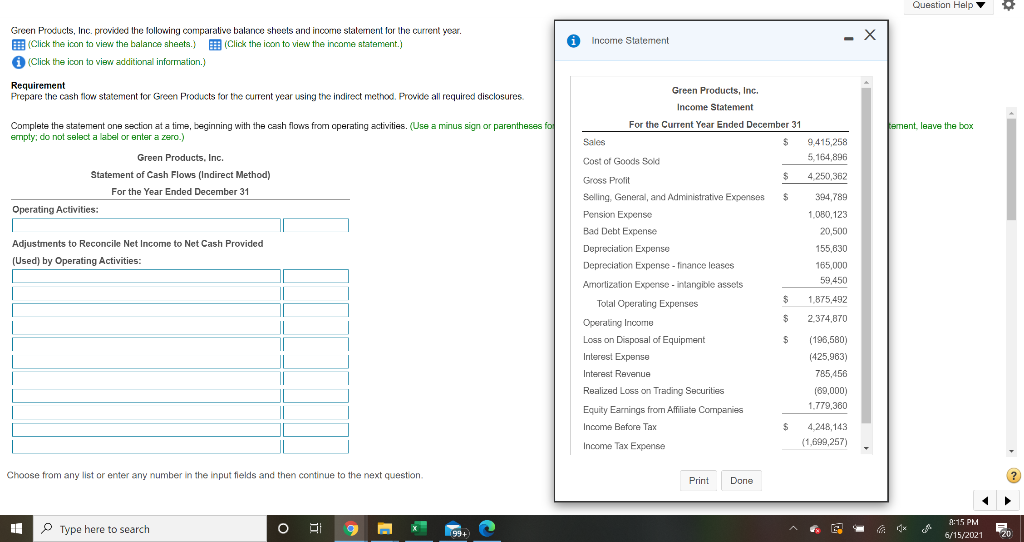

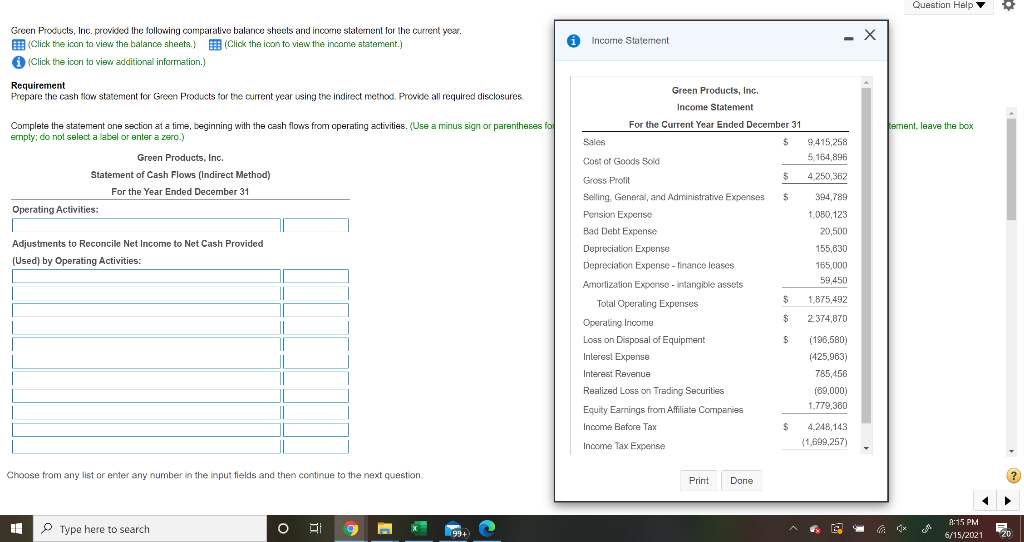

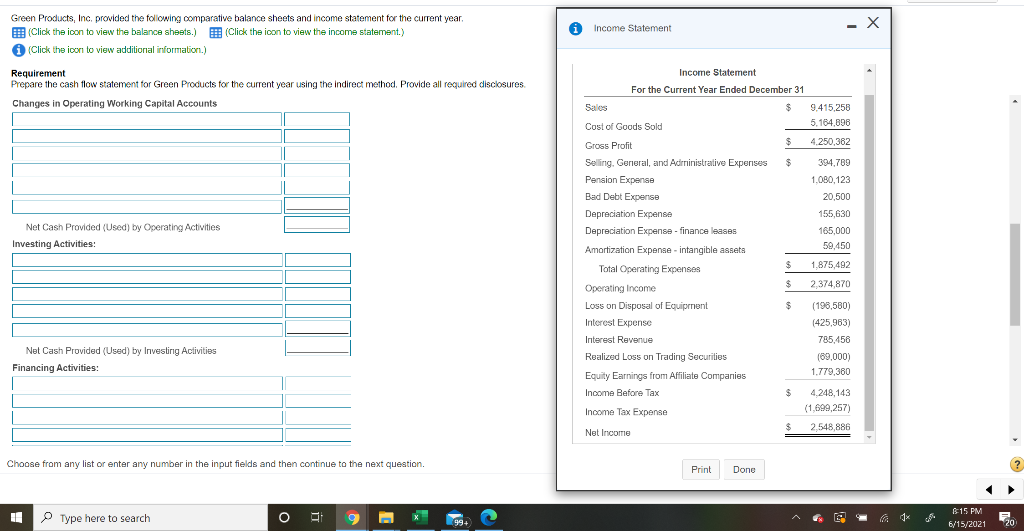

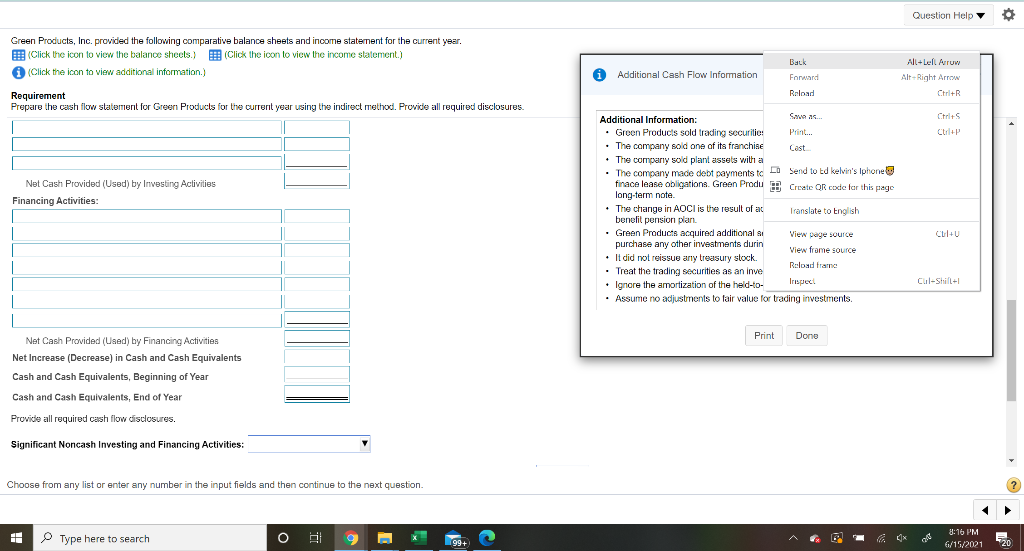

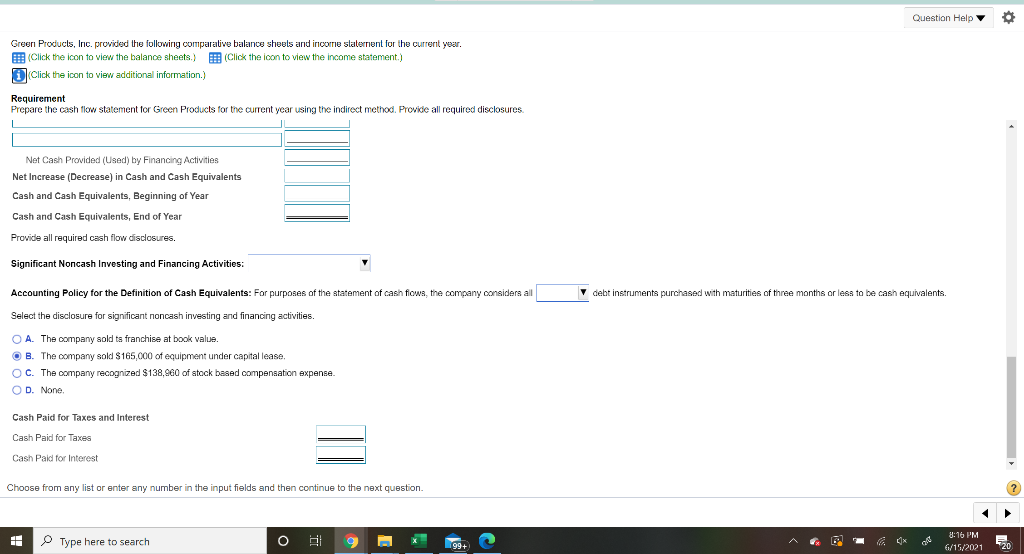

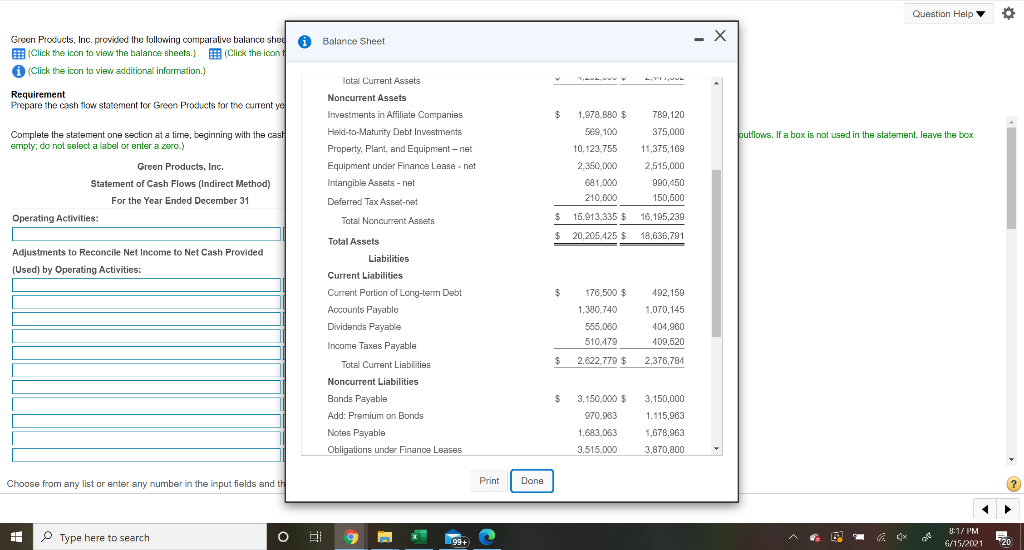

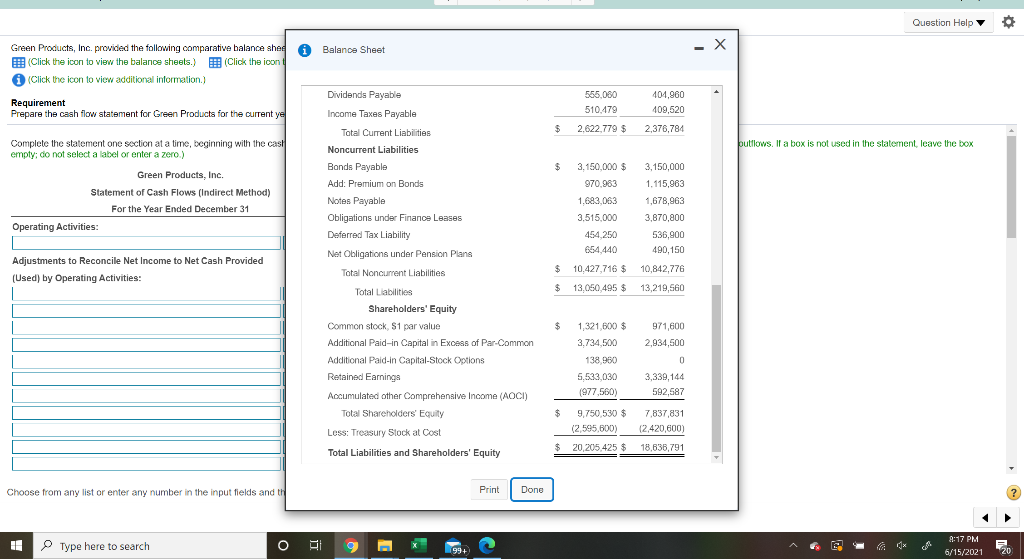

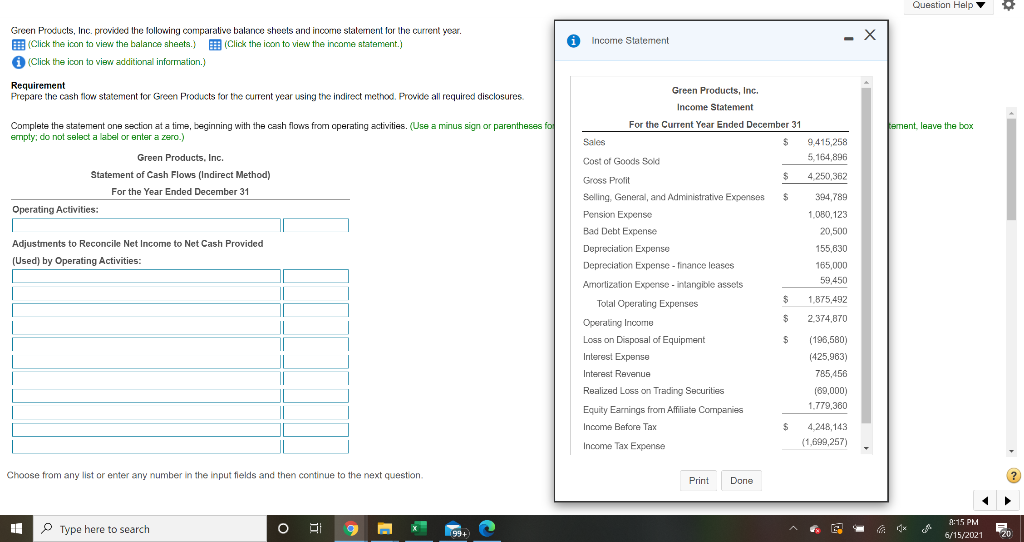

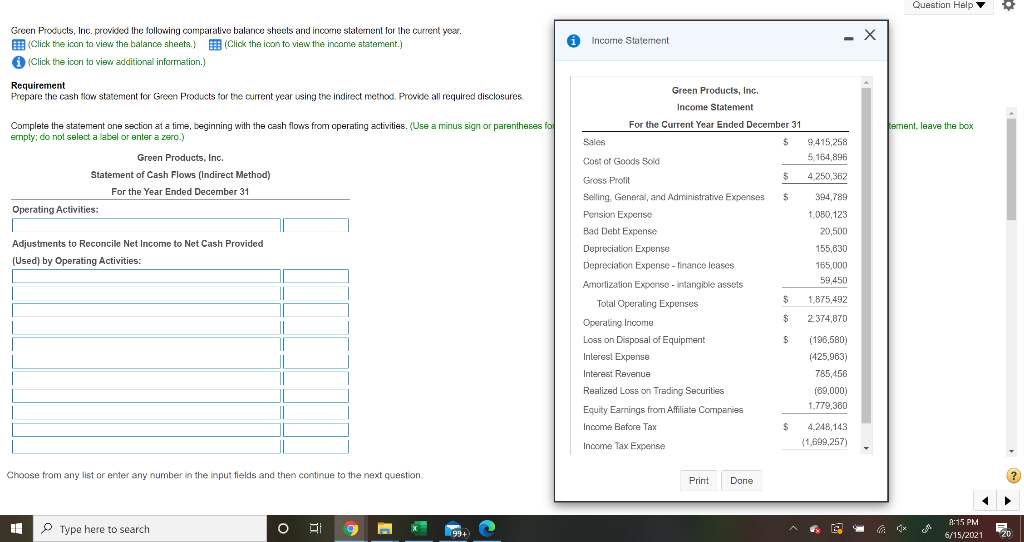

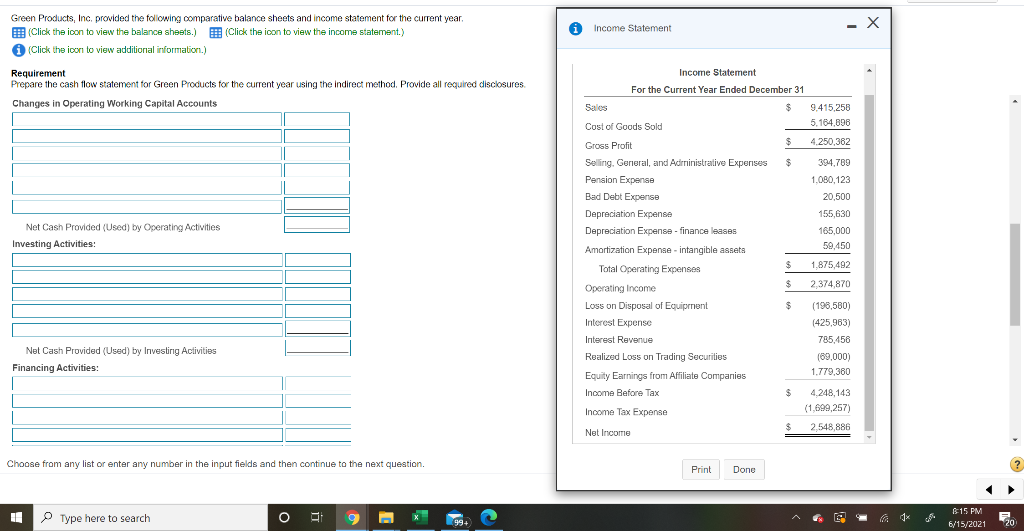

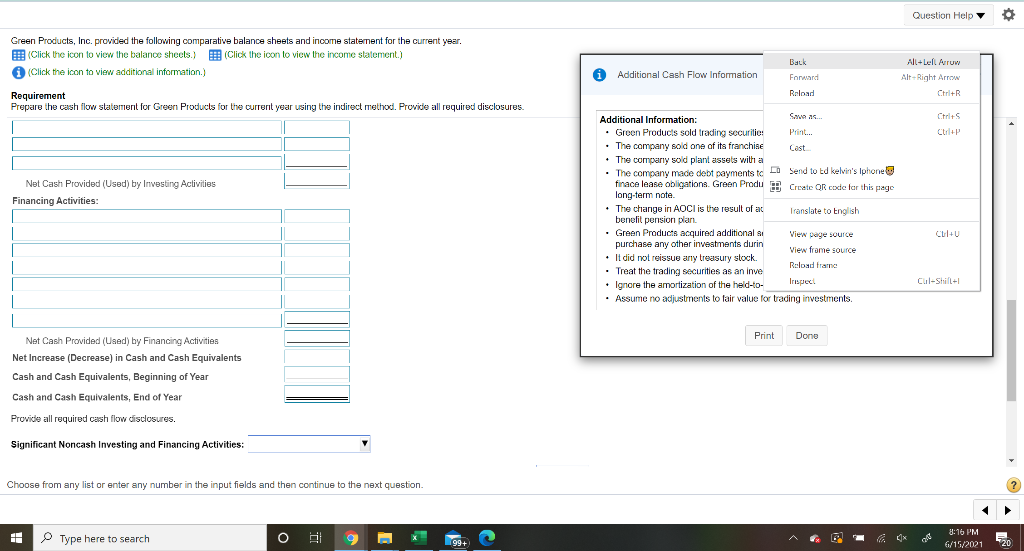

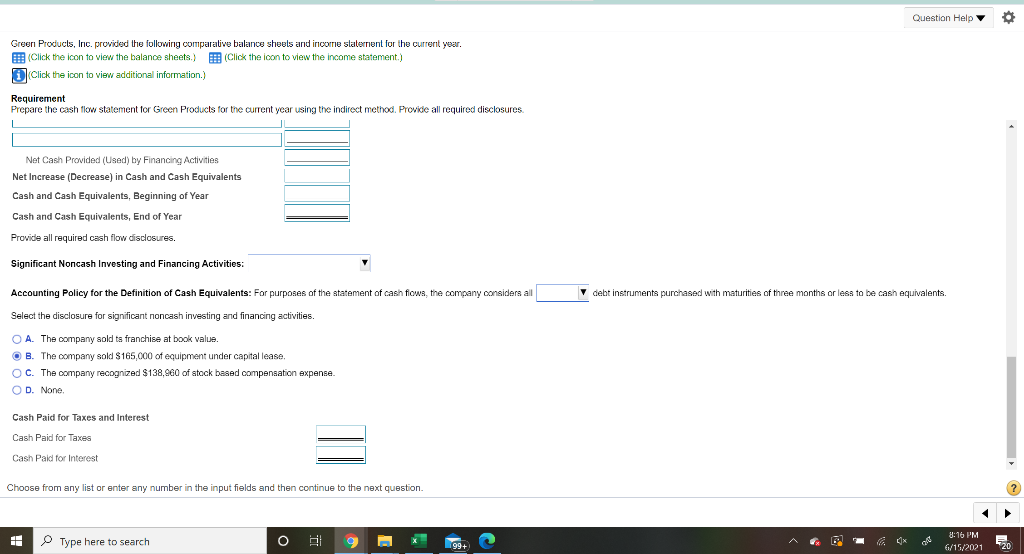

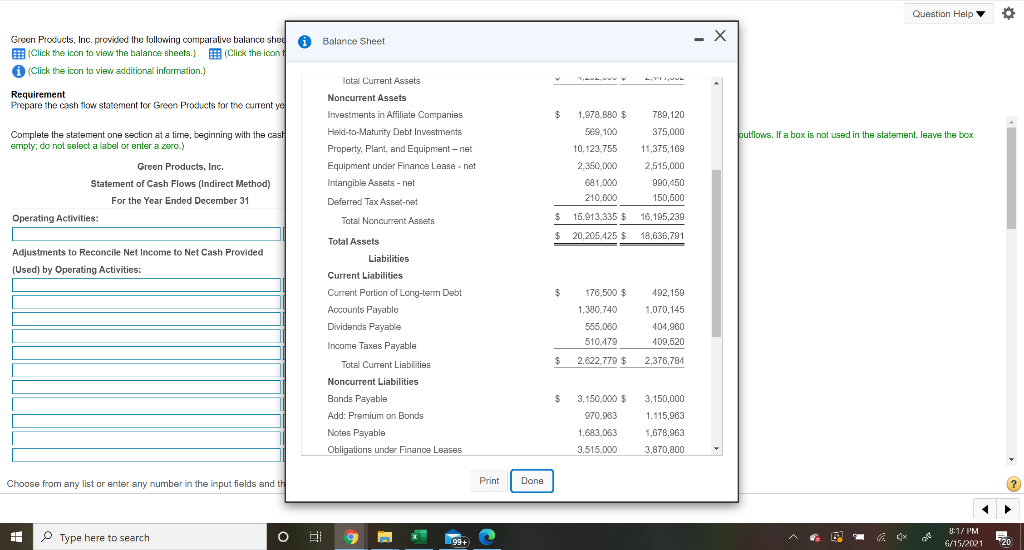

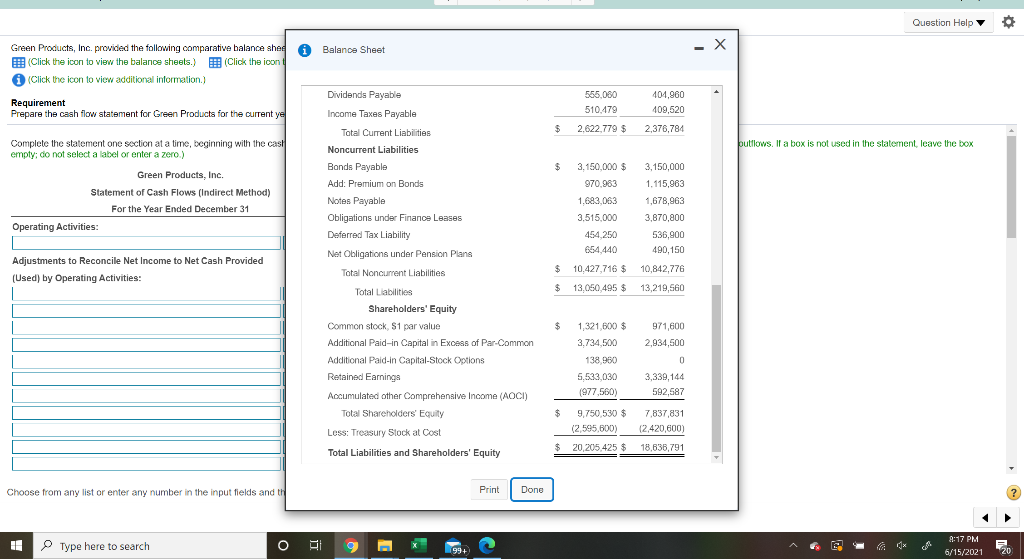

Question Help A Income Statement - Green Products, Inc. provided the following comparalive balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) Click the icon to view the income statement.) i (Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures . Green Products, Inc. Income Statement For the Current Year Ended December 31 tement, leave the box Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses fo empty, do not select a label or enter a zero.) Sales $ 9,415,258 Green Products, Inc. 5.164 896 Cost of Goods Sold Statement of Cash Flows (Indirect Method) $ 4,250,362 For the Year Ended December 31 Gross Profit Selling General, and Administrative Expenses Pension Expense $ 394,789 Operating Activities: 1,080,123 Bad Debt Expense 20,500 Adjustments to Reconcile Net Income to Net Cash Provided Depreciation Expense 155,630 (Used) by Operating Activities: Depreciation Expense - finance leases 165,000 59,450 Amortization Expense - intangible assets II $ 1,875,492 Total Operating Expenses II $ 2.374,870 Operating Income Loss on Disposal of Equipment Interest Expense $ (196,580) (425,963) Interest Revenue 785.456 Realized Loss on Trading Securities (69,000) 1.779,380 II Equity Earnings from Affiliate Companies Income Before Tax $ 4,248,143 Income Tax Expense (1,699,257) Choose from any list or enter any number in the input fields and then continue to the next question Print Done 8:15 PM Type here to search O F 199+ 6/15/2021 20 Question Help A Income Statement - Green Products, Inc. provided the following comparalive balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) Click the icon to view the income statement.) i (Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures . Green Products, Inc. Income Statement For the Current Year Ended December 31 tement, leave the box Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses fo empty, do not select a label or enter a zero.) Sales $ 9,415,258 Green Products, Inc. 5.164 896 Cost of Goods Sold Statement of Cash Flows (Indirect Method) $ 4,250,362 For the Year Ended December 31 Gross Profit