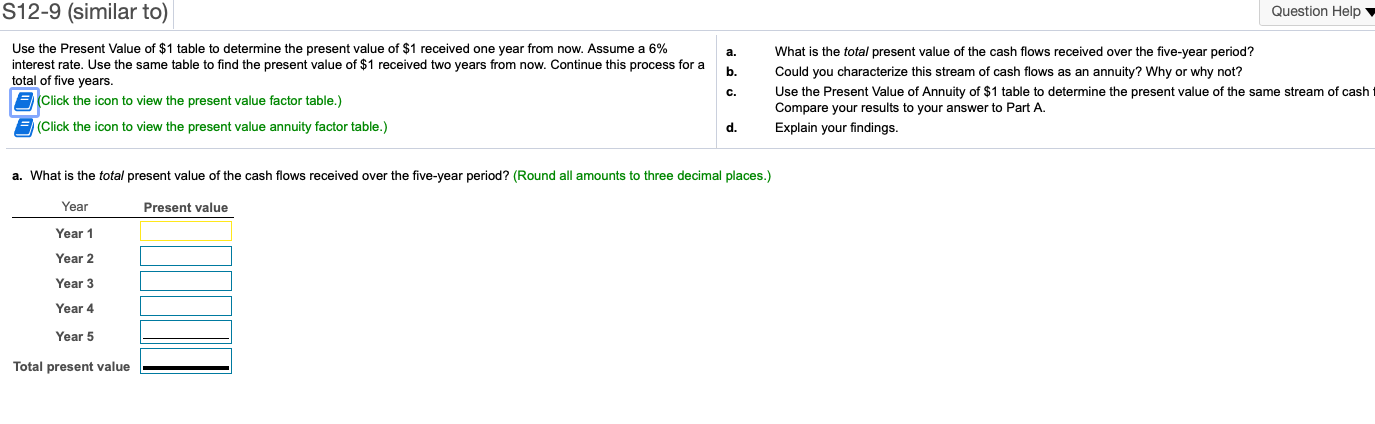

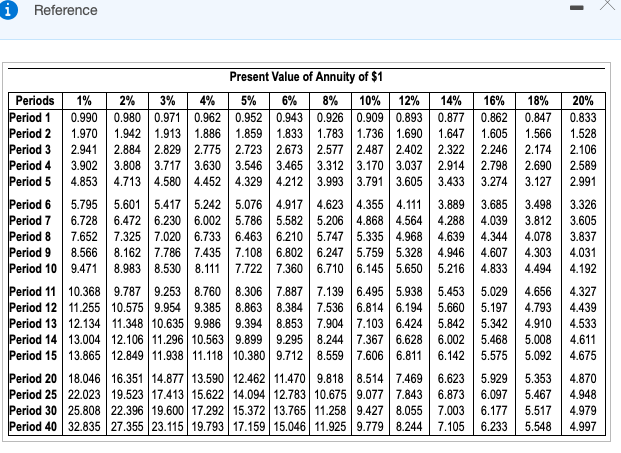

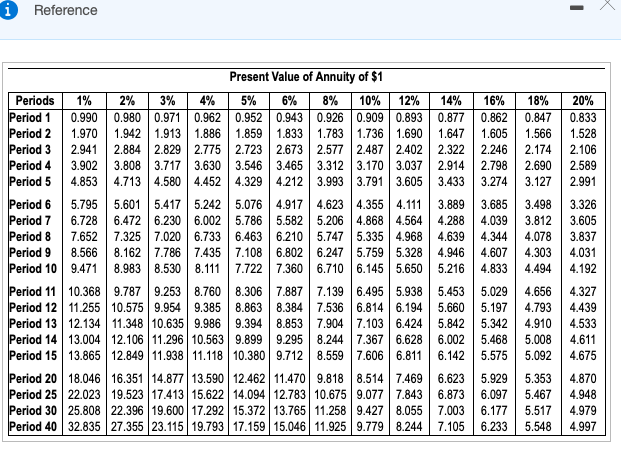

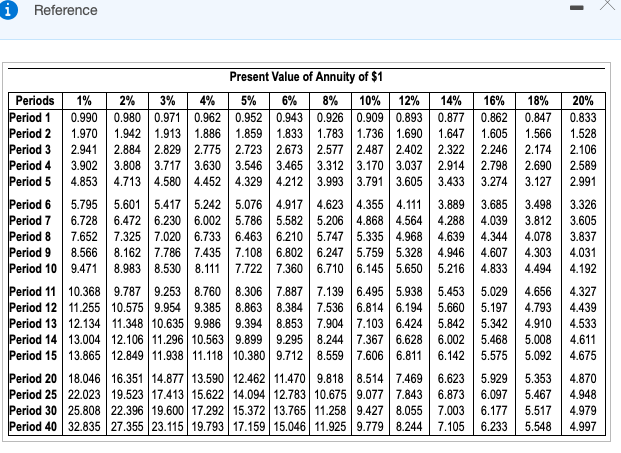

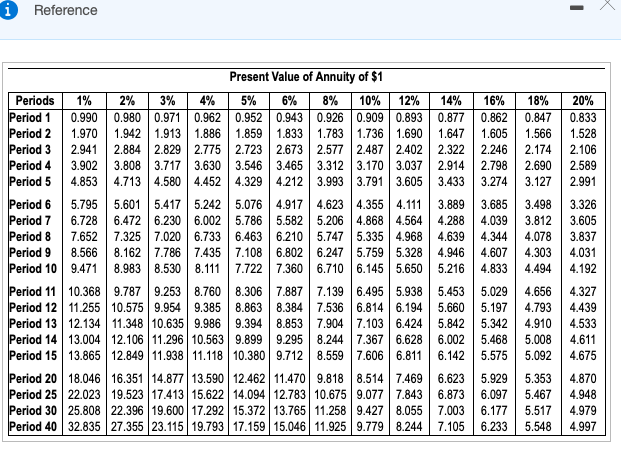

Question Help a. S12-9 (similar to) Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume a 6% interest rate. Use the same table to find the present value of $1 received two years from now. Continue this process for a total of five years. Click the icon to view the present value factor table.) 2 (Click the icon to view the present value annuity factor table.) b. c. What is the total present value of the cash flows received over the five-year period? Could you characterize this stream of cash flows as an annuity? Why or why not? Use the Present Value of Annuity of $1 table to determine the present value of the same stream of cash Compare your results to your answer to Part A. Explain your findings. d. a. What is the total present value of the cash flows received over the five-year period? (Round all amounts to three decimal places.) Year Present value Year 1 Year 2 Year 3 Year 4 Year 5 Total present value i Reference 5% 14% 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 6% 8% 10% 12% 16% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.605 Period 3 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 Period 5 4.853 4.713 4.580 4.452 4.329 4.2123.993 3.791 3.605 3.433 3.274 Period 6 5.795 5.601 5.417 5.2425.076 4.917 4.623 4.355 4.111 3.889 3.685 Period 7 6.728 6.472 6.230 6.002 5.786 5.5825.206 4.868 4.564 4.288 4.039 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 Period 9 8.566 8.1627.786 