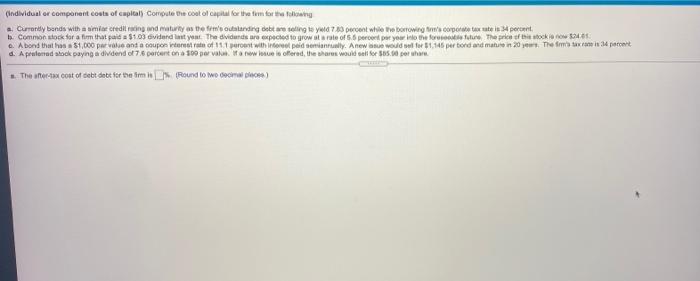

question has multiple part to it:

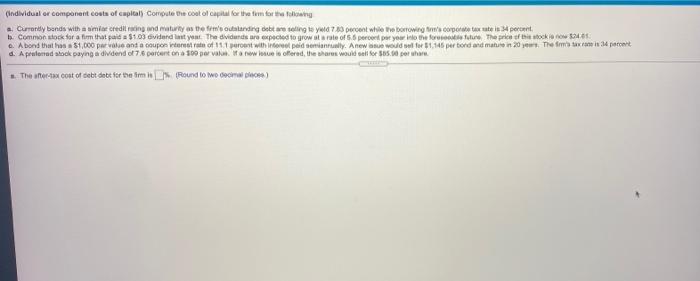

a) asks for the after-tax cost of debt for firm

b) asks for cost of common equity of firm

c) asks for the after-tax cost of debt for firm

d) asks for cost of preferred stock of firm

questions do not specify what they're asking, the options above is what theyre asking for in each part. thank you!

(individual or component costs of capital) Comote the cost of capital for the fem for the Currondy bands with a smile credit rating and many as the foutarding debt refing wyd 720 percent while to borrowing the corporate trate is percent b. Common stock for a firm that paid $1.03 vided into the dividends are expected to grow its role of 5.6 percepet your into the future The price of this stock now 6. A bond that has 51,000 per value and a couporteret rate of 11.1 percent with no peid seminully. Anew would wolf $1,146 per bond and matuon 20. The main percent d. A peutered stock payn dividend of 7 percent on a 100 perala we offered the wars would will 5.00 per www. The art cost of debt debt for the miss Round to wo decimo) Individual or component costs of capital) Compute the cost of capital for the form for the following Currently bonds with a similar credit rating and maturity as the firm's outstanding debt resting to yold percent while the wing's corporale per Common stock for a firm that pada 10 dividends year. The dividends rected to grow at percent into the form the facto Abond that has a 1.000 per valued coupon retro 11. what www1.148 por bond and mature is 20 There d. A preferred stock paying a dividend of 26 percent on 90 para new soffered the shares would be for the The whor tax cost of cott dobit to the forms. Round to two decimal (individual or component costs of capital) Comote the cost of capital for the fem for the Currondy bands with a smile credit rating and many as the foutarding debt refing wyd 720 percent while to borrowing the corporate trate is percent b. Common stock for a firm that paid $1.03 vided into the dividends are expected to grow its role of 5.6 percepet your into the future The price of this stock now 6. A bond that has 51,000 per value and a couporteret rate of 11.1 percent with no peid seminully. Anew would wolf $1,146 per bond and matuon 20. The main percent d. A peutered stock payn dividend of 7 percent on a 100 perala we offered the wars would will 5.00 per www. The art cost of debt debt for the miss Round to wo decimo) Individual or component costs of capital) Compute the cost of capital for the form for the following Currently bonds with a similar credit rating and maturity as the firm's outstanding debt resting to yold percent while the wing's corporale per Common stock for a firm that pada 10 dividends year. The dividends rected to grow at percent into the form the facto Abond that has a 1.000 per valued coupon retro 11. what www1.148 por bond and mature is 20 There d. A preferred stock paying a dividend of 26 percent on 90 para new soffered the shares would be for the The whor tax cost of cott dobit to the forms. Round to two decimal