Selling General, and Administrative Expenses Pension Expense $ 394,789 Operating Activities: 1,080,123 Bad Debt Expense 20,500 Adjustments to Reconcile Net Income to Net Cash Provided Depreciation Expense 155,630 (Used) by Operating Activities: Depreciation Expense - finance leases 165,000 59,450 Amortization Expense - intangible assets II $ 1,875,492 Total Operating Expenses II $ 2.374,870 Operating Income Loss on Disposal of Equipment Interest Expense $ (196,580) (425,963) Interest Revenue 785.456 Realized Loss on Trading Securities (69,000) 1.779,380 II Equity Earnings from Affiliate Companies Income Before Tax $ 4,248,143 Income Tax Expense (1,699,257) Choose from any list or enter any number in the input fields and then continue to the next question Print Done 8:15 PM Type here to search O F 199+ 6/15/2021 20 i Income Statement Green Products, Inc, provided the following comparative balance sheets and income statement for the current year. Click the icon to view the balance sheets.) Click the icon to view the income statement.) Click the icon to view additional information..) Income Statement Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures For the Current Year Ended December 31 Changes in Operating Working Capital Accounts Sales $ 9.415.258 Cost of Goods Sold 5.164,896 $ Gross Profit 4.250.362 | Selling. General, and Administrative Expenses $ 394,789 Pension Expense 1.080,123 Bad Debt Expense 20,500 Depreciation Expense 155,630 Net Cash Provided (Used) by Operating Activities Depreciation Expense finance leases 165,000 Investing Activities: 59,450 Amortization Expense - intangible assets Total Operating Expenses $ 1,875,492 $ 2.374.870 Operating Income $ (198,580) Loss on Disposal of Equipment Interest Expense (425,963) Interest Revenue 785,456 Net Cash Provided (Used) by Investing Activities Financing Activities: Realized Loss on Trading Securities (69,000) 1.779,360 Equity Earnings from Affiliate Companies Income Before Tax $ 4.248,143 Income Tax Expense (1,699,257) $ 2548,886 Net Income Choose from any list or enter any number in the input fields and then continue to the next question. ? Print Done 8:15 PM 1 Type here to search O 99+) PA 6/15/2021 20 Question Help O Green Products, Inc. provided the following comparative balance sheets and income statement for the current year. Click the icon to view the balance sheets. (Click the icon to view the income statement.) (Click the icon to view additional information.) Back All+Lell Auruw Additional Cash Flow Information Forward Alt-Right Arrow Reload Ctrl+R Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures Save As... Ctrl+S Ctrip Cast Net Cash Provided (Used) by Investing Activities Financing Activities: Additional Information: Green Products sold trading securities Print... The company sold one of its franchise The comparty sold plant assets with a The company made debt payments to Send to bd kelvin's Iphone finace lease obligations. Green Produ : Create or code for this page long-term note. The change in AOCI is the result of a Translate to English benefit pension plan Green Products acquired additional a View page source purchase any other investments durin View frame source It did not reissue any treasury stock. Reload Frame Treat the trading securities as an inve Ignore the amortization of the held-to- Irespect Assume no adjustments to fair value for trading investments. CLIEU Cul-Still Print Done Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year Provide all required cash flow disclosures. Significant Noncash Investing and Financing Activities: Choose from any list or enter any number in the input fields and then continue to the next question. ? 8:16 PM Type here to search O AL 2 199+ 6/15/2021 20 Question Help 7 Greer Products, Inc. provided the following comparative balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year Provide all required cash flow disclosures. Significant Noncash Investing and Financing Activities: Accounting Policy for the Definition of Cash Equivalents: For purposes of the statement of cash flows, the company considers all V debt instruments purchased with maturities of three months or less to be cash equivalents. Select the disclosure for significant noncash investing and financing activities. O A. The company sold ts franchise at book value. B. The company sold $165,000 of equipment under capital lease, OC. The company recognized $138,960 of stock based compensation expense. OD. None Cash Paid for Taxes and Interest Cash Paid for Taxes Cash Paid for Interest Choose from any list or enter any number in the input fields and then continue to the next question ? 8:16 PM Type here to search O 9 @ 199+ 6/15/2021 20 Question Help A Balance Sheet Green Products, Inc. provided the following comparative balance shee Click the icon to view the balance sheets.) Click the icon (Click the icon to view additional information.) Total Current Assets Noncurrent Assets Requirement Prepare the cash flow statement for Green Products for the current ye $ 1.978,880 $ 789,120 Investments in Affiliate Companies Held-to-Maturity Debt Investments 569,100 375,000 Complete the statement one section at a time, beginning with the cast empty; do not select a label or enter a zero.) putflows. If a box is not used in the statement, leave the box Property, Plant, and