7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.607 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.6505.216 4.833 Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 Period 13 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5,468 Period 15 | 13.865 12.849 11.938 11.118 10.380 9.7128.559 7.606 6.811 6.142 5.575 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.427 8.055 7.003 6.177 Period 40 32.835 27.355 23.115 19.793 17.159 15.046 11.925 9.7798.244 7.105 6.233 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 5.353 5.467 5.517 5.548 4.870 4.948 4.979 4.997 i Reference 5% 14% 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 6% 8% 10% 12% 16% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.605 Period 3 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 Period 5 4.853 4.713 4.580 4.452 4.329 4.2123.993 3.791 3.605 3.433 3.274 Period 6 5.795 5.601 5.417 5.2425.076 4.917 4.623 4.355 4.111 3.889 3.685 Period 7 6.728 6.472 6.230 6.002 5.786 5.5825.206 4.868 4.564 4.288 4.039 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 Period 9 8.566 8.1627.786 7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.607 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.6505.216 4.833 Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 Period 13 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5,468 Period 15 | 13.865 12.849 11.938 11.118 10.380 9.7128.559 7.606 6.811 6.142 5.575 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.427 8.055 7.003 6.177 Period 40 32.835 27.355 23.115 19.793 17.159 15.046 11.925 9.7798.244 7.105 6.233 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 5.353 5.467 5.517 5.548 4.870 4.948 4.979 4.997