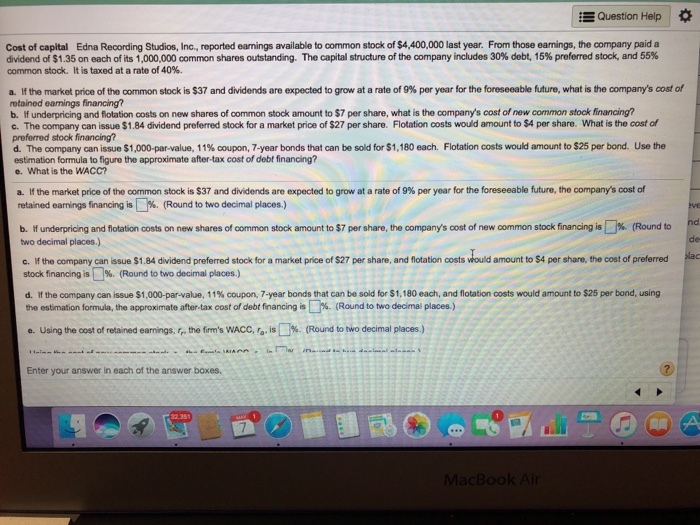

Question Help Cost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,400,000 last year. From those earnings, the company paid a dividend of $1.35 on each of its 1,000,000 common shares outstanding The capital structure of the o p any includes 30% do t 15% prefered stock and 55% common stock. It is taxed at a rate of 40%. a If the market price of the common stock is $37 and dividends are expected to grow at a rate of 9% per year for the foreseeable han tat is the amamsta rotained earnings financing? b. If underpricing and flotation costs on new shares of common stock amount to $7 per share, what is the company's cost of new common stock financing? c.The company can issue $1.84 dividend preferred stock for a market price of $27 per share. Flotation costs would amount to $4 per share. What is the cost of preferred stock financing? d. The company can issue $1,000 par value, 11% coupon, 7 year bonds that can be sold for S 1,180 each. Flotation costs would amount to S25 band. Use the estimation formula to figure the approximate after-tax cost of debt financing? e. What is the WACC? a. If the market price of the common stock is$37 and dividends are expected to grow at a rate of 9% per year for the foreseeable future, the company's cost of retained earnings financing is . (Round to two decimal places.) nd otation costs on new shares of common stock amount to S7 per share, the company's cost of new common stock nancing is %. Round to b. If underpring and two decimal places.) c. If the company can issue $1.84 dividend preferred stock for a market price of $27 per share, and flotation costs would amount to $4 per share, the cost of preferred stock financing is?%. (Round to two decimal places) d. If the company can issue S1,000 par-value 11% coupon 7 year bondsthat can be sold for S1 180 each and flotation costs would amount to S25 per bond, using he estimation formula, the approx mate after-tax cost of debt franc ng is %. (Round to two decimal places. using the cost of retained earnings, r the firm s WACC '. is % Round to two decimal places. e Enter your answer in each of the answer boxes