Equipment-net 10.123.755 11,375,169 Green Products, Inc. Equipment under Finance Leane - net 2.350.000 2,515,000 Statement of Cash Flows (Indirect Method) Intangible Assets - net 681,000 990.450 For the Year Ended December 31 210,600 150,500 Deferred Tax Asset-net Operating Activities: $ 15,913,335 $ $ Total Noncurrent Assets 16,195,239 $ 20,205,425 $ 18,636,791 Total Assets Adjustments to Reconcile Net Income to Net Cash Provided Liabilities (Used) by Operating Activities: Current Liabilities $ 176,500 $ 492,159 Current Portion of Long-term Debt Accounts Payable 1,380.740 1.070,145 Dividends Payable 565,000 404,960 510.479 Income Taxes Payable 409,520 $ 2.622.779 $ Total Current Liabilities 2.376.784 Noncurrent Liabilities Bonds Payable $ 3.150.000 $ 3,150,000 Add: Premium on Bonds 970.983 1.115,963 Notes Payable 1.683.063 1,678,963 Obligations under Finance Leases 3.515.000 3,870,000 Choose from any list or enter any number in the input fields and th Print Done ? 8:17 PM 1 Type here to search O 9 199+ 6/15/2021 20 Question Help 565 080 404,960 510,479 409,520 $ 2.622.779 $ 2,376,784 Green Products, Inc. provided the following comparative balance shee Balance Sheet (Click the icon to view the balance sheets.) (Click the icon ( Click the icon to view additional information.) Dividends Payable Requirement Prepare the cash flow statement for Green Products for the current ye Income Taxes Payable Total Current Liabilities Complete the statement one section at a time, beginning with the cast empty: do not select a label or enter a zero) Bonds Payable Green Products, Inc. Add: Premium on Bonds Statement of Cash Flows (Indirect Method) Notes Payable Obligations under Finance Leases Operating Activities: Deferred Tax Liability outflows. If a box is not used in the statement, leave the box Noncurrent Liabilities $ 3,150,000 $ 3,150,000 970.963 1.115,963 1.683.063 1,678,963 For the Year Ended December 31 3.515.000 3,870,800 454 250 536,900 490,150 654,440 Net Obligations under Pension Plans Adjustments to Reconcile Net Income to Net Cash Provided Total Noncurrent Liabilities $ 10.427.716 $ 10,842,776 (Used) by Operating Activities: Total Liabilities $ 13,050,495 $ 13,219,560 Shareholders' Equity Common stock, S1 par value Additional Paid-in Capital in Excess of Par-Common $ 1,321,000 $ 971,600 3.734.500 2,934,500 Additional Paid-in Capital-Stock Options 138,950 0 Retained Earnings 3,339,144 5,533,030 (977,560 592,587 Accumulated other Comprehensive Income (ACI) Total Shareholders' Equity $ 7,837,831 9,750,530 $ (2,565 600) Less: Treasury Stock at Cost 12,420,600) $ 20,205 425 $ 18,636,791 Total Liabilities and Shareholders' Equity