Answered step by step

Verified Expert Solution

Question

1 Approved Answer

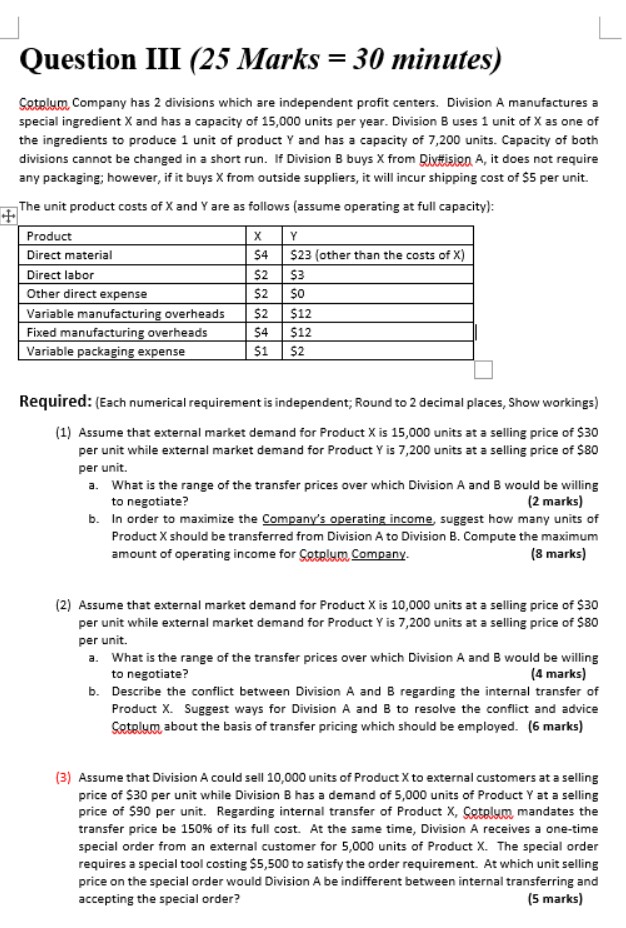

Question III ( 2 5 Marks = 3 0 minutes ) Cotplum Company has 2 divisions which are independent profit centers. Division A manufactures a

Question III Marks minutes

Cotplum Company has divisions which are independent profit centers. Division A manufactures a

special ingredient and has a capacity of units per year. Division B uses unit of as one of

the ingredients to produce unit of product and has a capacity of units. Capacity of both

divisions cannot be changed in a short run. If Division buys from Dix#isien it does not require

any packaging; however, if it buys from outside suppliers, it will incur shipping cost of $ per unit.

The unit product costs of and are as follows assume operating at full capacity:

Required: Each numerical requirement is independent; Round to decimal places, Show workings

Assume that external market demand for Product is units at a selling price of $

per unit while external market demand for Product is units at a selling price of $

per unit.

a What is the range of the transfer prices over which Division A and would be willing

to negotiate?

marks

b In order to maximize the Company's operating income, suggest how many units of

Product should be transferred from Division A to Division B Compute the maximum

amount of operating income for Cotplym Company.

marks

Assume that external market demand for Product is units at a selling price of $

per unit while external market demand for Product is units at a selling price of $

per unit.

a What is the range of the transfer prices over which Division A and B would be willing

to negotiate?

marks

b Describe the conflict between Division A and B regarding the internal transfer of

Product Suggest ways for Division A and B to resolve the conflict and advice

Sotslum about the basis of transfer pricing which should be employed. marks

Assume that Division A could sell units of Product to external customers at a selling

price of $ per unit while Division B has a demand of units of Product at a selling

price of $ per unit. Regarding internal transfer of Product Cotslycu mandates the

transfer price be of its full cost. At the same time, Division A receives a onetime

special order from an external customer for units of Product The special order

requires a special tool costing $ to satisfy the order requirement. At which unit selling

price on the special order would Division be indifferent between internal transferring and

accepting the special order?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started