Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION Harbor Repair Services Trial Balance 1/1/2021 During January 2021, the following transactions took place: Jan 1 Paid $700 cash for January rent. 2 Billed

QUESTION

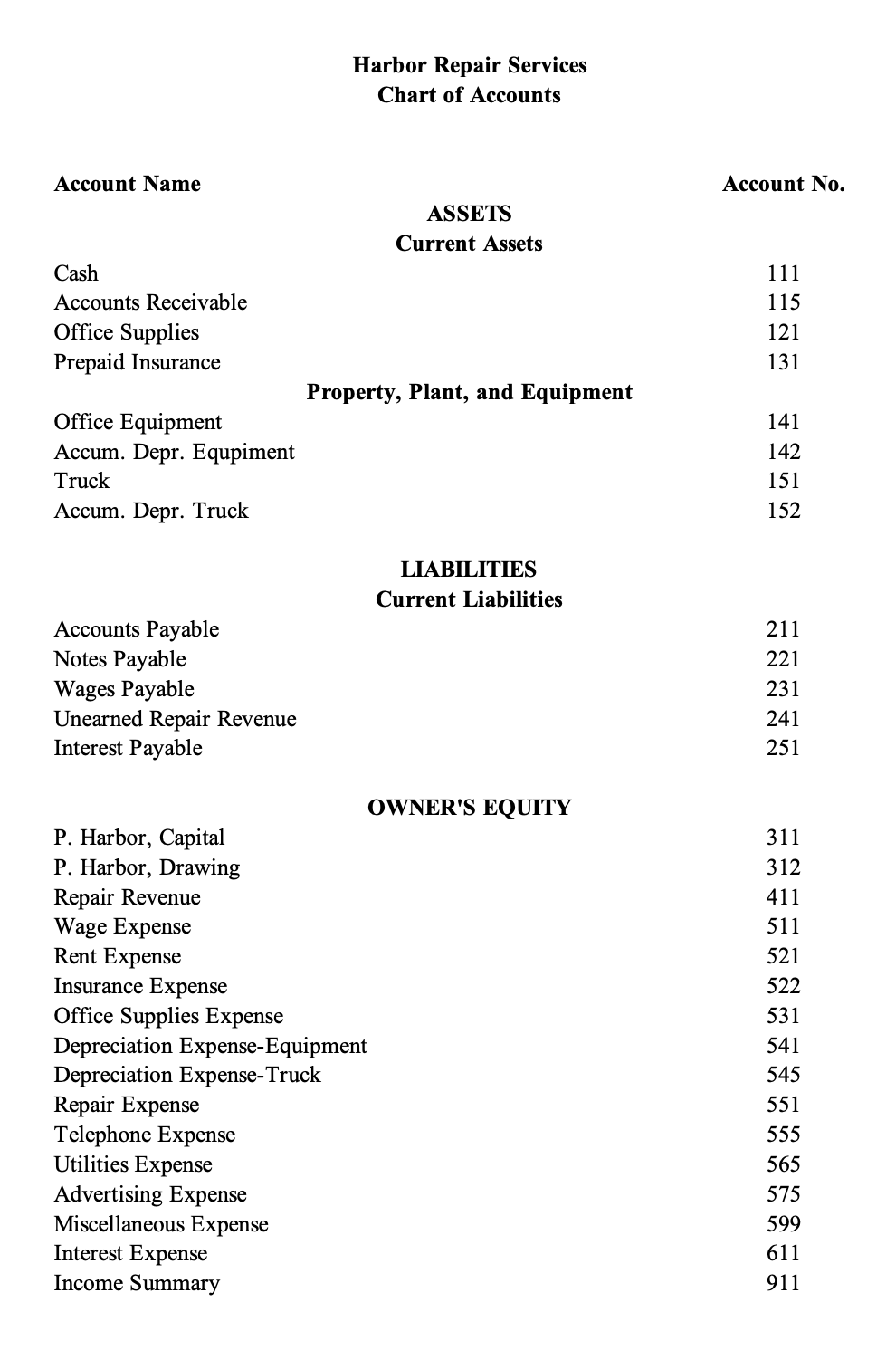

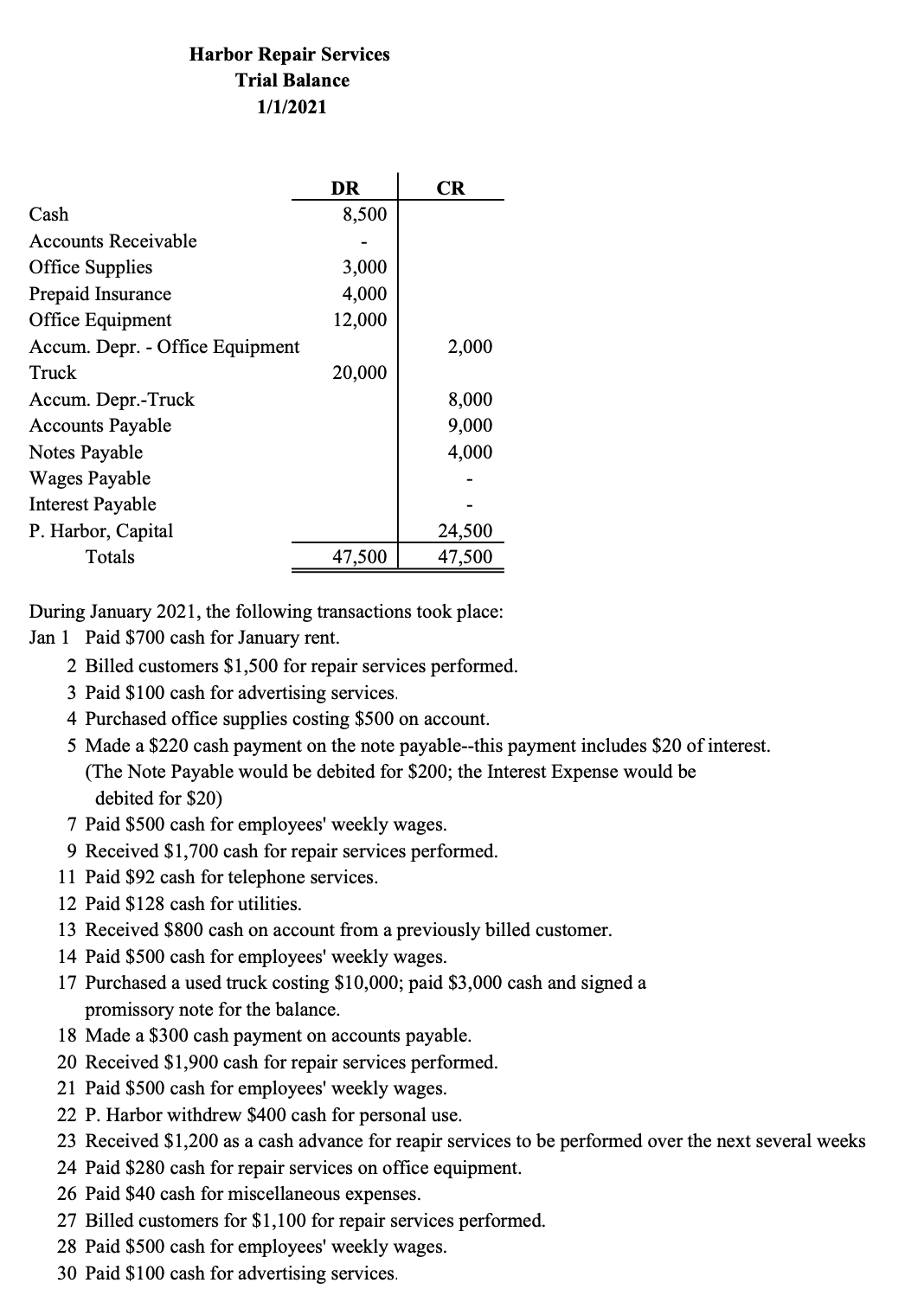

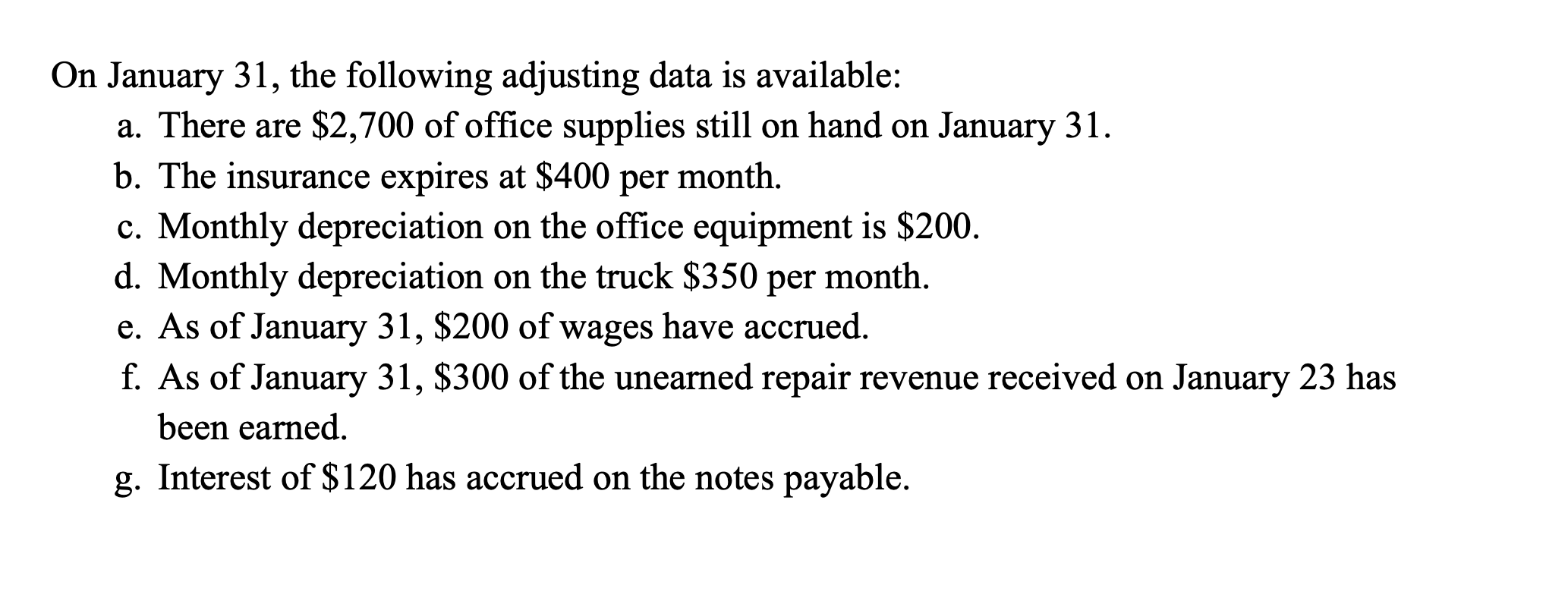

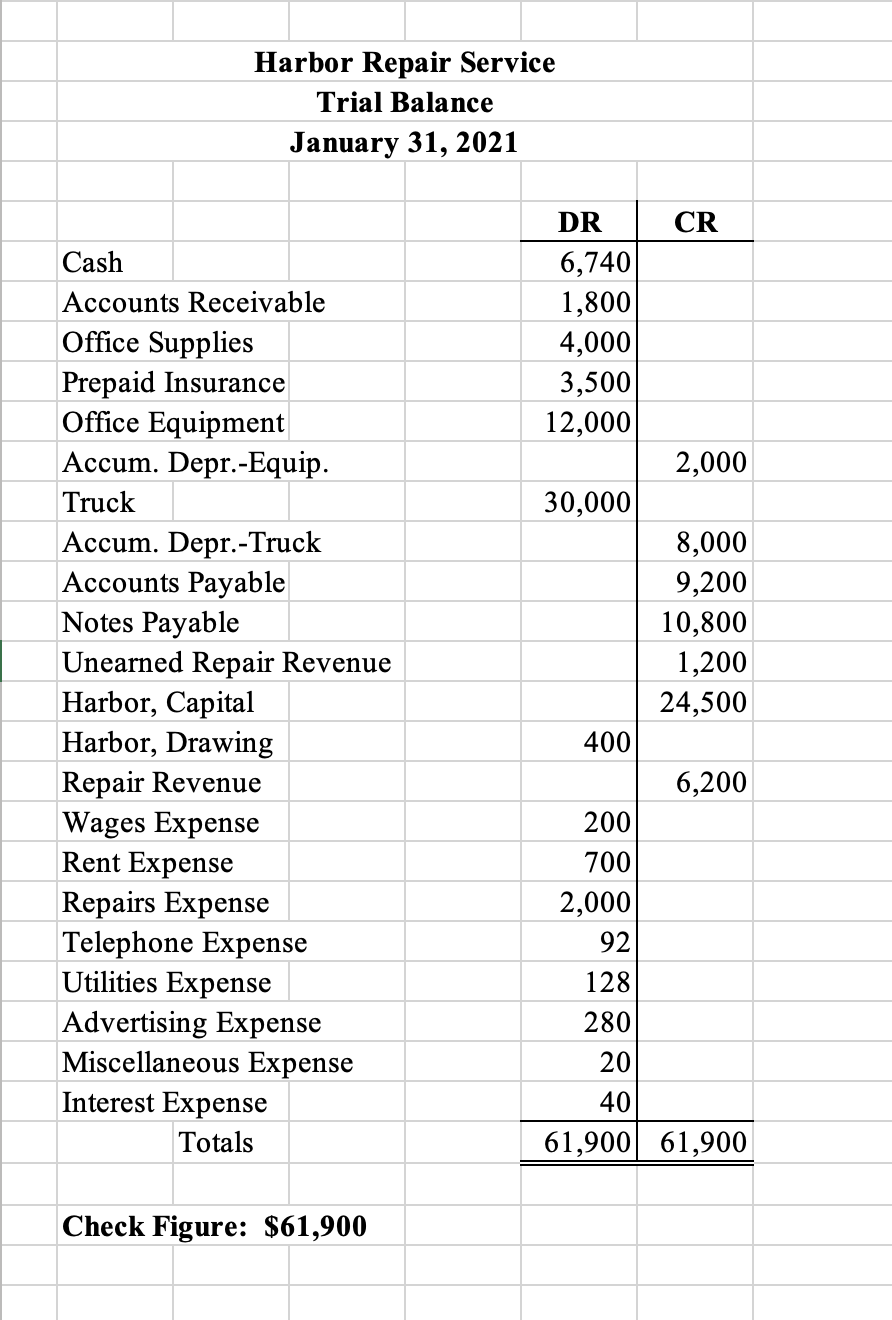

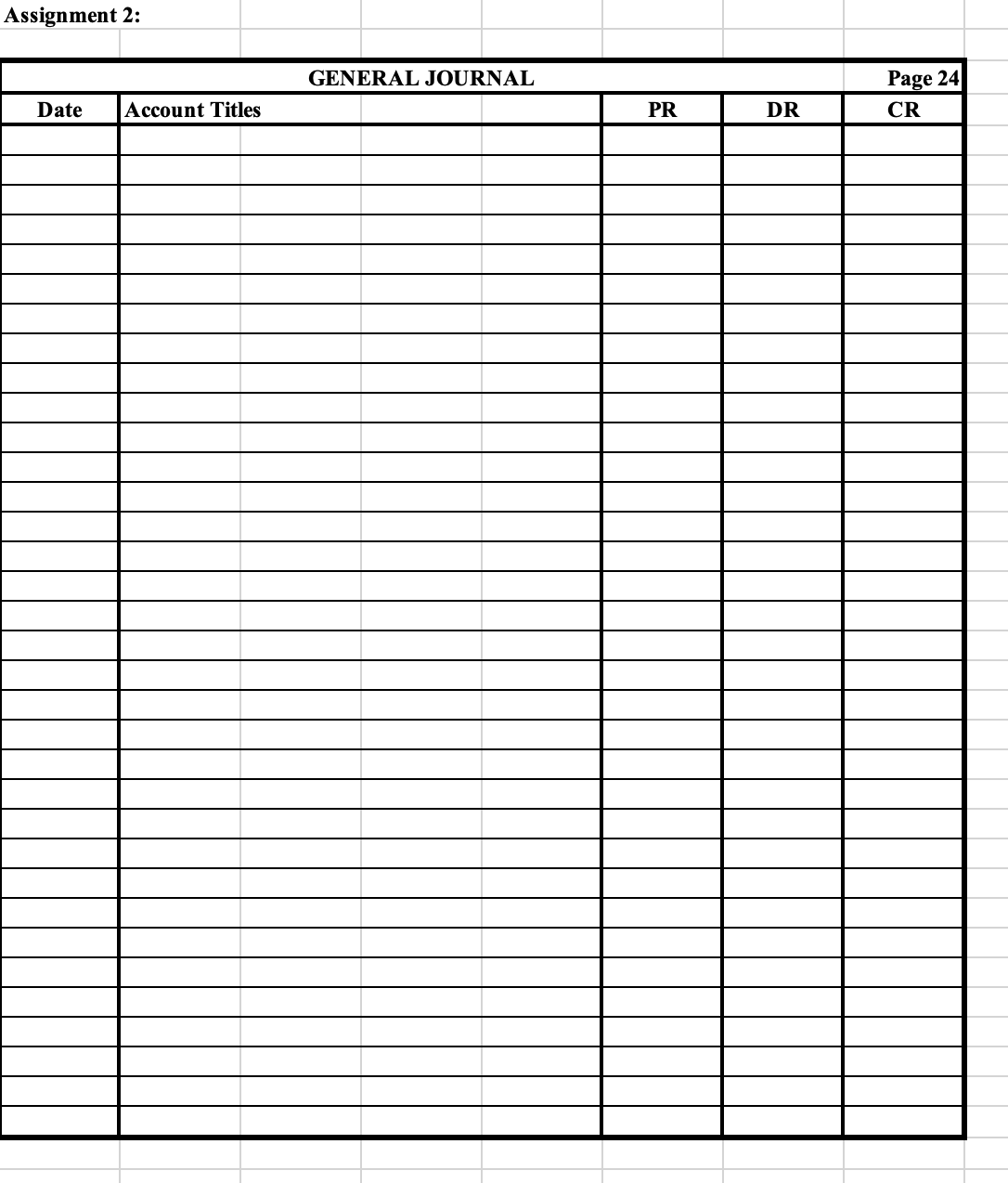

Harbor Repair Services Trial Balance 1/1/2021 During January 2021, the following transactions took place: Jan 1 Paid $700 cash for January rent. 2 Billed customers $1,500 for repair services performed. 3 Paid $100 cash for advertising services. 4 Purchased office supplies costing $500 on account. 5 Made a $220 cash payment on the note payable--this payment includes $20 of interest. (The Note Payable would be debited for \$200; the Interest Expense would be debited for \$20) 7 Paid \$500 cash for employees' weekly wages. 9 Received $1,700 cash for repair services performed. 11 Paid $92 cash for telephone services. 12 Paid $128 cash for utilities. 13 Received $800 cash on account from a previously billed customer. 14 Paid $500 cash for employees' weekly wages. 17 Purchased a used truck costing $10,000; paid $3,000 cash and signed a promissory note for the balance. 18 Made a $300 cash payment on accounts payable. 