Answered step by step

Verified Expert Solution

Question

1 Approved Answer

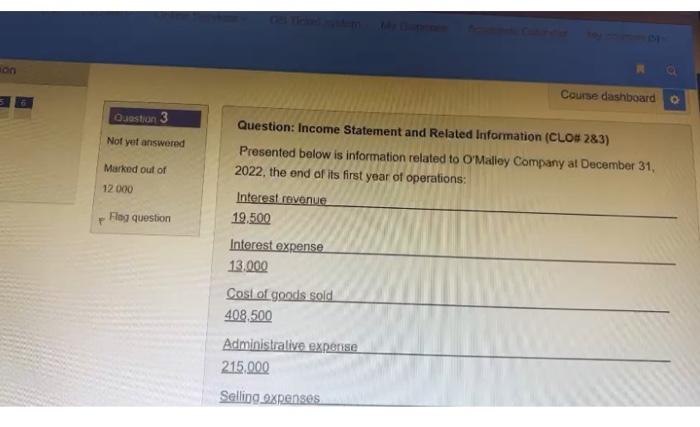

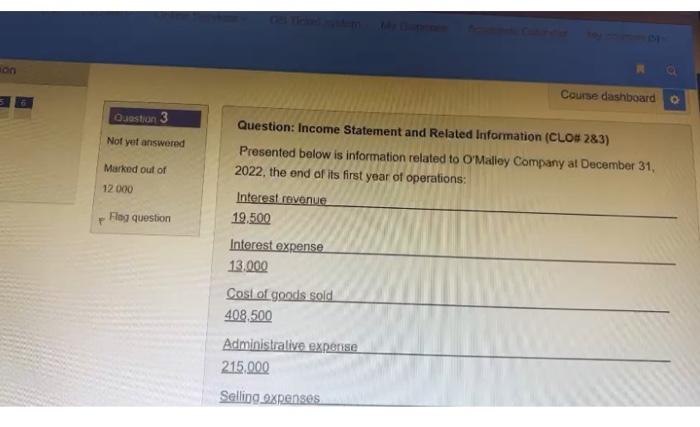

Question: Income Statement and Related Information (CLO# 283) Presented below is information related to O'Malley Company at December 31 , 2022 , the end of

