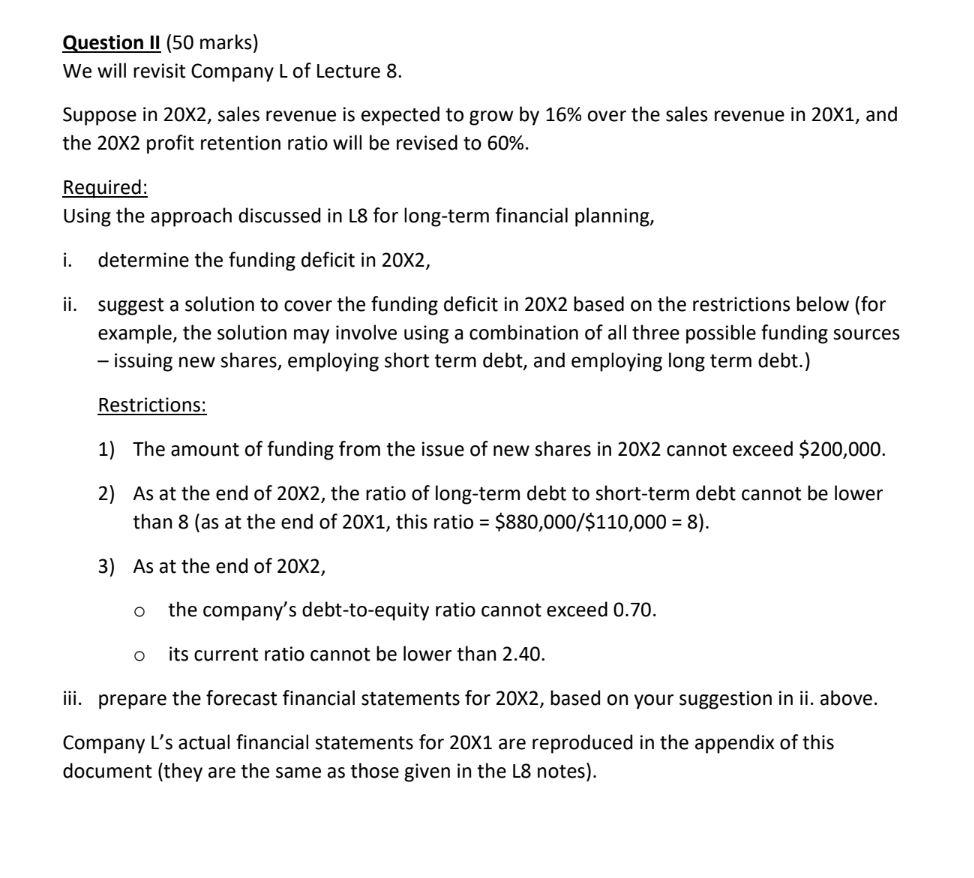

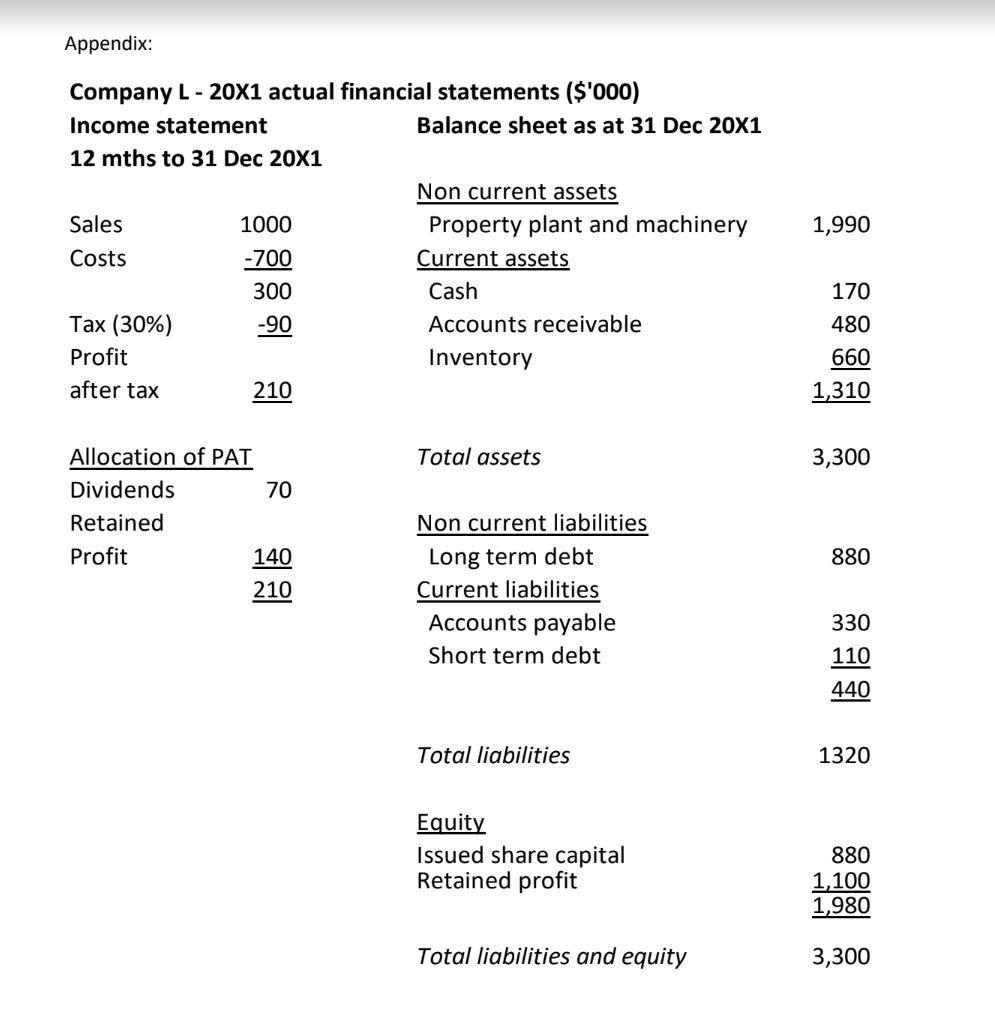

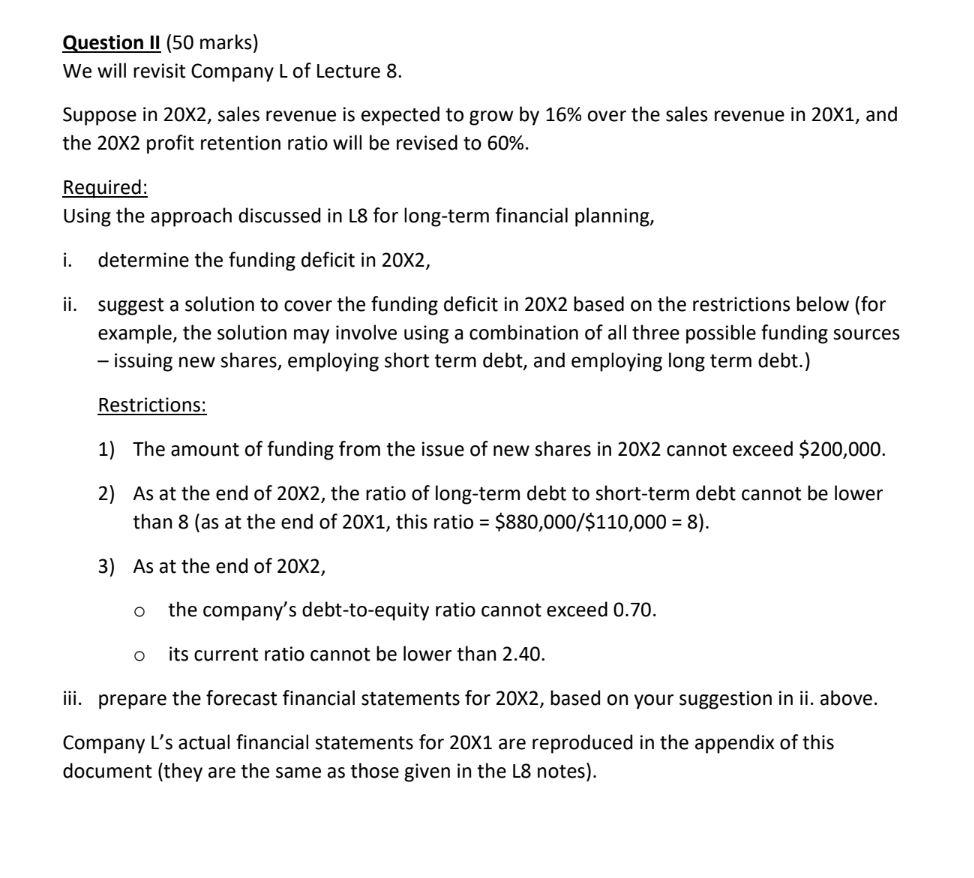

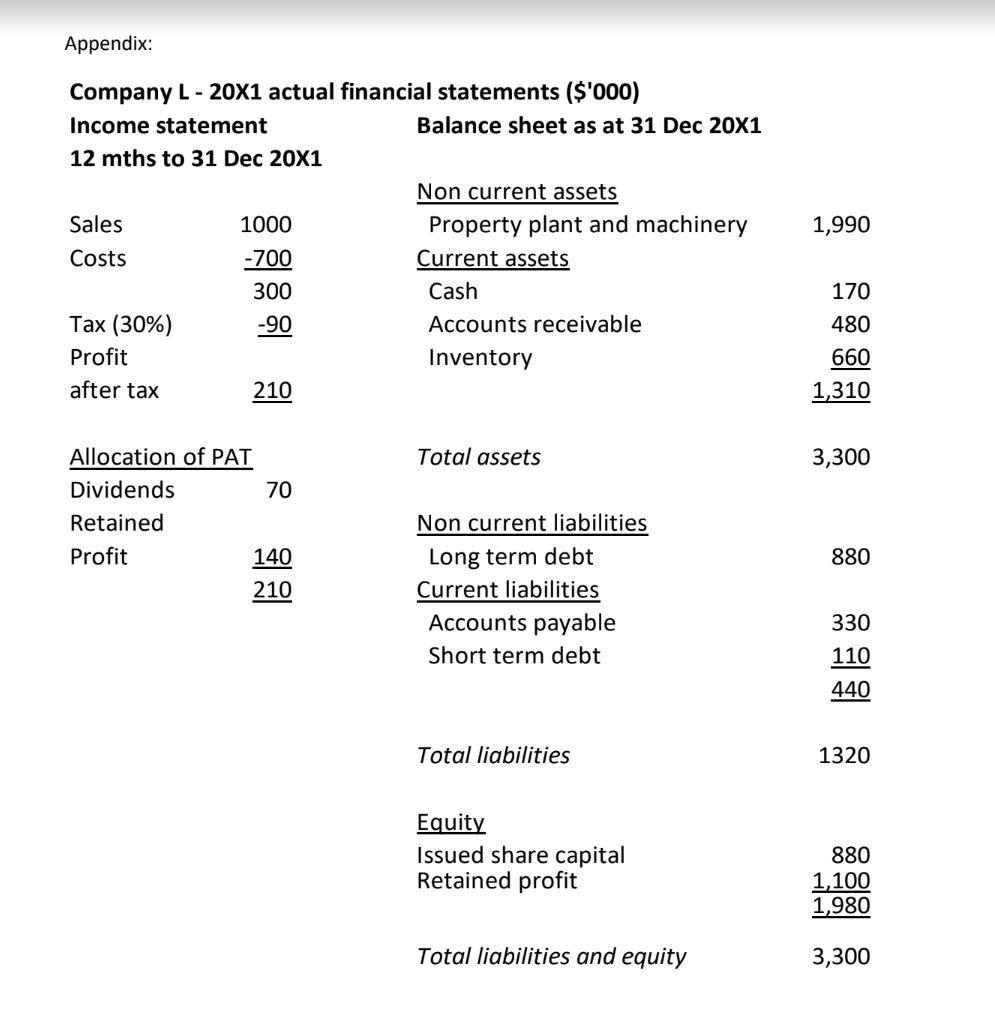

Question II (50 marks) We will revisit Company L of Lecture 8. Suppose in 202, sales revenue is expected to grow by 16% over the sales revenue in 201, and the 202 profit retention ratio will be revised to 60%. Required: Using the approach discussed in L8 for long-term financial planning, i. determine the funding deficit in 202, ii. suggest a solution to cover the funding deficit in 202 based on the restrictions below (for example, the solution may involve using a combination of all three possible funding sources - issuing new shares, employing short term debt, and employing long term debt.) Restrictions: 1) The amount of funding from the issue of new shares in 202 cannot exceed $200,000. 