Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: How much of Noah's Social Security Is taxable? a. $0 b. $6851 c. $2175 d. $31000 Interview Notes Noah, age 65, and Ella, age

Question: How much of Noah's Social Security Is taxable?

a. $0

b. $6851

c. $2175

d. $31000

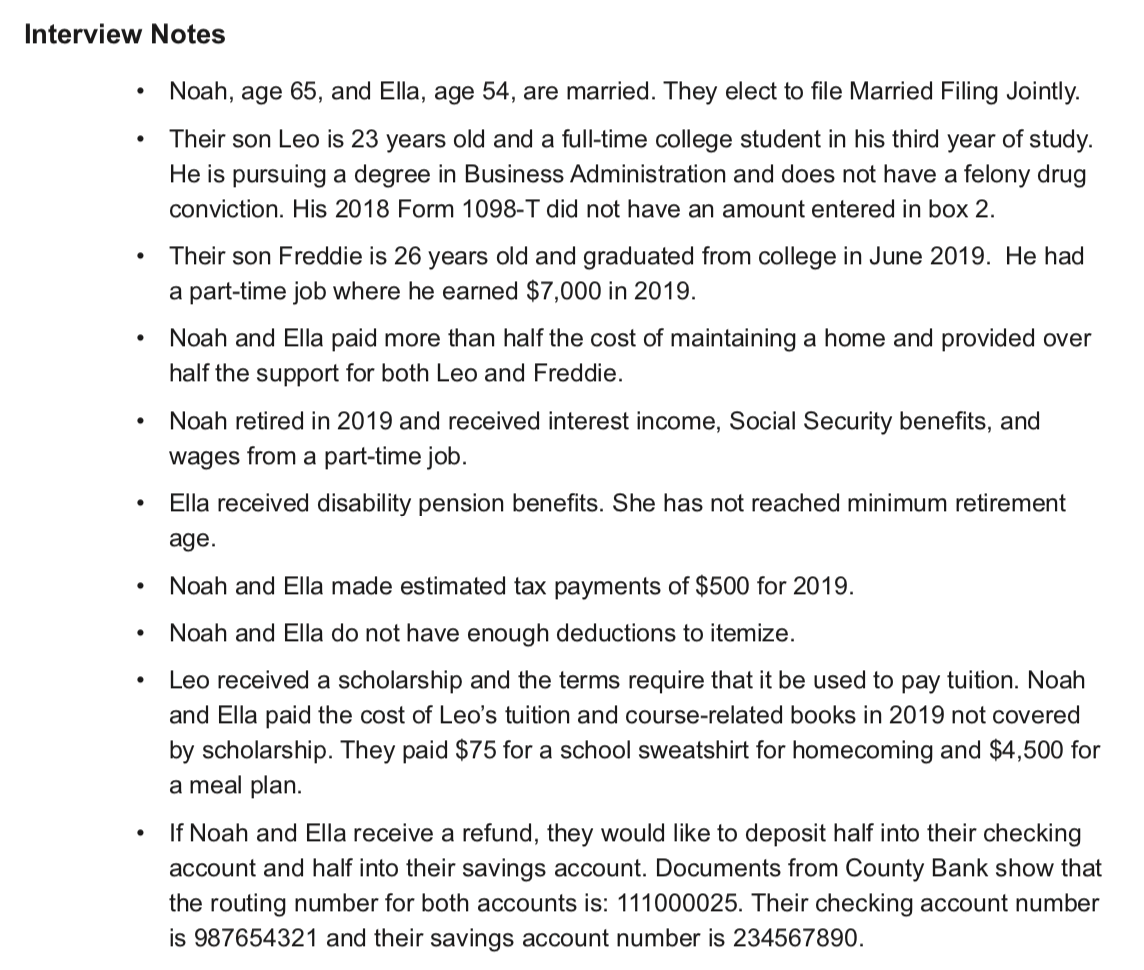

Interview Notes Noah, age 65, and Ella, age 54, are married. They elect to file Married Filing Jointly. Their son Leo is 23 years old and a full-time college student in his third year of study. He is pursuing a degree in Business Administration and does not have a felony drug conviction. His 2018 Form 1098-T did not have an amount entered in box 2. Their son Freddie is 26 years old and graduated from college in June 2019. He had a part-time job where he earned $7,000 in 2019. Noah and Ella paid more than half the cost of maintaining a home and provided over half the support for both Leo and Freddie. Noah retired in 2019 and received interest income, Social Security benefits, and wages from a part-time job. Ella received disability pension benefits. She has not reached minimum retirement age. Noah and Ella made estimated tax payments of $500 for 2019. Noah and Ella do not have enough deductions to itemize. Leo received a scholarship and the terms require that it be used to pay tuition. Noah and Ella paid the cost of Leo's tuition and course-related books in 2019 not covered by scholarship. They paid $75 for a school sweatshirt for homecoming and $4,500 for a meal plan. If Noah and Ella receive a refund, they would like to deposit half into their checking account and half into their savings account. Documents from County Bank show that the routing number for both accounts is: 111000025. Their checking account number is 987654321 and their savings account number is 234567890

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started