Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: For foreign exchnage trading, what is the difference about Asia, Compared to Europe and North America? Do you think that this difference is surprising?

Question: For foreign exchnage trading, what is the difference about Asia, Compared to Europe and North America? Do you think that this difference is surprising?

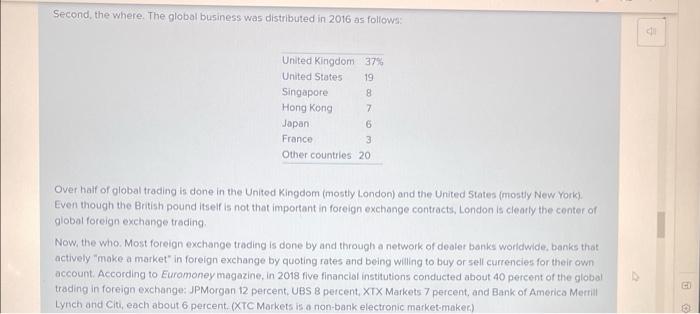

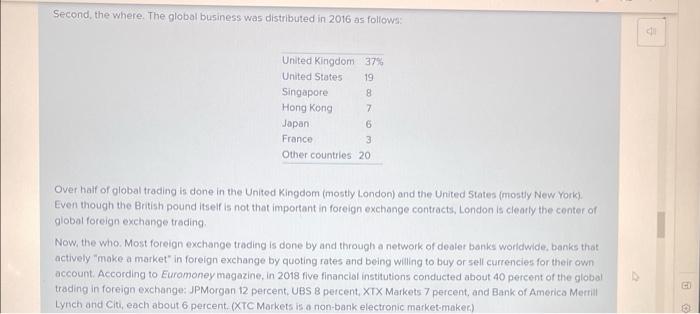

In 2016, foreign exchange trading was an astounding $4.7 trillion per day. It is difficult to comprehend how large this number is. One comparison offers some guidance. In about four days the amount of money traded in the foreign exchange market equals the value of U.S. production of goods and services for an entire year. In just the nine years from 2004 to 2013, global foreign exchange trading almost tripled, from $1.8 trillion per day to $5.0 trillion per day. This rapid growth was driven by large increases in trading by hedge funds, pension funds, and other financial institutions. These institutions expanded their foreign exchange trading as they pursue international diversification of their financial investment portfolios. They also are increasingly using algorithms for computer-driven foreign exchange trading. including automated high-frequency trading. What exactly is being traded in the huge global foreign exchange market? Where is the trading done? And who are the traders? First, the what. In addition to spot and forward foreign exchange, there is one other traditional foreign exchange contract, the foreign exchange swap. A foreign exchange swap is a package trade that includes both a spot exchange of two currencies and an agreement to the reverse forward exchange of the two currencies (the future exchange back again). This type of package contract is useful when the parties to the trade have only a temporaty need for the currency each is buying spot. In the 2016 global market, spot exchange was 35 percent of trading, forward exchange 15 percent, and foreign exchange swaps 50 percent. For all of this foreign exchange trading in. 2016, the U.S. dollar was involved in 88 percent of all trades, the euro in 31 percent, the Japanese yen in 22 percent, the British pound in 13 Dercent. the Australian dollar in 7 cercent, and the Canadian dollar and Swiss franc in 5 Dercent each. Second, the where. The global business was distributed in 2016 as follows: Over haif of global trading is done in the Unitod Kingdom (mostly London) and the United 5 tates (mostly New York). Even though the British pound itself is not that important in foreign exchange contracts, London is cleatly the center of global foreign exchange trading. Now, the who. Most foreign exchange trading is done by and through a network of deater banks worldwide, banks that actively "make a market" in foreign exchange by quoting rates and being willing to buy or sell currencies for their own account. According to Euramoney magazine, in 2018 five financial institutions conducted about 40 percent of the global trading in foreign exchange: JPMorgan 12 percent, UBS B percent, XTX Markets 7 percent, and Bank of America Merrill Lyrich and Citi, each about 6 percent. (XTC Markets is a non-bank electronic mafket-makec) Now, the who, Most foreign exchange trading is done by and through a network of dealer banks woridwide, banks that actively "make a market" in foreign exchange by quoting rates and being willing to buy or sell currencies for their own account. According to Euromoney magazine, in 2018 five financial institutions conducted about 40 percent of the global trading in forelgn exchange; JPMorgan 12 percent, UBS B percent, XTX Markets 7 percent, and Bank of America Merriil Lynch and Citi, each about 6 percent (XTC Markets is a non-bank electronic market-maker) Most trading is done by several thousand traders who are employed at these several hundred banks. This is a surprisingly small number of traders, relative to the huge volume of trading conducted. There are good reasons why there are so few foreign exchange traders. One is the capital intensity of this business. it takes a fot of money and substantial investments in computer and telecommunications hardware and software, but only a few decision-makers. Another is the nature of the work itself. Trading miltions of dollars of foreign exchange per minute is a harrowing job; it's almost in the same category with being an air traftic controller or a bomb defuser. A trader should be somebody who loves pressures, makes quick decisions, and can take losses. Many who try it soon develop a taste for other work. Once an economics student visiting a foreign exchange trading room in a major bank asked a trader. "How long do people last in this job?" The enthusiastic answer: "Yes, it is an excellent job for young people." DISCUSSION QUESTION For foreign exchange trading, what is diffecent about Asia, compared to Europe and North America? Do you think that this difference is surptising

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started