Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Help Ryle Exercise Equipment, Inc. reported the following financial statements for 2024: (Click the icon to view the income statement.) BE (Click the icon

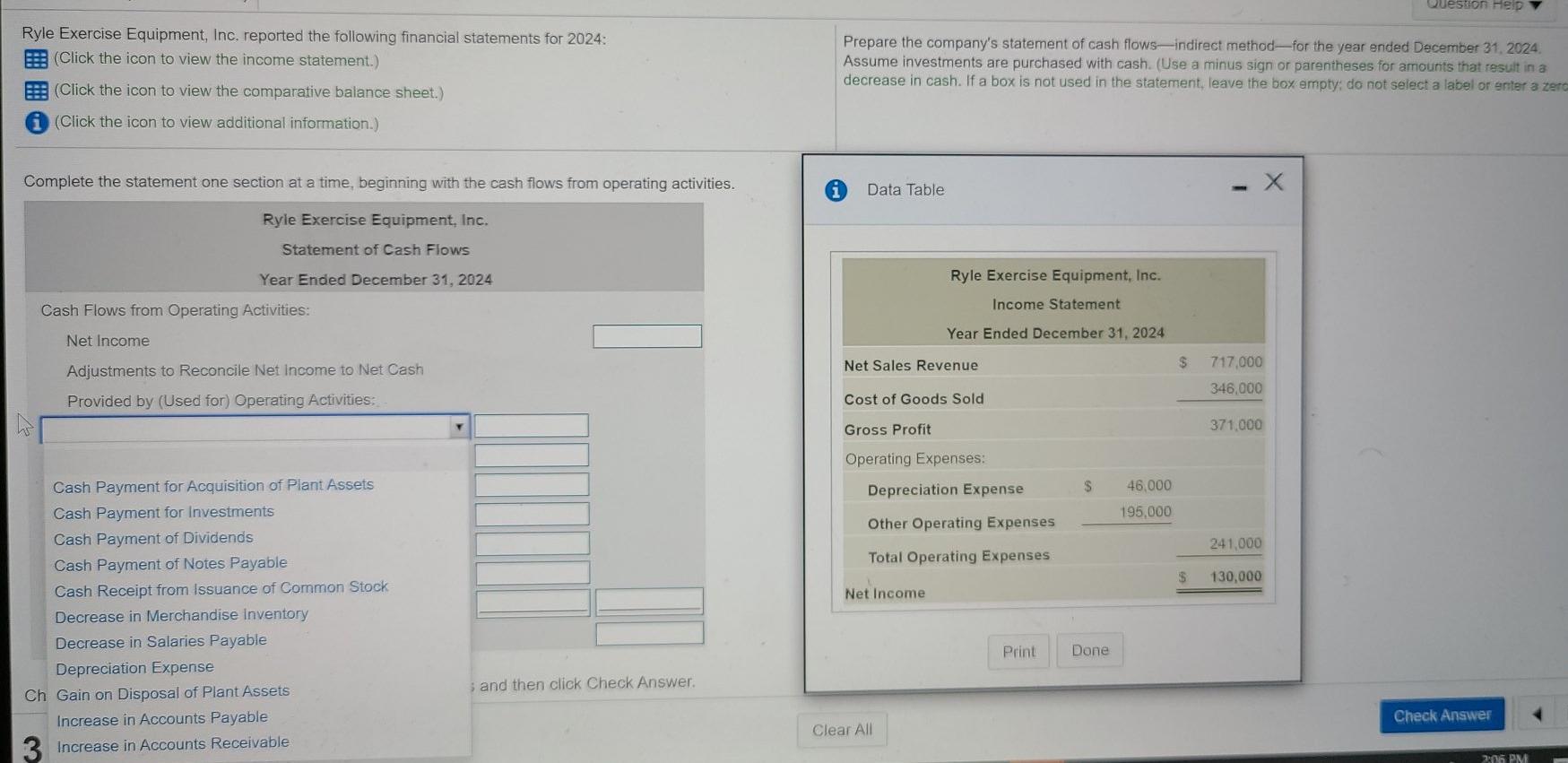

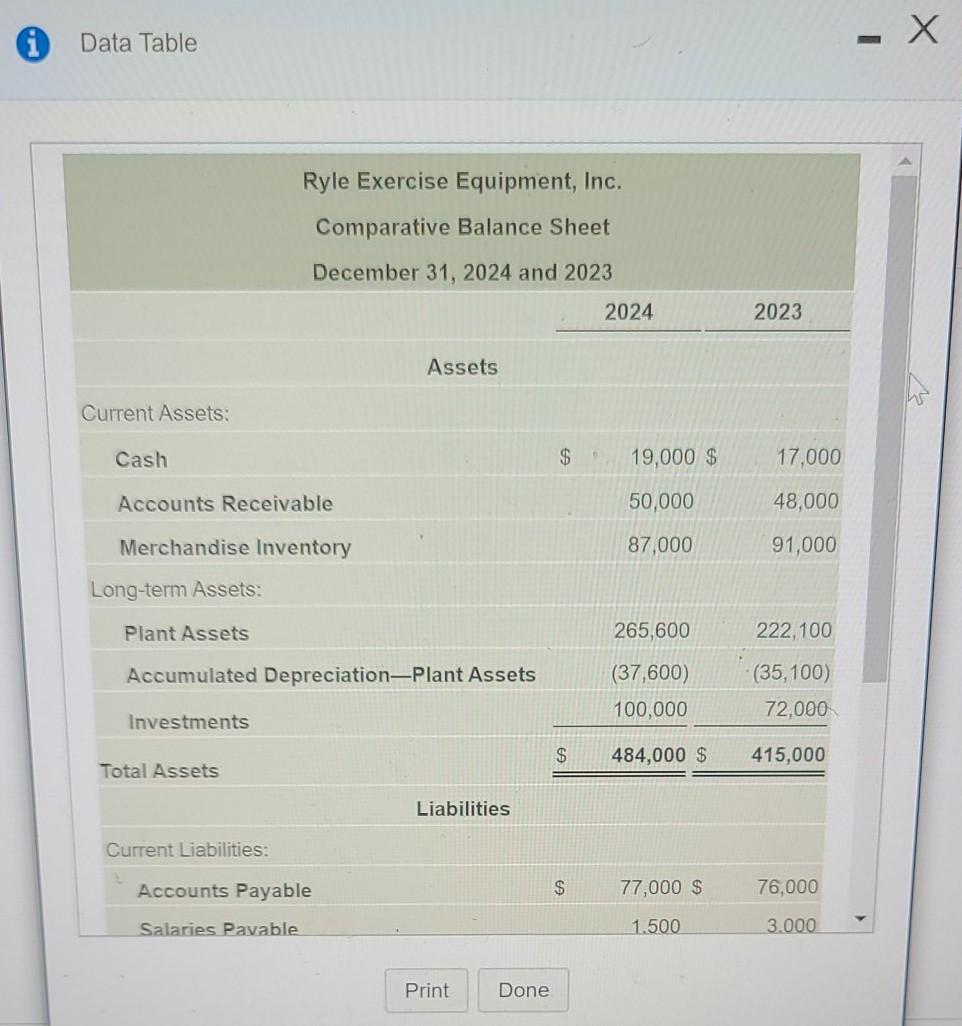

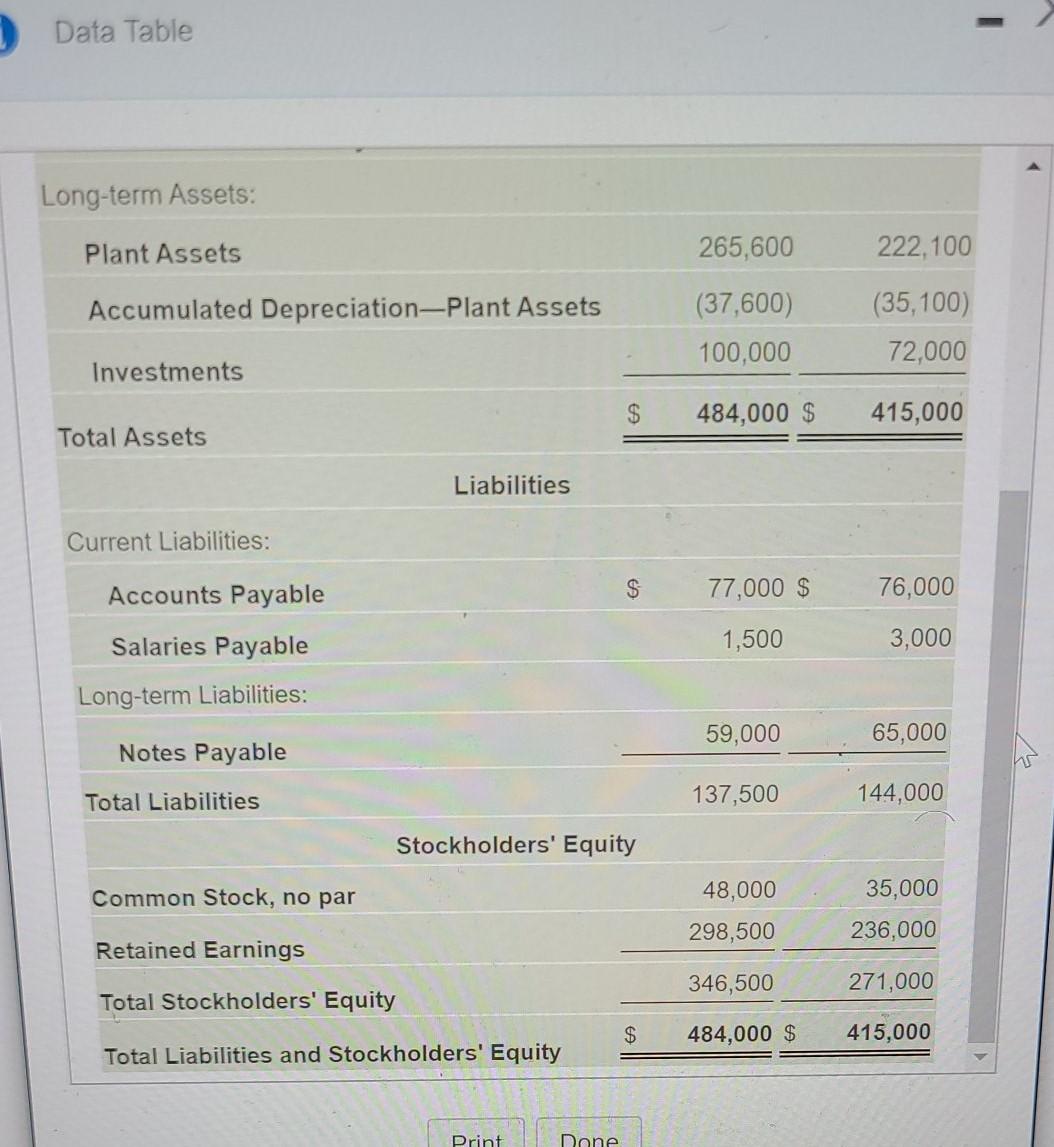

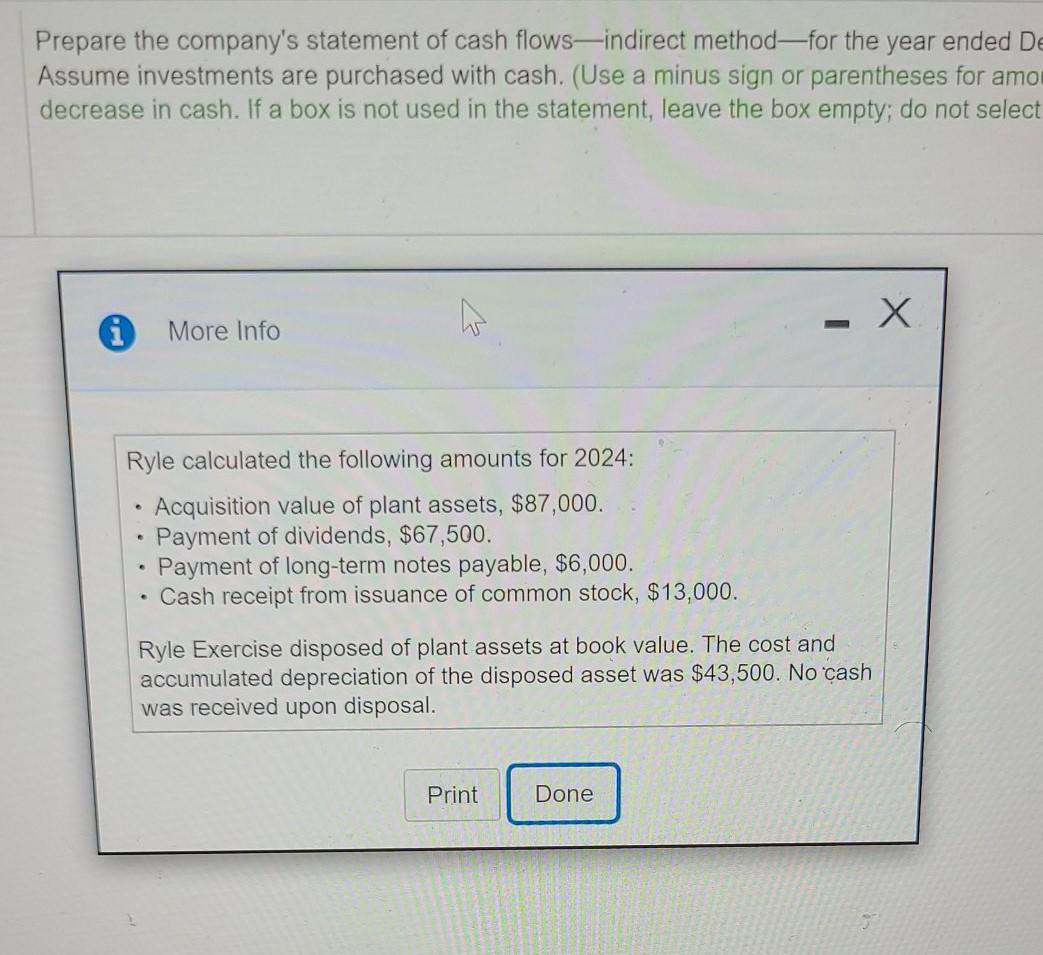

Question Help Ryle Exercise Equipment, Inc. reported the following financial statements for 2024: (Click the icon to view the income statement.) BE (Click the icon to view the comparative balance sheet.) (Click the icon to view additional information.) Prepare the company's statement of cash flowsindirect method for the year ended December 31, 2024 Assume investments are purchased with cash. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty: do not select a label or enter a zero Complete the statement one section at a time, beginning with the cash flows from operating activities. Data Table Ryle Exercise Equipment, Inc. Statement of Cash Flows Ryle Exercise Equipment, Inc. Year Ended December 31, 2024 Cash Flows from Operating Activities: Income Statement Year Ended December 31, 2024 Net Income $ Net Sales Revenue 717,000 Adjustments to Reconcile Net Income to Net Cash 346,000 Provided by (Used for) Operating Activities: Cost of Goods Sold Gross Profit 371.000 Operating Expenses: Depreciation Expense $ 46,000 195,000 Other Operating Expenses 241,000 Total Operating Expenses $ 130,000 Net Income Cash Payment for Acquisition of Plant Assets Cash Payment for Investments Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Decrease in Merchandise inventory Decrease in Salaries Payable Depreciation Expense Ch Gain on Disposal of Plant Assets Increase in Accounts Payable Increase in Accounts Receivable Print Done ; and then click Check Answer Check Answer Clear All 706 PM Data Table Ryle Exercise Equipment, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Assets Current Assets: Cash $ 19,000 $ 17,000 Accounts Receivable 50,000 48,000 Merchandise Inventory 87,000 91,000 Long-term Assets: Plant Assets 265,600 222,100 Accumulated Depreciation-Plant Assets (37,600) 100,000 (35,100) 72,000 Investments $ 484,000 $ 415,000 Total Assets Liabilities Current Liabilities: Accounts Payable $ 77,000 $ 76.000 Salaries Pavable 1.500 3.000 Print Done Data Table Long-term Assets: Plant Assets 265,600 222,100 Accumulated Depreciation-Plant Assets (37,600) 100,000 (35,100) 72,000 Investments $ 484,000 $ 415,000 Total Assets Liabilities Current Liabilities: Accounts Payable $ 77,000 $ 76,000 1,500 3,000 Salaries Payable Long-term Liabilities: 59,000 65,000 Notes Payable Total Liabilities 137,500 144,000 Stockholders' Equity Common Stock, no par 48,000 35,000 298,500 236,000 Retained Earnings 346,500 271,000 Total Stockholders' Equity $ 484,000 $ 415,000 Total Liabilities and Stockholders' Equity Print Done Prepare the company's statement of cash flows-indirect methodfor the year ended De Assume investments are purchased with cash. (Use a minus sign or parentheses for amo decrease in cash. If a box is not used in the statement, leave the box empty; do not select . i More Info Ryle calculated the following amounts for 2024: Acquisition value of plant assets, $87,000. Payment of dividends, $67,500. Payment of long-term notes payable, $6,000. Cash receipt from issuance of common stock, $13,000. . Ryle Exercise disposed of plant assets at book value. The cost and accumulated depreciation of the disposed asset was $43,500. No cash was received upon disposal. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started