2) As at the end of 202, the ratio of long-term debt to short-term debt cannot be lower than 8 (as at the end of 201, this ratio =$880,000/$110,000=8 ). 3) As at the end of 202, - the company's debt-to-equity ratio cannot exceed 0.70. - its current ratio cannot be lower than 2.40. iii. prepare the forecast financial statements for 202, based on your suggestion in ii. above. Company L's actual financial statements for 20X1 are reproduced in the appendix of this document (they are the same as those given in the L8 notes). Company L - 20X1 actual finan Question II (50 marks) We will revisit Company L of Lecture 8. Suppose in 202, sales revenue is expected to grow by 16% over the sales revenue in 201, and the 202 profit retention ratio will be revised to 60%. Required: Using the approach discussed in L8 for long-term financial planning, i. determine the funding deficit in 202, ii. suggest a solution to cover the funding deficit in 202 based on the restrictions below (for example, the solution may involve using a combination of all three possible funding sources - issuing new shares, employing short term debt, and employing long term debt.) Restrictions: 1) The amount of funding from the issue of new shares in 202 cannot exceed $200,000. 2) As at the end of 202, the ratio of long-term debt to short-term debt cannot be lower than 8 (as at the end of 201, this ratio =$880,000/$110,000=8 ). 3) As at the end of 202, - the company's debt-to-equity ratio cannot exceed 0.70. - its current ratio cannot be lower than 2.40. iii. prepare the forecast financial statements for 202, based on your suggestion in ii. above. Company L's actual financial statements for 20X1 are reproduced in the appendix of this document (they are the same as those given in the L8 notes). Company L - 20X1 actual finan