Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to

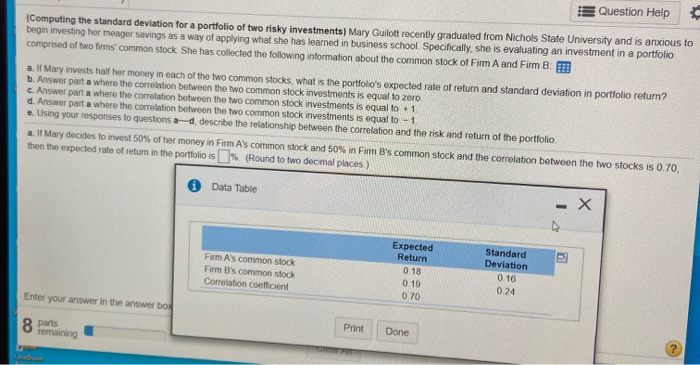

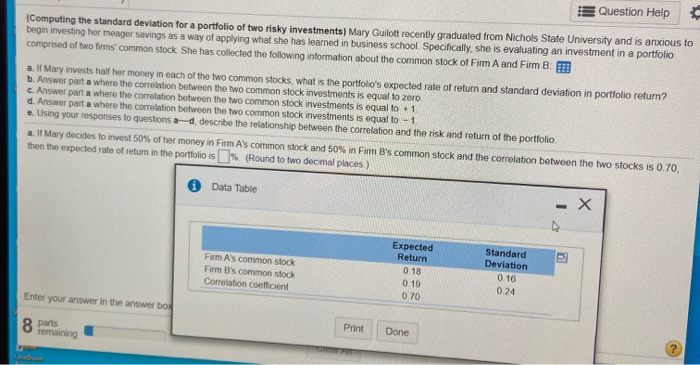

Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school. Specifically, she is evaluating an investment in a portfolio comprised of two firms' common stock She has collected the following information about the common stock of Firm A and Firm B: a. If Mary invests half her money in each of the two common stocks, what is the portfolo's expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero c. Answer part a where the corolation between the two common stock investments is equal to 1 d. Answer part a where the corelation between the two common stock investments is equal to-1 e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. a. If Mary decides to invest 50 % of her money in Firm A's common stock and 50% in Fim B's common stock and the correlation between the two stocks is 0.70 then the expected rate of returm in the portfolio is% (Round to two decimal places.) Data Table Expected Return Standard Deviation 0.16 Firm A's common stock 0.18 Firm B's common stock 0 19 0 24 Comrelation coefficient 070 Enter your answer in the answer bo Print Done 8 parts remaining ab

Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school. Specifically, she is evaluating an investment in a portfolio comprised of two firms' common stock She has collected the following information about the common stock of Firm A and Firm B: a. If Mary invests half her money in each of the two common stocks, what is the portfolo's expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero c. Answer part a where the corolation between the two common stock investments is equal to 1 d. Answer part a where the corelation between the two common stock investments is equal to-1 e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. a. If Mary decides to invest 50 % of her money in Firm A's common stock and 50% in Fim B's common stock and the correlation between the two stocks is 0.70 then the expected rate of returm in the portfolio is% (Round to two decimal places.) Data Table Expected Return Standard Deviation 0.16 Firm A's common stock 0.18 Firm B's common stock 0 19 0 24 Comrelation coefficient 070 Enter your answer in the answer bo Print Done 8 parts remaining ab

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started