20 Received $1,900 cash for repair services performed. 21 Paid $500 cash for employees' weekly wages. 22 P. Harbor withdrew $400 cash for personal use. 23 Received $1,200 as a cash advance for reapir services to be performed over the next several weeks 24 Paid $280 cash for repair services on office equipment. 26 Paid $40 cash for miscellaneous expenses. 27 Billed customers for $1,100 for repair services performed. 28 Paid $500 cash for employees' weekly wages. 30 Paid $100 cash for advertising services. Assignment 2: GENERAL JOURNAL Page 24 On January 31, the following adjusting data is available: a. There are $2,700 of office supplies still on hand on January 31 . b. The insurance expires at $400 per month. c. Monthly depreciation on the office equipment is $200. d. Monthly depreciation on the truck $350 per month. e. As of January 31, \$200 of wages have accrued. f. As of January 31,$300 of the unearned repair revenue received on January 23 has been earned. g. Interest of $120 has accrued on the notes payable. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Harbor Repair Service } \\ \hline \multicolumn{5}{|c|}{ Trial Balance } \\ \hline \multicolumn{5}{|c|}{ January 31, 2021} \\ \hline & & & DD & CD \\ \hline Cash & & & & \\ \hline Casil & & & 0,140 & \\ \hline \multicolumn{3}{|c|}{ Accounts Receivable } & 1,800 & \\ \hline \multicolumn{2}{|c|}{ Office Supplies } & & 4,000 & \\ \hline \multicolumn{3}{|c|}{ Prepaid Insurance } & 3,500 & \\ \hline \multicolumn{3}{|c|}{ Office Equipment } & 12,000 & \\ \hline \multicolumn{3}{|c|}{ Accum. Depr.-Equip. } & & 2,000 \\ \hline Truck & & & 30,000 & \\ \hline \multicolumn{3}{|c|}{ Accum. Depr.-Truck } & & 8,000 \\ \hline \multicolumn{3}{|c|}{ Accounts Payable } & & 9,200 \\ \hline \multicolumn{3}{|c|}{ Notes Payable } & & 10,800 \\ \hline \multicolumn{3}{|c|}{ Unearned Repair Revenue } & & 1,200 \\ \hline \multicolumn{3}{|c|}{ Harbor, Capital } & & 24,500 \\ \hline \multicolumn{3}{|c|}{ Harbor, Drawing } & 400 & \\ \hline \multicolumn{3}{|c|}{ Repair Revenue } & & 6,200 \\ \hline \multicolumn{3}{|c|}{ Wages Expense } & 200 & \\ \hline \multicolumn{3}{|c|}{ Rent Expense } & 700 & \\ \hline \multicolumn{3}{|c|}{ Repairs Expense } & 2,000 & \\ \hline \multicolumn{3}{|c|}{ Telephone Expense } & 92 & \\ \hline \multicolumn{3}{|c|}{ Utilities Expense } & 128 & \\ \hline \multicolumn{3}{|c|}{ Advertising Expense } & 280 & \\ \hline \multicolumn{3}{|c|}{ Miscellaneous Expense } & 20 & \\ \hline \multicolumn{3}{|c|}{ Interest Expense } & 40 & \\ \hline \multicolumn{3}{|c|}{\begin{tabular}{|l|l|} Totals \\ \end{tabular}} & 61,900 & 61,900 \\ \hline \multicolumn{5}{|c|}{ Check Figure: $61,900} \\ \hline & & & & \\ \hline \end{tabular} Harbor Repair Services Chart of Accounts Account Name ASSETS Current Assets Cash Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accum. Depr. Equpiment Truck Accum. Depr. Truck Accounts Payable Notes Payable Wages Payable Unearned Repair Revenue Interest Payable Account No. 111 115 121 131 Property, Plant, and Equipment 141 142 151 152 LIABILITIES Current Liabilities 211 221 231 241 251 OWNER'S EQUITY P. Harbor, Capital P. Harbor, Drawing Repair Revenue Wage Expense Rent Expense Insurance Expense Office Supplies Expense Depreciation Expense-Equipment Depreciation Expense-Truck Repair Expense Telephone Expense Utilities Expense Advertising Expense Miscellaneous Expense Interest Expense Income Summary 311 312 411 511 521 522 531 541 545 551 555 565 575 599 611 911

Harbor Repair Services Trial Balance 1/1/2021 During January 2021, the following transactions took place: Jan 1 Paid $700 cash for January rent. 2 Billed customers $1,500 for repair services performed. 3 Paid $100 cash for advertising services. 4 Purchased office supplies costing $500 on account. 5 Made a $220 cash payment on the note payable--this payment includes $20 of interest. (The Note Payable would be debited for \$200; the Interest Expense would be debited for \$20) 7 Paid \$500 cash for employees' weekly wages. 