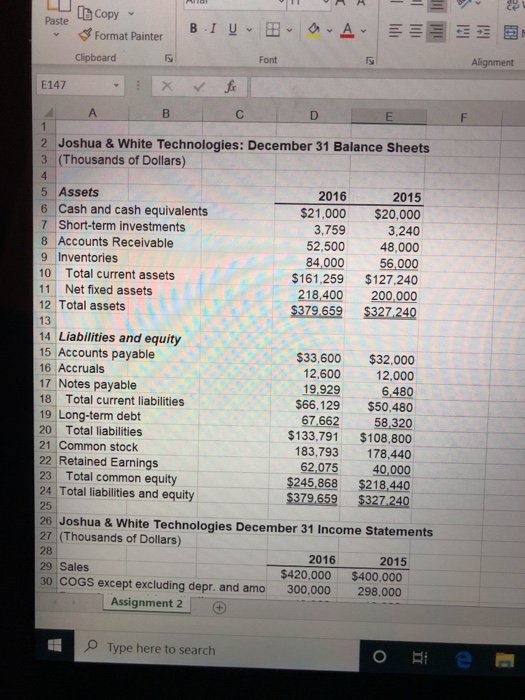

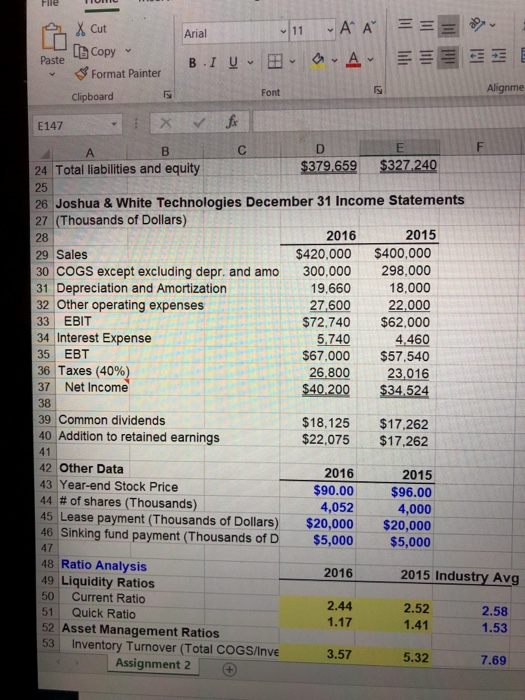

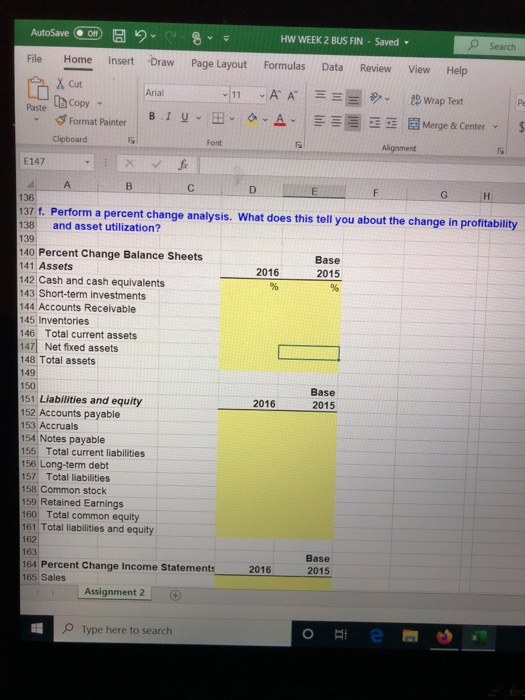

U A 5 BI U - E -A la Copy % Format Painter Clipboard - X LB Font Alignment E147 V fix C D E 2 Joshua & White Technologies: December 31 Balance Sheets 3 (Thousands of Dollars) 2016 $21,000 3,759 52,500 84,000 $161,259 218,400 $379.659 2015 $20,000 3,240 48,000 56,000 $127.240 200.000 $327.240 5 Assets 6 Cash and cash equivalents 7 Short-term investments 8 Accounts Receivable 9 Inventories 10 Total current assets 11 Net fixed assets 12 Total assets 13 14 Liabilities and equity 15 Accounts payable 16 Accruals 17 Notes payable 18 Total current liabilities 19 Long-term debt 20 Total liabilities 21 Common stock 22 Retained Earnings 23 Total common equity 24 Total liabilities and equity $33,600 12,600 19.929 $66,129 67,662 $133,791 183,793 62.075 $245,868 $379.659 $32,000 12.000 6,480 $50.480 58,320 $108.800 178,440 40.000 $218,440 $327 240 26 Joshua & White Technologies December 31 Income Statements 27 (Thousands of Dollars) 28 2016 2015 29 Sales $420,000 $400.000 30 COGS except excluding depr. and amo 300.000 298.000 Assignment 2 Type here to search File 1 o X Cut Arial A A 11 B- Paste Copy B 1 0 - - A === = = E Format Painter Clipboard Font Alignme E147 24 Total liabilities and equity $379,659 $327240 28 26 Joshua & White Technologies December 31 Income Statements 27 (Thousands of Dollars) 2016 2015 29 Sales $420,000 $400,000 30 COGS except excluding depr. and amo 300,000 298,000 31 Depreciation and Amortization 19,660 18,000 32 Other operating expenses 27,600 22,000 33 EBITD ezza $72.740 $62,000 34 Interest Expense 5.740 4,460 $67,000 $57,540 36 Taxes (40%) 26.800 23,016 37 Net Income $40.200 $34,524 38 39 Common dividends $18,125 $17,262 40 Addition to retained earnings $22,075 $17.262 - 35 EBT 42 Other Data 43 Year-end Stock Price 44 # of shares (Thousands) 45 Lease payment (Thousands of Dollars) 46 Sinking fund payment (Thousands of D 2016 $90.00 4,052 $20,000 $5,000 $96.00 4,000 $20,000 $5,000 2016 2015 Industry Avg 48 Ratio Analysis 49 Liquidity Ratios 50 Current Ratio 51 Quick Ratio 52 Asset Management Ratios 53 Inventory Turnover (Total COGS/Inve Assignment 2 2.44 1.17 2.52 1.41 2.58 1.53 3.57 5 .32 7.69 HW WEEK 2 BUS FIN - Saved Formulas Data Review Search View Help AutoSave OHA 2 8 File Home insert Draw Page Layout 8 x cut Arial -11 Format Painter inter BIUR O Clipboard Font E147 - Xf Copy Paste = -A A -A E 25 Wrap Text Merge & Center Alignment G 136 137 1. Perform a percent change analysis. What does this tell you about the change in profitability 138 and asset utilization? 139 140 Percent Change Balance Sheets Base 141 Assets 2016 2015 142 Cash and cash equivalents 143 Short-term investments 144 Accounts Receivable 145 Inventories 146 Total current assets 147 Net fixed assets 148 Total assets 149 150 Base 151 Liabilities and equity 2016 2015 152 Accounts payable 153 Accruals 154 Notes payable 155 Total current liabilities 156 Long-term debt 157 Total liabilities 158 Common stock 159 Retained Earnings 160 Total common equity 161 Total liabilities and equity 162 163 Base 164 Percent Change Income Statements 2016 2015 165 Sales Assignment 2 Type here to search