Choose from any list or enter any number in the input fields and the Print Done 4:17 PM Type here to search O gi x @ 0 F 1994 6/15/2021 20 Question Help A Income Statement - Green Products, Inc. provided the following comparalive balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) Click the icon to view the income statement.) i (Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures . Green Products, Inc. Income Statement For the Current Year Ended December 31 tement, leave the box Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses fo empty, do not select a label or enter a zero.) Sales $ 9,415,258 Green Products, Inc. 5.164 896 Cost of Goods Sold Statement of Cash Flows (Indirect Method) $ 4,250,362 For the Year Ended December 31 Gross Profit Selling General, and Administrative Expenses Pension Expense $ 394,789 Operating Activities: 1,080,123 Bad Debt Expense 20,500 Adjustments to Reconcile Net Income to Net Cash Provided Depreciation Expense 155,630 (Used) by Operating Activities: Depreciation Expense - finance leases 165,000 59,450 Amortization Expense - intangible assets II $ 1,875,492 Total Operating Expenses II $ 2.374,870 Operating Income Loss on Disposal of Equipment Interest Expense $ (196,580) (425,963) Interest Revenue 785.456 Realized Loss on Trading Securities (69,000) 1.779,380 II Equity Earnings from Affiliate Companies Income Before Tax $ 4,248,143 Income Tax Expense (1,699,257) Choose from any list or enter any number in the input fields and then continue to the next question Print Done 8:15 PM Type here to search O F 199+ 6/15/2021 20 Question Help A Income Statement - Green Products, Inc. provided the following comparalive balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) Click the icon to view the income statement.) i (Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures . Green Products, Inc. Income Statement For the Current Year Ended December 31 tement, leave the box Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses fo empty, do not select a label or enter a zero.) Sales $ 9,415,258 Green Products, Inc. 5.164 896 Cost of Goods Sold Statement of Cash Flows (Indirect Method) $ 4,250,362 For the Year Ended December 31 Gross Profit Selling General, and Administrative Expenses Pension Expense $ 394,789 Operating Activities: 1,080,123 Bad Debt Expense 20,500 Adjustments to Reconcile Net Income to Net Cash Provided Depreciation Expense 155,630 (Used) by Operating Activities: Depreciation Expense - finance leases 165,000 59,450 Amortization Expense - intangible assets II $ 1,875,492 Total Operating Expenses II $ 2.374,870 Operating Income Loss on Disposal of Equipment