Question

If Abnormal Earnings are expected to grow at a rate of 3% per year after 2024, what would the continuing value be in 2024? The

If Abnormal Earnings are expected to grow at a rate of 3% per year after 2024, what would the continuing value be in 2024?

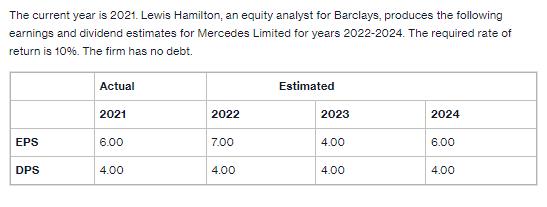

If Abnormal Earnings are expected to grow at a rate of 3% per year after 2024, what would the continuing value be in 2024? The current year is 2021. Lewis Hamilton, an equity analyst for Barclays, produces the following earnings and dividend estimates for Mercedes Limited for years 2022-2024. The required rate of return is 10%. The firm has no debt. EPS DPS Actual 2021 6.00 4.00 2022 7.00 4.00 Estimated 2023 4.00 4.00 2024 6.00 4.00

Step by Step Solution

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Year 2022 Dividend per Share DPS 400 Expected EPS 700 Expected Dividend Payout Ratio DPS EPS 400 700 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

5th Edition

0135811600, 978-0135811603

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App