Answered step by step

Verified Expert Solution

Question

1 Approved Answer

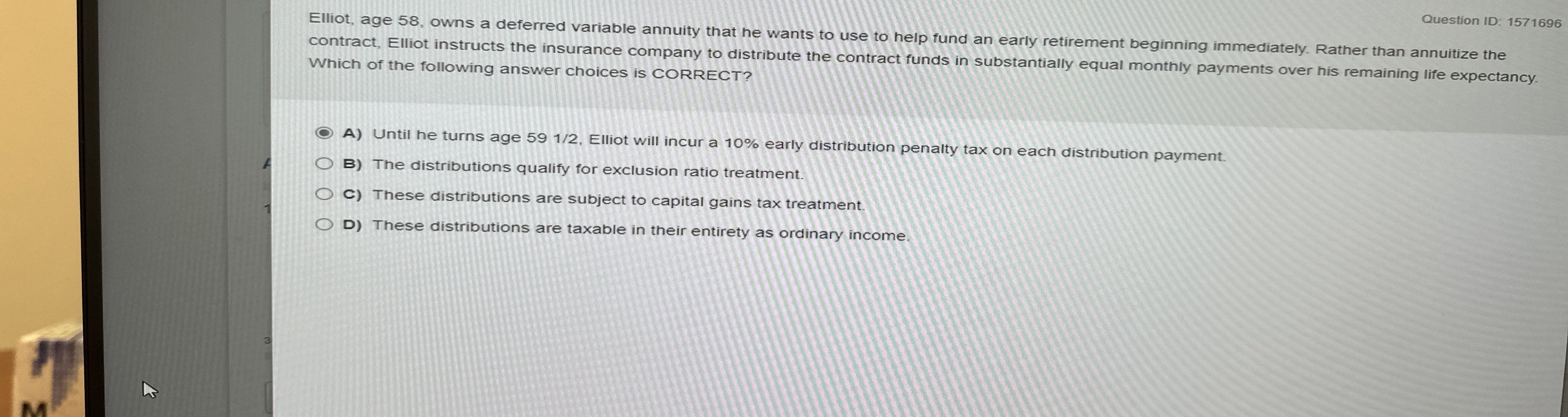

Question ID 1 5 7 1 6 9 6 Elliot, age 5 8 , owns a deferred variable annuity that he wants to use to

Question ID

Elliot, age owns a deferred variable annuity that he wants to use to help fund an early retirement beginning immediately. Rather than annuitize the contract, Elliot instructs the insurance company to distribute the contract funds in substantially equal monthly payments over his remaining life expectancy. Which of the following answer choices is CORRECT?

A Until he turns age Elliot will incur a early distribution penalty tax on each distribution payment.

B The distributions qualify for exclusion ratio treatment.

C These distributions are subject to capital gains tax treatment.

D These distributions are taxable in their entirety as ordinary income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started