Interest Expense $ (196,580) (425,963) Interest Revenue 785.456 Realized Loss on Trading Securities (69,000) 1.779,380 II Equity Earnings from Affiliate Companies Income Before Tax $ 4,248,143 Income Tax Expense (1,699,257) Choose from any list or enter any number in the input fields and then continue to the next question Print Done 8:15 PM Type here to search O F 199+ 6/15/2021 20 i Income Statement Green Products, Inc, provided the following comparative balance sheets and income statement for the current year. Click the icon to view the balance sheets.) Click the icon to view the income statement.) Click the icon to view additional information..) Income Statement Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures For the Current Year Ended December 31 Changes in Operating Working Capital Accounts Sales $ 9.415.258 Cost of Goods Sold 5.164,896 $ Gross Profit 4.250.362 | Selling. General, and Administrative Expenses $ 394,789 Pension Expense 1.080,123 Bad Debt Expense 20,500 Depreciation Expense 155,630 Net Cash Provided (Used) by Operating Activities Depreciation Expense finance leases 165,000 Investing Activities: 59,450 Amortization Expense - intangible assets Total Operating Expenses $ 1,875,492 $ 2.374.870 Operating Income $ (198,580) Loss on Disposal of Equipment Interest Expense (425,963) Interest Revenue 785,456 Net Cash Provided (Used) by Investing Activities Financing Activities: Realized Loss on Trading Securities (69,000) 1.779,360 Equity Earnings from Affiliate Companies Income Before Tax $ 4.248,143 Income Tax Expense (1,699,257) $ 2548,886 Net Income Choose from any list or enter any number in the input fields and then continue to the next question. ? Print Done 8:15 PM 1 Type here to search O 99+) PA 6/15/2021 20 Question Help O Green Products, Inc. provided the following comparative balance sheets and income statement for the current year. Click the icon to view the balance sheets. (Click the icon to view the income statement.) (Click the icon to view additional information.) Back All+Lell Auruw Additional Cash Flow Information Forward Alt-Right Arrow Reload Ctrl+R Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures Save As... Ctrl+S Ctrip Cast Net Cash Provided (Used) by Investing Activities Financing Activities: Additional Information: Green Products sold trading securities Print... The company sold one of its franchise The comparty sold plant assets with a The company made debt payments to Send to bd kelvin's Iphone finace lease obligations. Green Produ : Create or code for this page long-term note. The change in AOCI is the result of a Translate to English benefit pension plan Green Products