Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: In the course of routine checking of all journal entries prior to preparing year-end reports, Betty Eller discovered several strange entries. She recalled that

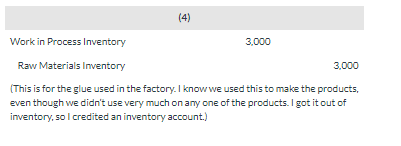

Question: In the course of routine checking of all journal entries prior to preparing year-end reports, Betty Eller discovered several strange entries. She recalled that the presidents son Joe had come in to help out during an especially busy time and that he had recorded some journal entries. She was relieved that there were only a few of his entries, and even more relieved that he had included rather lengthy explanations. The entries Joe made were:

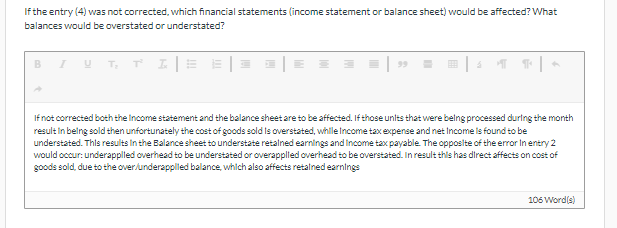

This is how I answered:

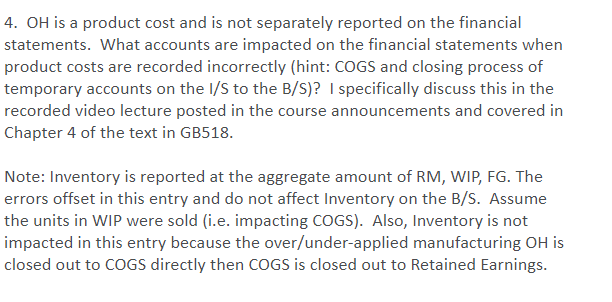

Professor Feedback: PLEASE HELP FIX IT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started