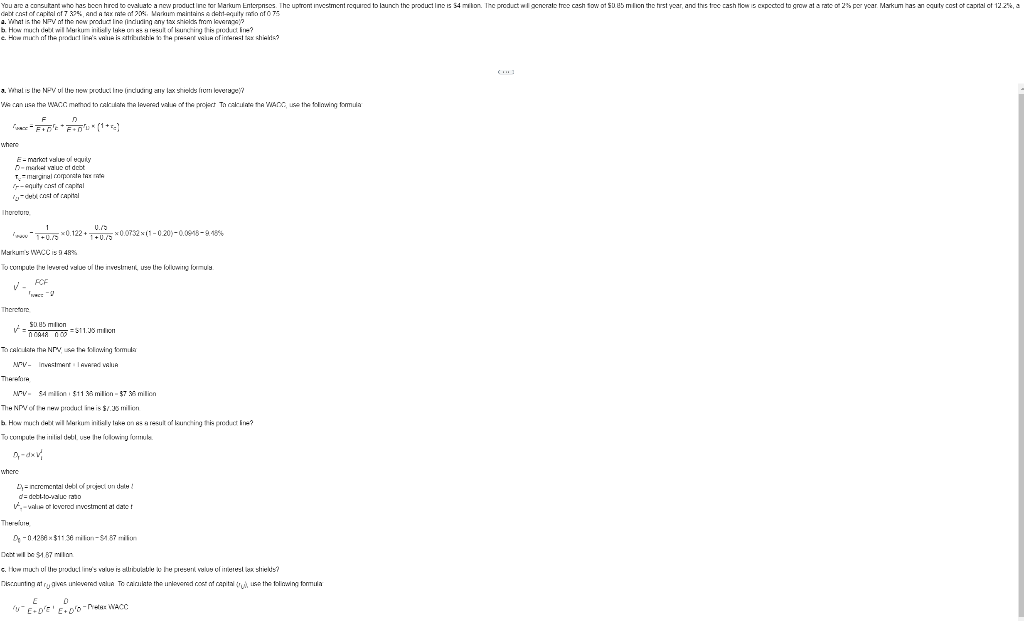

You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $9 million. The product will generate free cash flow of $0.73 million the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of capital of 11.4%, a debt cost of capital of 5.07%, and a tax rate of 26%. Markum maintains a debt-equity ratio of 0.70 . a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields? rSAC=F+Frc+F+rL(1+rz) whare E-maroct value ou yquily D - madket va ue ol doot T. =magiral onemonata ter me Cr-enuity cat of caphal iycu2d cnst of cavitsl hargitg iN.10=1+0./010.122+1+U.15U.150.073 Aykum ' WVC Is 9488 vroFrnaz2 Thcreche v2=ncotsin005045micn=211.25micn 7ia Altar Mrv=$4 milim \&11 38 milin =\$7 . How fuch iter wil Wokum indiely take ton a1dv1 whare Q1= neremenesl dubl of wciat unitsla d=dxt12vaduc rage b2b - is of kvcrod rucstmcnt at cate t 0e0^1268$138 milu-1 $1.87 milu Cotat wi be \$1.67 mil on HWw muct vi us procusil ine's vy us is aldic at*:n.nt ng at ry q ahe unkend val.A Th cA fEE+DeEE+Dr0MHEWACC. You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $9 million. The product will generate free cash flow of $0.73 million the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of capital of 11.4%, a debt cost of capital of 5.07%, and a tax rate of 26%. Markum maintains a debt-equity ratio of 0.70 . a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields? rSAC=F+Frc+F+rL(1+rz) whare E-maroct value ou yquily D - madket va ue ol doot T. =magiral onemonata ter me Cr-enuity cat of caphal iycu2d cnst of cavitsl hargitg iN.10=1+0./010.122+1+U.15U.150.073 Aykum ' WVC Is 9488 vroFrnaz2 Thcreche v2=ncotsin005045micn=211.25micn 7ia Altar Mrv=$4 milim \&11 38 milin =\$7 . How fuch iter wil Wokum indiely take ton a1dv1 whare Q1= neremenesl dubl of wciat unitsla d=dxt12vaduc rage b2b - is of kvcrod rucstmcnt at cate t 0e0^1268$138 milu-1 $1.87 milu Cotat wi be \$1.67 mil on HWw muct vi us procusil ine's vy us is aldic at*:n.nt ng at ry q ahe unkend val.A Th cA fEE+DeEE+Dr0MHEWACC.