acquired additional a View page source purchase any other investments durin View frame source It did not reissue any treasury stock. Reload Frame Treat the trading securities as an inve Ignore the amortization of the held-to- Irespect Assume no adjustments to fair value for trading investments. CLIEU Cul-Still Print Done Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year Provide all required cash flow disclosures. Significant Noncash Investing and Financing Activities: Choose from any list or enter any number in the input fields and then continue to the next question. ? 8:16 PM Type here to search O AL 2 199+ 6/15/2021 20 Question Help 7 Greer Products, Inc. provided the following comparative balance sheels and income statement for the current year. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) Click the icon to view additional information.) Requirement Prepare the cash flow statement for Green Products for the current year using the indirect method. Provide all required disclosures Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year Provide all required cash flow disclosures. Significant Noncash Investing and Financing Activities: Accounting Policy for the Definition of Cash Equivalents: For purposes of the statement of cash flows, the company considers all V debt instruments purchased with maturities of three months or less to be cash equivalents. Select the disclosure for significant noncash investing and financing activities. O A. The company sold ts franchise at book value. B. The company sold $165,000 of equipment under capital lease, OC. The company recognized $138,960 of stock based compensation expense. OD. None Cash Paid for Taxes and Interest Cash Paid for Taxes Cash Paid for Interest Choose from any list or enter any number in the input fields and then continue to the next question ? 8:16 PM Type here to search O 9 @ 199+ 6/15/2021 20 Question Help A Balance Sheet Green Products, Inc. provided the following comparative balance shee Click the icon to view the balance sheets.) Click the icon (Click the icon to view additional information.) Total Current Assets Noncurrent Assets Requirement Prepare the cash flow statement for Green Products for the current ye $ 1.978,880 $ 789,120 Investments in Affiliate Companies Held-to-Maturity Debt Investments 569,100 375,000 Complete the statement one section at a time, beginning with the cast empty; do not select a label or enter a zero.) putflows. If a box is not used in the statement, leave the box Property, Plant, and Equipment-net 10.123.755 11,375,169 Green Products, Inc. Equipment under Finance Leane - net 2.350.000 2,515,000 Statement of Cash Flows (Indirect Method) Intangible Assets - net 681,000 990.450 For the Year Ended December 31 210,600 150,500 Deferred Tax Asset-net Operating Activities: $ 15,913,335 $ $ Total Noncurrent Assets 16,195,239 $ 20,205,425 $ 18,636,791 Total Assets Adjustments to Reconcile Net Income to Net Cash Provided Liabilities (Used) by Operating Activities: Current Liabilities $ 176,500 $ 492,159 Current Portion of Long-term Debt Accounts Payable 1,380.740 1.070,145 Dividends Payable 565,000 404,960 510.479 Income Taxes Payable 409,520 $ 2.622.779 $ Total Current Liabilities 2.376.784 Noncurrent Liabilities Bonds Payable $ 3.150.000 $ 3,150,000 Add: Premium on Bonds 970.983 1.115,963 Notes Payable 1.683.063 1,678,963 Obligations under Finance Leases 3.515.000 3,870,000 Choose from any list or enter any number in the input fields and th Print Done ? 8:17 PM 1 Type here to search O 9 199+ 6/15/2021 20 Question Help 565 080 404,960 510,479 409,520 $ 2.622.779 $ 2,376,784 Green Products, Inc. provided the following comparative balance shee Balance Sheet (Click the icon to view the balance sheets.) (Click the icon ( Click the icon to view additional information.) Dividends Payable Requirement Prepare the cash flow statement for Green Products for the current ye Income Taxes Payable Total Current Liabilities Complete the statement one section at a time, beginning with the cast empty: do not select a label or enter a zero) Bonds Payable Green Products, Inc. Add: Premium on Bonds Statement of Cash Flows (Indirect Method) Notes Payable Obligations under Finance Leases Operating Activities: Deferred Tax Liability outflows. If a box is not used in the statement, leave the box Noncurrent Liabilities $ 3,150,000 $ 3,150,000 970.963 1.115,963 1.683.063 1,678,963 For the Year Ended December 31 3.515.000 3,870,800 454 250 536,900 490,150 654,440 Net Obligations under Pension Plans Adjustments to Reconcile Net Income to Net Cash Provided Total Noncurrent Liabilities $ 10.427.716 $ 10,842,776 (Used) by Operating Activities: Total Liabilities $ 13,050,495 $ 13,219,560 Shareholders' Equity Common stock, S1 par value Additional Paid-in Capital in Excess of Par-Common $ 1,321,000 $ 971,600 3.734.500 2,934,500 Additional Paid-in Capital-Stock Options 138,950 0 Retained Earnings 3,339,144 5,533,030 (977,560 592,587 Accumulated other Comprehensive Income (ACI) Total Shareholders' Equity $ 7,837,831 9,750,530 $ (2,565 600) Less: Treasury Stock at Cost 12,420,600) $ 20,205 425 $ 18,636,791 Total Liabilities and Shareholders' Equity Choose from any list or enter any number in the input fields and the Print Done 4:17 PM Type here to search O gi x @ 0 F 1994 6/15/2021 20