Question has 3 parts all together

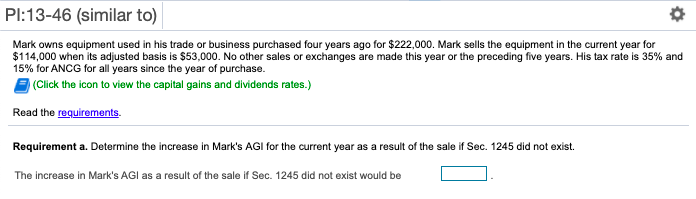

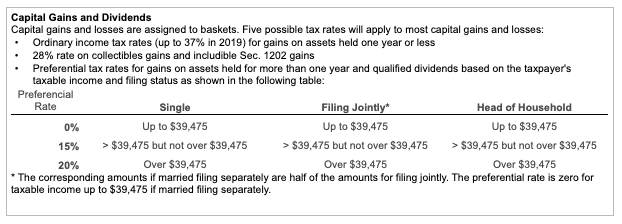

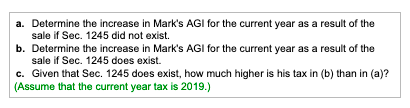

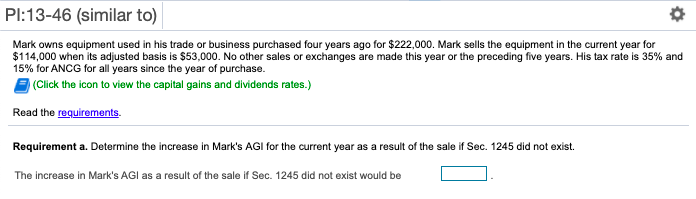

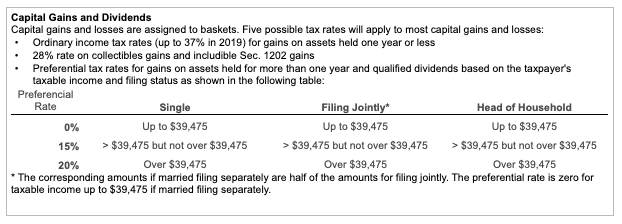

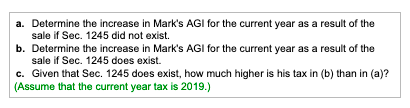

o PI:13-46 (similar to) Mark owns equipment used in his trade or business purchased four years ago for $222,000. Mark sells the equipment in the current year for $114,000 when its adjusted basis is $53,000. No other sales or exchanges are made this year or the preceding five years. His tax rate is 35% and 15% for ANCG for all years since the year of purchase. (Click the icon to view the capital gains and dividends rates.) Read the requirements Requirement a. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 did not exist. The increase in Mark's AGI as a result of the sale if Sec. 1245 did not exist would be Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,475 Up to $39,475 Up to $39,475 15% > $39,475 but not over $39,475 > $39,475 but not over $39,475 > $39,475 but not over $39,475 20% Over $39,475 Over $39,475 Over $39,475 The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $39,475 if married filing separately. a. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 did not exist. b. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 does exist. c. Given that Sec. 1245 does exist, how much higher is his tax in (b) than in (a)? (Assume that the current year tax is 2019.) o PI:13-46 (similar to) Mark owns equipment used in his trade or business purchased four years ago for $222,000. Mark sells the equipment in the current year for $114,000 when its adjusted basis is $53,000. No other sales or exchanges are made this year or the preceding five years. His tax rate is 35% and 15% for ANCG for all years since the year of purchase. (Click the icon to view the capital gains and dividends rates.) Read the requirements Requirement a. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 did not exist. The increase in Mark's AGI as a result of the sale if Sec. 1245 did not exist would be Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,475 Up to $39,475 Up to $39,475 15% > $39,475 but not over $39,475 > $39,475 but not over $39,475 > $39,475 but not over $39,475 20% Over $39,475 Over $39,475 Over $39,475 The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $39,475 if married filing separately. a. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 did not exist. b. Determine the increase in Mark's AGI for the current year as a result of the sale if Sec. 1245 does exist. c. Given that Sec. 1245 does exist, how much higher is his tax in (b) than in (a)? (Assume that the current year tax is 2019.)