Answered step by step

Verified Expert Solution

Question

1 Approved Answer

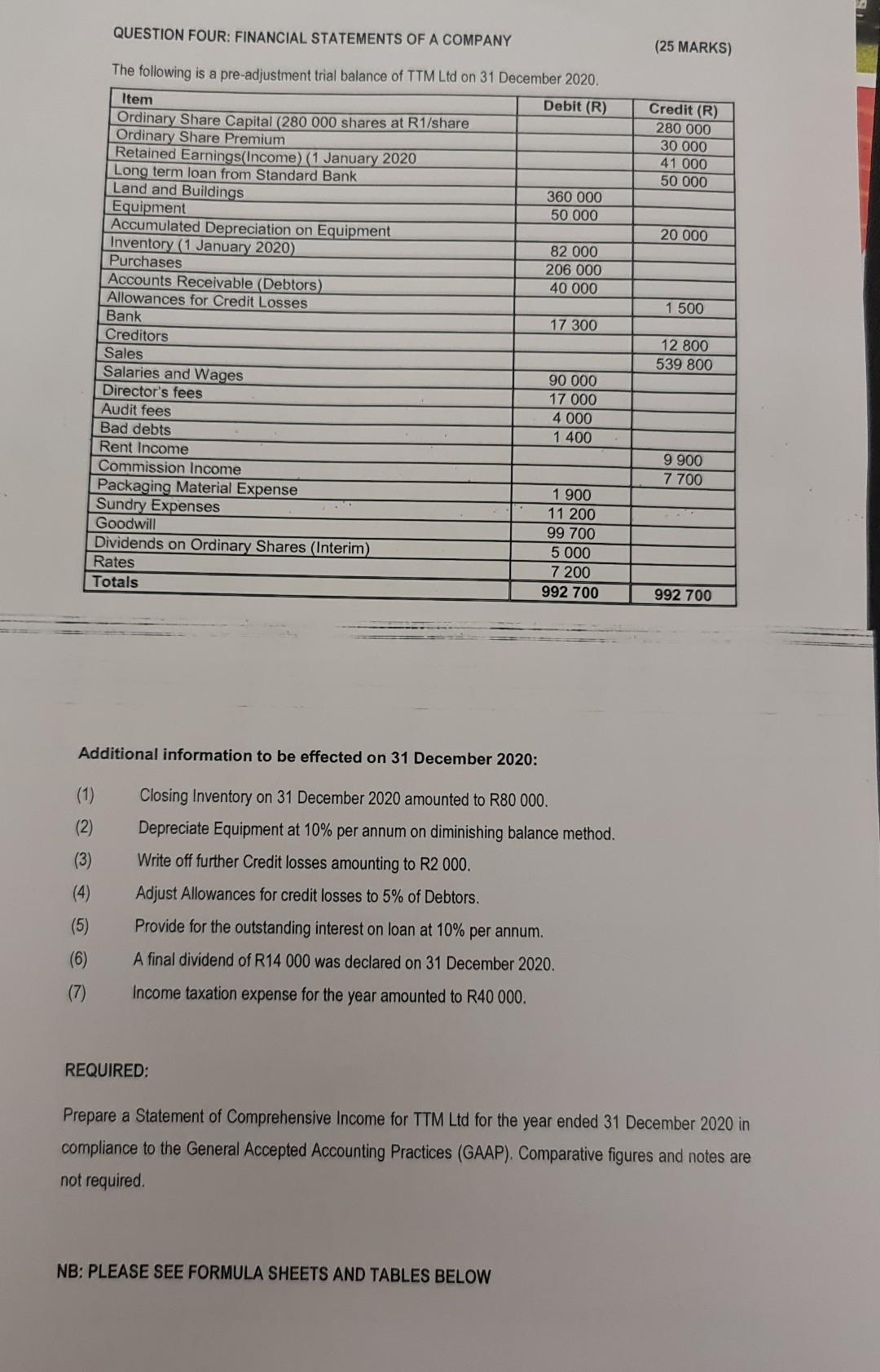

QUESTION FOUR: FINANCIAL STATEMENTS OF A COMPANY (25 MARKS) The following is a pre-adjustment trial balance of TTM Ltd on 31 December 2020. Additional information

QUESTION FOUR: FINANCIAL STATEMENTS OF A COMPANY (25 MARKS) The following is a pre-adjustment trial balance of TTM Ltd on 31 December 2020. Additional information to be effected on 31 December 2020 : (1) Closing Inventory on 31 December 2020 amounted to R80 000. (2) Depreciate Equipment at 10% per annum on diminishing balance method. (3) Write off further Credit losses amounting to R2 000 . (4) Adjust Allowances for credit losses to 5% of Debtors. (5) Provide for the outstanding interest on loan at 10% per annum. (6) A final dividend of R14000 was declared on 31 December 2020. (7) Income taxation expense for the year amounted to R40 000 . REQUIRED: Prepare a Statement of Comprehensive Income for TTM Ltd for the year ended 31 December 2020 in compliance to the General Accepted Accounting Practices (GAAP). Comparative figures and notes are not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started