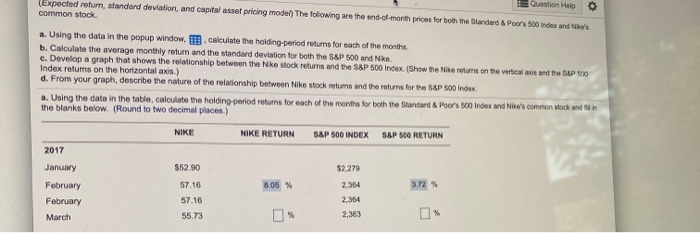

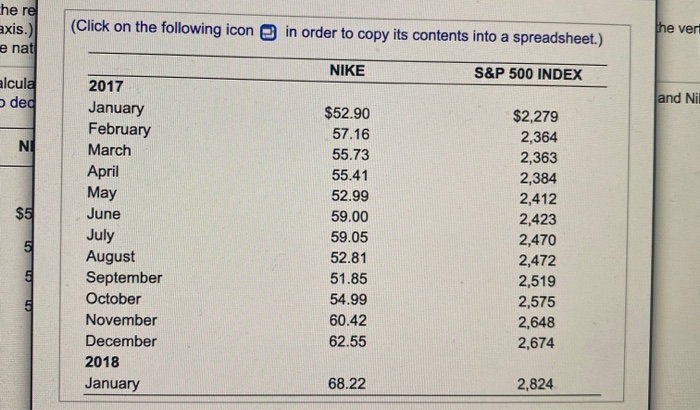

Question Help (Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 index and he's common stock a. Using the data in the popup window. 2. calculate the holong period returns for each of the months b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nke. c. Develop a graph that shows the relationship between the Nike stock returns and the S&P 500 Index. (Show the Nike returns on the verticals and the SAP 500 Index retums on the horizontal axis.) d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S&P 500 Index a. Using the data in the table, calculate the holding period returns for each of the months for both the Standard & Poors 500 index and Nils common stock and fin the blanks below. (Round to two decimal places) NIKE NIKE RETURN S&P 500 INDEX S&P 500 RETURN 2017 January $52.90 $2.270 February 57.16 8.05% 2,364 3.72 % February 57.16 2,364 March 55.73 2,363 he re exis.) e nat (Click on the following icon in order to copy its contents into a spreadsheet.) the vert NIKE S&P 500 INDEX alcula ded and Ni NI $ $5 2017 January February March April May June July August September October November December 2018 January $52.90 57.16 55.73 55.41 52.99 59.00 59.05 52.81 51.85 54.99 60.42 62.55 $2,279 2,364 2,363 2,384 2,412 2,423 2,470 2,472 2,519 2,575 2,648 2,674 5 5 on 68.22 2,824 Question Help (Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 index and he's common stock a. Using the data in the popup window. 2. calculate the holong period returns for each of the months b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nke. c. Develop a graph that shows the relationship between the Nike stock returns and the S&P 500 Index. (Show the Nike returns on the verticals and the SAP 500 Index retums on the horizontal axis.) d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S&P 500 Index a. Using the data in the table, calculate the holding period returns for each of the months for both the Standard & Poors 500 index and Nils common stock and fin the blanks below. (Round to two decimal places) NIKE NIKE RETURN S&P 500 INDEX S&P 500 RETURN 2017 January $52.90 $2.270 February 57.16 8.05% 2,364 3.72 % February 57.16 2,364 March 55.73 2,363 he re exis.) e nat (Click on the following icon in order to copy its contents into a spreadsheet.) the vert NIKE S&P 500 INDEX alcula ded and Ni NI $ $5 2017 January February March April May June July August September October November December 2018 January $52.90 57.16 55.73 55.41 52.99 59.00 59.05 52.81 51.85 54.99 60.42 62.55 $2,279 2,364 2,363 2,384 2,412 2,423 2,470 2,472 2,519 2,575 2,648 2,674 5 5 on 68.22 2,824