9 Received $1,700 cash for repair services performed. 11 Paid $92 cash for telephone services. 12 Paid $128 cash for utilities. 13 Received $800 cash on account from a previously billed customer. 14 Paid $500 cash for employees' weekly wages. 17 Purchased a used truck costing $10,000; paid $3,000 cash and signed a promissory note for the balance. 18 Made a $300 cash payment on accounts payable. 20 Received $1,900 cash for repair services performed. 21 Paid $500 cash for employees' weekly wages. 22 P. Harbor withdrew $400 cash for personal use. 23 Received $1,200 as a cash advance for reapir services to be performed over the next several weeks 24 Paid $280 cash for repair services on office equipment. 26 Paid $40 cash for miscellaneous expenses. 27 Billed customers for $1,100 for repair services performed. 28 Paid $500 cash for employees' weekly wages. 30 Paid $100 cash for advertising services. Assignment 2: GENERAL JOURNAL Page 24 On January 31, the following adjusting data is available: a. There are $2,700 of office supplies still on hand on January 31 . b. The insurance expires at $400 per month. c. Monthly depreciation on the office equipment is $200. d. Monthly depreciation on the truck $350 per month. e. As of January 31, \$200 of wages have accrued. f. As of January 31,$300 of the unearned repair revenue received on January 23 has been earned. g. Interest of $120 has accrued on the notes payable. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Harbor Repair Service } \\ \hline \multicolumn{5}{|c|}{ Trial Balance } \\ \hline \multicolumn{5}{|c|}{ January 31, 2021} \\ \hline & & & DD & CD \\ \hline Cash & & & & \\ \hline Casil & & & 0,140 & \\ \hline \multicolumn{3}{|c|}{ Accounts Receivable } & 1,800 & \\ \hline \multicolumn{2}{|c|}{ Office Supplies } & & 4,000 & \\ \hline \multicolumn{3}{|c|}{ Prepaid Insurance } & 3,500 & \\ \hline \multicolumn{3}{|c|}{ Office Equipment } & 12,000 & \\ \hline \multicolumn{3}{|c|}{ Accum. Depr.-Equip. } & & 2,000 \\ \hline Truck & & & 30,000 & \\ \hline \multicolumn{3}{|c|}{ Accum. Depr.-Truck } & & 8,000 \\ \hline \multicolumn{3}{|c|}{ Accounts Payable } & & 9,200 \\ \hline \multicolumn{3}{|c|}{ Notes Payable } & & 10,800 \\ \hline \multicolumn{3}{|c|}{ Unearned Repair Revenue } & & 1,200 \\ \hline \multicolumn{3}{|c|}{ Harbor, Capital } & & 24,500 \\ \hline \multicolumn{3}{|c|}{ Harbor, Drawing } & 400 & \\ \hline \multicolumn{3}{|c|}{ Repair Revenue } & & 6,200 \\ \hline \multicolumn{3}{|c|}{ Wages Expense } & 200 & \\ \hline \multicolumn{3}{|c|}{ Rent Expense } & 700 & \\ \hline \multicolumn{3}{|c|}{ Repairs Expense } & 2,000 & \\ \hline \multicolumn{3}{|c|}{ Telephone Expense } & 92 & \\ \hline \multicolumn{3}{|c|}{ Utilities Expense } & 128 & \\ \hline \multicolumn{3}{|c|}{ Advertising Expense } & 280 & \\ \hline \multicolumn{3}{|c|}{ Miscellaneous Expense } & 20 & \\ \hline \multicolumn{3}{|c|}{ Interest Expense } & 40 & \\ \hline \multicolumn{3}{|c|}{\begin{tabular}{|l|l|} Totals \\ \end{tabular}} & 61,900 & 61,900 \\ \hline \multicolumn{5}{|c|}{ Check Figure: $61,900} \\ \hline & & & & \\ \hline \end{tabular} Harbor Repair Services Chart of Accounts Account Name ASSETS Current Assets Cash Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accum. Depr. Equpiment Truck Accum. Depr. Truck Accounts Payable Notes Payable Wages Payable Unearned Repair Revenue Interest Payable Account No. 111 115 121 131 Property, Plant, and Equipment 141 142 151 152 LIABILITIES Current Liabilities 211 221 231 241 251 OWNER'S EQUITY P. Harbor, Capital P. Harbor, Drawing Repair Revenue Wage Expense Rent Expense Insurance Expense Office Supplies Expense Depreciation Expense-Equipment Depreciation Expense-Truck Repair Expense Telephone Expense Utilities Expense Advertising Expense Miscellaneous Expense Interest Expense Income Summary 311 312 411 511 521 522 531 541 545 551 555 565 575 599 611 911 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started