Answered step by step

Verified Expert Solution

Question

1 Approved Answer

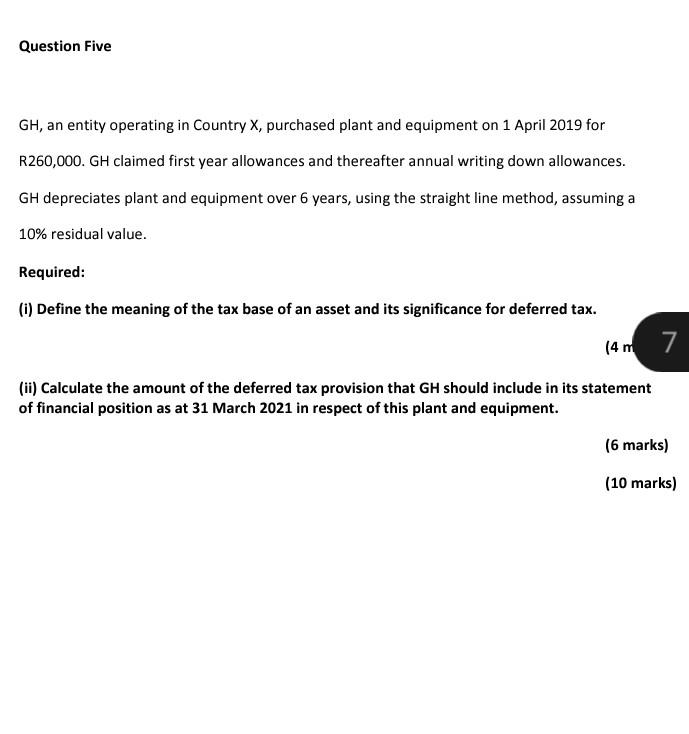

Question Five GH, an entity operating in Country X, purchased plant and equipment on 1 April 2019 for R260,000. GH claimed first year allowances and

Question Five GH, an entity operating in Country X, purchased plant and equipment on 1 April 2019 for R260,000. GH claimed first year allowances and thereafter annual writing down allowances. GH depreciates plant and equipment over 6 years, using the straight line method, assuming a 10% residual value. Required: (i) Define the meaning of the tax base of an asset and its significance for deferred tax. (4 m 7 (ii) Calculate the amount of the deferred tax provision that GH should include in its statement of financial position as at 31 March 2021 in respect of this plant and equipment. (6 marks) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started