Answered step by step

Verified Expert Solution

Question

1 Approved Answer

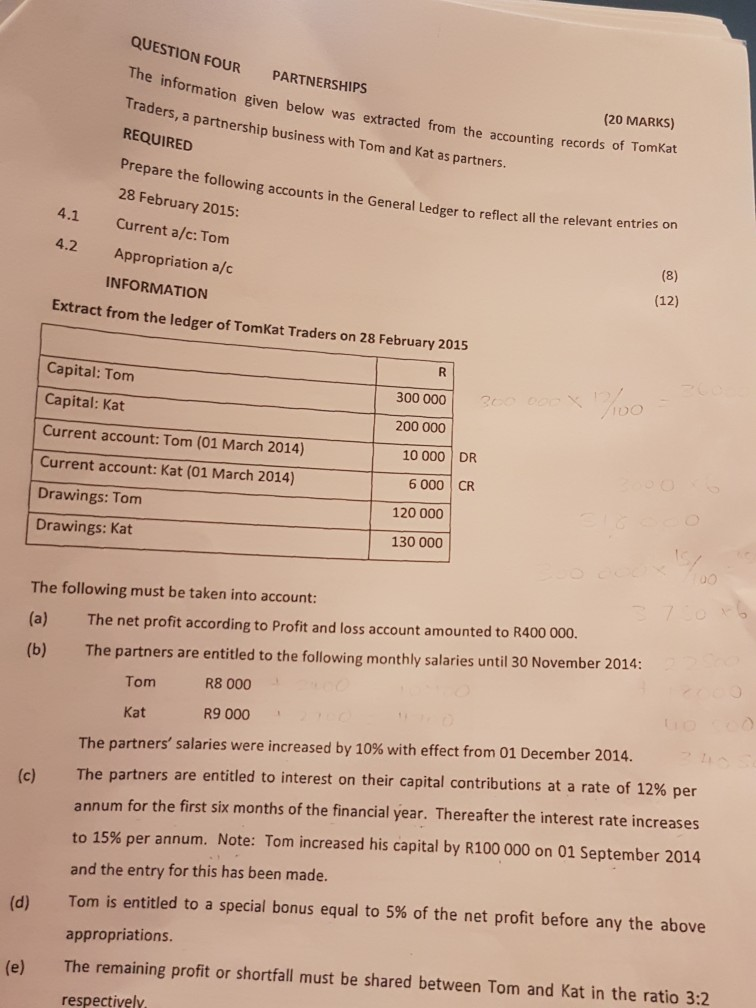

QUESTION FOUR PARTNERSHIPS The information given below was extracted from the accounting r Traders, a partnership business with Tom and Kat as partners. REQUIRED Prepa

QUESTION FOUR PARTNERSHIPS The information given below was extracted from the accounting r Traders, a partnership business with Tom and Kat as partners. REQUIRED Prepa 28 February 2015: Current a/c: Tom (20 MARKS) ecords of TomKat re the following accounts in the General Ledger to reflect all the relevant entries on 4.1 4.2 Appropriation a/c (12) INFORMATION Extract from the ledger of TomKat Traders on 28 February 2015 Capital: Tom Capital: Kat Current account: Tom (01 March 2014) Current account: Kat (01 March 2014) Drawings: Tom Drawings: Kat 300 000 200 000 10 000 DR 6 000 CR 120 000 130 000 The following must be taken into account: (a) The net profit according to Profit and loss account amounted to R400 000. (b) The partners are entitled to the following monthly salaries until 30 November 2014: Tom R8 000 Kat R9 000 The partners' salaries were increased by 10% with effect from 01 December 2014. The partners are entitled to interest on their capital contributions at a rate of 12% per annum for the first six months of the financial year. Thereafter the interest rate increases to 15% per annum. Note: Tom increased his capital by R100 000 on 01 September 2014 and the entry for this has been made. Tom is entitled to a special bonus equal to 5% of the net profit before any the above appropriations (c) (d) (e) The remaining profit or shortfall must be shared between Tom and Kat in the ratio 3:2 respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started