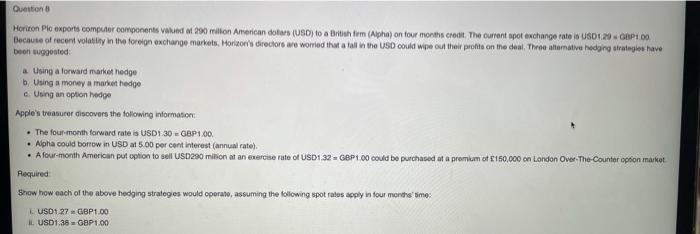

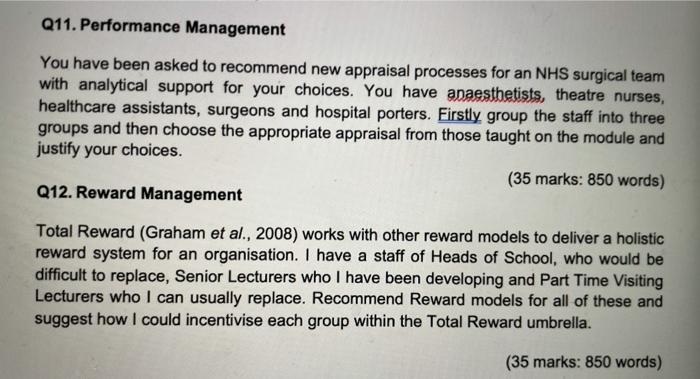

Question Hortton Plc exports computer Components vaked 200 million American dollar (USD) to a British fem (Apha) on four months credit. The current spot exchange rate in USD129 GBP1.00 Because of recent volatility in the foreign exchange markets, Horteon's director we worted that a fail in the USD could wipe out their profile on the deal. Three tomative hedging orties have boon suggested a Using a forward market hedge b. Using a money a market hedge c. Using an option hedge Apple's treasurer discovers the folowing information The four month forward rate is USD 1.30 GBP100 Alpha could borrow in USD at 5.00 per cent interest (annual rate). A four month American put option to sell USD290 milion at an exercise rate of USD132 - GP100 could be purchased at a premium of 160,000 on London Over-The-Counter option market Required Show how each of the above hedging strategies would operato, assuming the following spot rates apply in four monthsme USD1 27 m ABP10 IL USD1.38 = GBP1.00 Q11. Performance Management You have been asked to recommend new appraisal processes for an NHS surgical team with analytical support for your choices. You have anaesthetists, theatre nurses, healthcare assistants, surgeons and hospital porters. Firstly group the staff into three groups and then choose the appropriate appraisal from those taught on the module and justify your choices. (35 marks: 850 words) Q12. Reward Management Total Reward (Graham et al., 2008) works with other reward models to deliver a holistic reward system for an organisation. I have a staff of Heads of School, who would be difficult to replace, Senior Lecturers who I have been developing and Part Time Visiting Lecturers who I can usually replace. Recommend Reward models for all of these and suggest how I could incentivise each group within the Total Reward umbrella. (35 marks: 850 words) Question Hortton Plc exports computer Components vaked 200 million American dollar (USD) to a British fem (Apha) on four months credit. The current spot exchange rate in USD129 GBP1.00 Because of recent volatility in the foreign exchange markets, Horteon's director we worted that a fail in the USD could wipe out their profile on the deal. Three tomative hedging orties have boon suggested a Using a forward market hedge b. Using a money a market hedge c. Using an option hedge Apple's treasurer discovers the folowing information The four month forward rate is USD 1.30 GBP100 Alpha could borrow in USD at 5.00 per cent interest (annual rate). A four month American put option to sell USD290 milion at an exercise rate of USD132 - GP100 could be purchased at a premium of 160,000 on London Over-The-Counter option market Required Show how each of the above hedging strategies would operato, assuming the following spot rates apply in four monthsme USD1 27 m ABP10 IL USD1.38 = GBP1.00 Q11. Performance Management You have been asked to recommend new appraisal processes for an NHS surgical team with analytical support for your choices. You have anaesthetists, theatre nurses, healthcare assistants, surgeons and hospital porters. Firstly group the staff into three groups and then choose the appropriate appraisal from those taught on the module and justify your choices. (35 marks: 850 words) Q12. Reward Management Total Reward (Graham et al., 2008) works with other reward models to deliver a holistic reward system for an organisation. I have a staff of Heads of School, who would be difficult to replace, Senior Lecturers who I have been developing and Part Time Visiting Lecturers who I can usually replace. Recommend Reward models for all of these and suggest how I could incentivise each group within the Total Reward umbrella. (35 marks: 850 words)