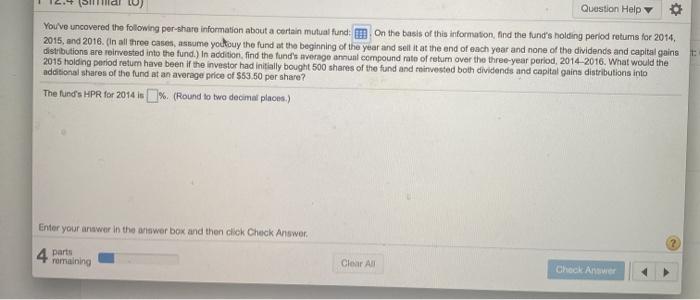

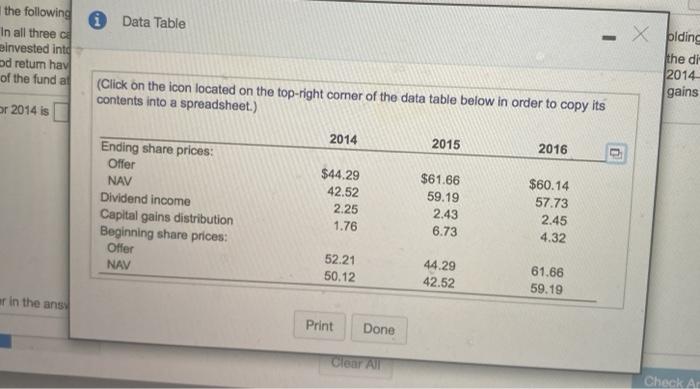

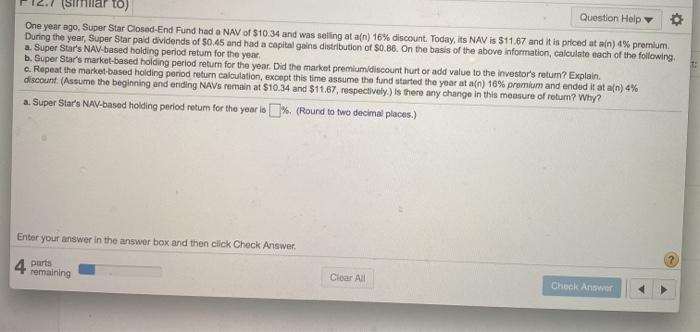

Question Help Youve uncovered the following per-share information about a certain mutual fund on the basis of this information, find the fund's holding period retums for 2014, 2015, and 2016. (In all three cases, assume youtouy the fund at the beginning of the year and set it at the end of each year and none of the dividends and capital gains distributions are reinvested into the fund.) In addition, find the fund's average annual compound rate of return over the three-year period, 2014-2016. What would the 2015 holding period return have been if the investor had initially bought 500 shares of the fund and invested both dividends and capital gains distributions into additional shares of the fund at an average price of $53.50 per share? The fund's HPR for 2014 %. (Round to two decimal pluona.) Enter your answer in the artswer box and then click Check Answer 4 Parts remaining Clear All Check Answer Data Table the following In all three of invested into od return hav of the fund af - x biding the di (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 2014 gains or 2014 is 2014 2015 2016 Ending share prices: Offer NAV Dividend income Capital gains distribution Beginning share prices: Offer NAV $44.29 42.52 2.25 1.76 $61.66 59.19 2.43 6.73 $60.14 57.73 2.45 4.32 52.21 50.12 44.29 42.52 61.66 59.19 er in the ans Print Done Clear All Check to) Question Help One year ago, Super Star Closed-End Fund had a NAV of $10.34 and was selling at a(n) 16% discount. Today, its NAV is $11.67 and it is priced at a(n) 4% premium During the year, Super Star paid dividends of $0.45 and had a capital gains distribution of $0.86. On the basis of the above information, calculate each of the following a. Super Star's NAV-based holding period retum for the year b. Super Star's market-based holding period return for the year. Did the market premium discount hurt or add value to the investor's retur? Explain e. Repeat the market-based holding period return calculation, except this time assume the fund started the year at a[n) 16% premium and ended it at a[n) 4% discount. (Assume the beginning and ending NAV remain at $10.34 and $11.67, respectively.) Is there any change in this measure of rotum? Why? a. Super Star's NAV-based holding period retum for the year is % (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. 4 parts remaining Clear All Check