Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, 2025, Wildhorse Service Co. was started with an initial investment in the company of $19,750 cash. Here are the assets, liabilities,

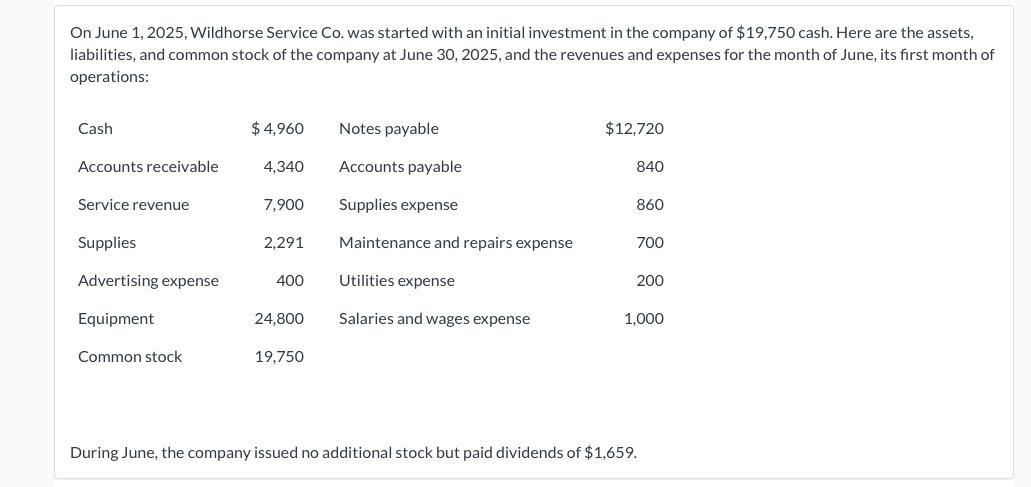

On June 1, 2025, Wildhorse Service Co. was started with an initial investment in the company of $19,750 cash. Here are the assets, liabilities, and common stock of the company at June 30, 2025, and the revenues and expenses for the month of June, its first month of operations: Cash Accounts receivable Service revenue Supplies Advertising expense Equipment Common stock $4,960 4,340 7,900 2,291 400 24,800 19,750 Notes payable Accounts payable Supplies expense Maintenance and repairs expense Utilities expense Salaries and wages expense $12,720 840 860 700 200 1,000 During June, the company issued no additional stock but paid dividends of $1,659.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Question WILDHORSE CO Income Statement for year ended June302022 Revenues Service ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started