Question i and ii

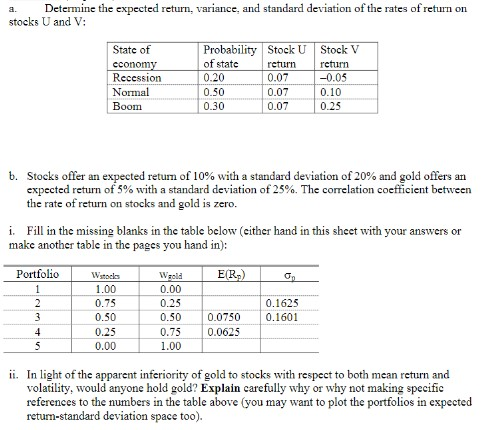

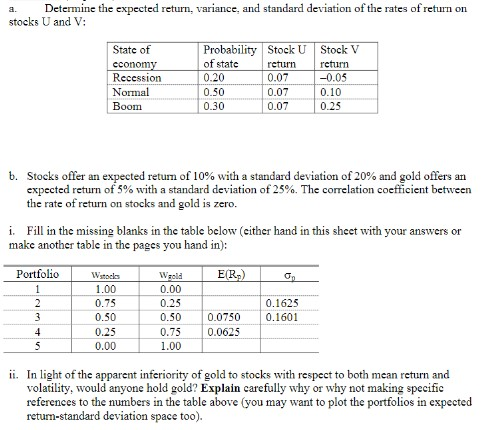

Determine the expected return, variance, and standard deviation of the rates of return on stocks U and V: State of economy Recession Normal Boom Probability Stock U Stock V of state return return 0.20 -0.05 0.50 0.07 0.10 0.30 0.07 0.25 0.07 b. Stocks offer an expected retum of 10% with a standard deviation of 20% and gold offers an expected return of 5% with a standard deviation of 25%. The correlation coefficient between the rate of return on stocks and gold is zero. i. Fill in the missing blanks in the table below (cither hand in this sheet with your answers or make another table in the pages you hand in): ER.) Portfolio 1 2 3 4 5 Wstols 1.00 0.75 0.50 0.25 0.00 Wald 0.00 0.25 0.50 0.75 1.00 0.1625 0.1601 0.0750 0.0625 ii. In light of the apparent inferiority of gold to stocks with respect to both mean return and volatility, would anyone hold gold? Explain carefully why or why not making specific references to the numbers in the table above (you may want to plot the portfolios in expected return-standard deviation space too). Determine the expected return, variance, and standard deviation of the rates of return on stocks U and V: State of economy Recession Normal Boom Probability Stock U Stock V of state return return 0.20 -0.05 0.50 0.07 0.10 0.30 0.07 0.25 0.07 b. Stocks offer an expected retum of 10% with a standard deviation of 20% and gold offers an expected return of 5% with a standard deviation of 25%. The correlation coefficient between the rate of return on stocks and gold is zero. i. Fill in the missing blanks in the table below (cither hand in this sheet with your answers or make another table in the pages you hand in): ER.) Portfolio 1 2 3 4 5 Wstols 1.00 0.75 0.50 0.25 0.00 Wald 0.00 0.25 0.50 0.75 1.00 0.1625 0.1601 0.0750 0.0625 ii. In light of the apparent inferiority of gold to stocks with respect to both mean return and volatility, would anyone hold gold? Explain carefully why or why not making specific references to the numbers in the table above (you may want to plot the portfolios in expected return-standard deviation space too)