Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION FOUR (a) Assume that you are financial analyst of Alpha Investments Plc based in Accra and you have been assigned to advise Mrs

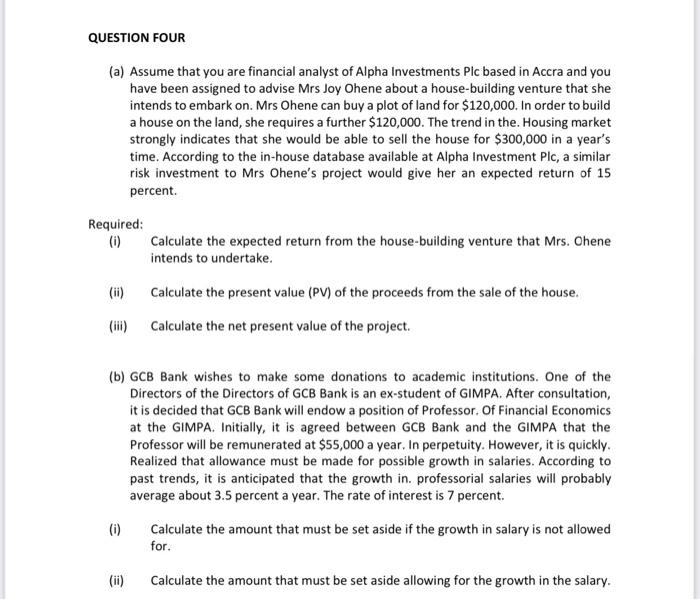

QUESTION FOUR (a) Assume that you are financial analyst of Alpha Investments Plc based in Accra and you have been assigned to advise Mrs Joy Ohene about a house-building venture that she intends to embark on. Mrs Ohene can buy a plot of land for $120,000. In order to build a house on the land, she requires a further $120,000. The trend in the. Housing market strongly indicates that she would be able to sell the house for $300,000 in a year's time. According to the in-house database available at Alpha Investment Plc, a similar risk investment to Mrs Ohene's project would give her an expected return of 15 percent. Required: (i) (ii) (i) Calculate the expected return from the house-building venture that Mrs. Chene intends to undertake. (b) GCB Bank wishes to make some donations to academic institutions. One of the Directors of the Directors of GCB Bank is an ex-student of GIMPA. After consultation, it is decided that GCB Bank will endow a position of Professor. Of Financial Economics at the GIMPA. Initially, it is agreed between GCB Bank and the GIMPA that the Professor will be remunerated at $55,000 a year. In perpetuity. However, it is quickly. Realized that allowance must be made for possible growth in salaries. According to past trends, it is anticipated that the growth in. professorial salaries will probably average about 3.5 percent a year. The rate of interest is 7 percent. (ii) Calculate the present value (PV) of the proceeds from the sale of the house. Calculate the net present value of the project. Calculate the amount that must be set aside if the growth in salary is not allowed for. Calculate the amount that must be set aside allowing for the growth in the salary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i To calculate the expected return from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started