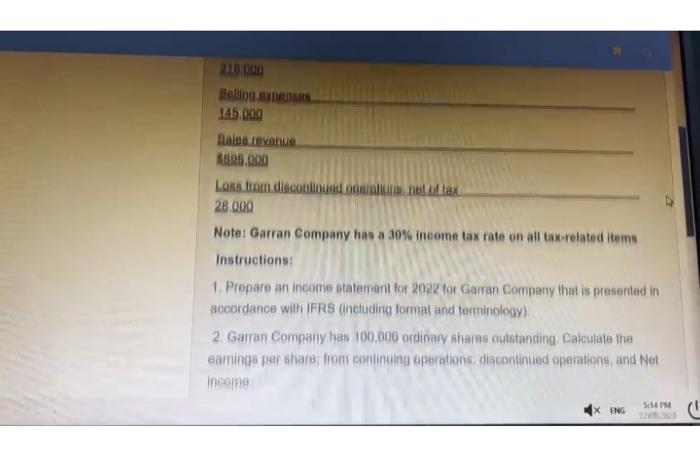

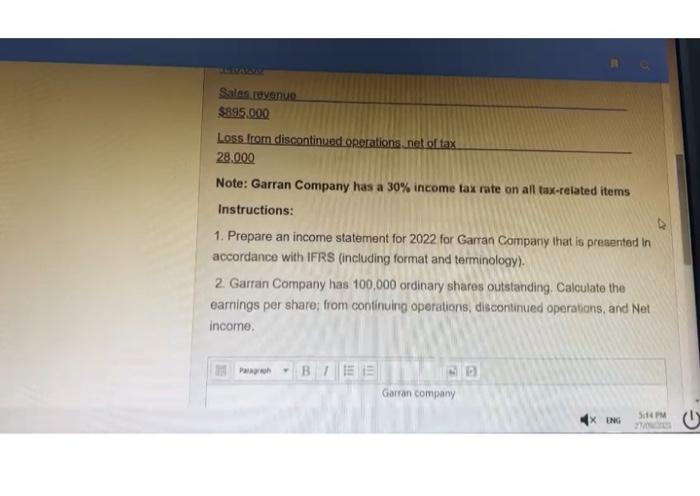

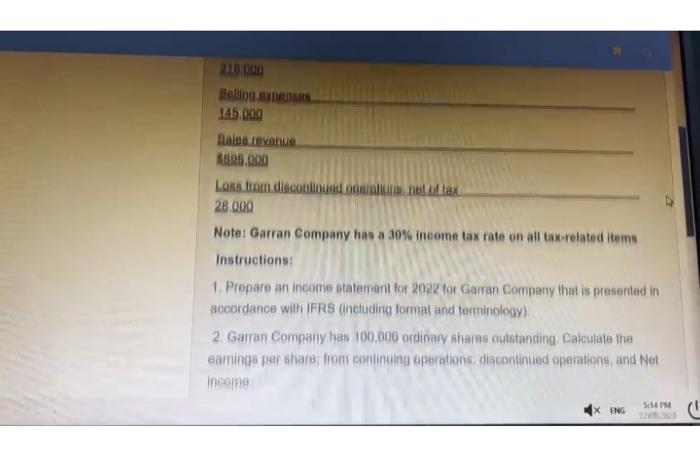

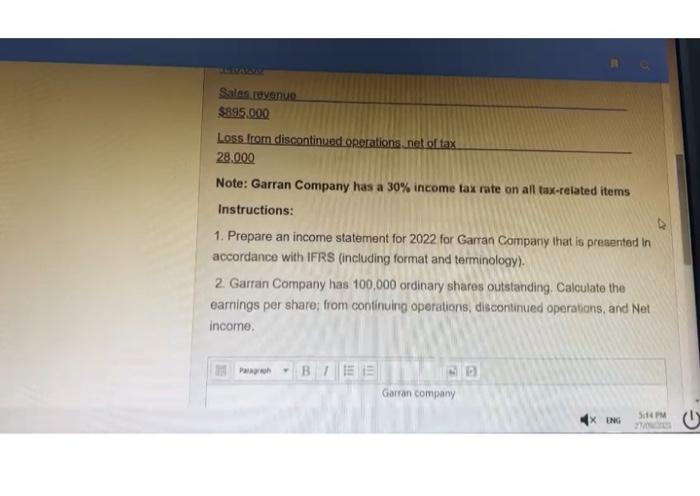

Question: Income Statement and Related Information (CLO\# 283) Presented below is information related to O'Malley Company at December 31 , 2022 , the end of its first vear of oneratione. Satas revenue $895.000 Less from discontinued operations net of tax 28.000 Note: Garran Company has a 30% income tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Company lhat is presented in accordance with IFRS (including format and terminology). 2. Garran Company has 100,000 ordinary shares outstanding. Calculate the earnings per share; from continuing operations, discontinued operations, and Net income. 216.099 Belliog synenties 145.000 Babe revanue s896.000 28.000 Note: Garran Company has a 30% ineome tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Comparry that is presented in accordance with IFRS (including format and terminology) 2. Garran Company has 100,000 ordinary sharas outstanding Caicutale the eamings per share; from continuing eperations, discontinued operations, and Net income Question: Income Statement and Related Information (CLO\# 283) Presented below is information related to O'Malley Company at December 31 , 2022 , the end of its first vear of oneratione. Satas revenue $895.000 Less from discontinued operations net of tax 28.000 Note: Garran Company has a 30% income tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Company lhat is presented in accordance with IFRS (including format and terminology). 2. Garran Company has 100,000 ordinary shares outstanding. Calculate the earnings per share; from continuing operations, discontinued operations, and Net income. 216.099 Belliog synenties 145.000 Babe revanue s896.000 28.000 Note: Garran Company has a 30% ineome tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Comparry that is presented in accordance with IFRS (including format and terminology) 2. Garran Company has 100,000 ordinary sharas outstanding Caicutale the eamings per share; from continuing eperations, discontinued operations, and Net income

Question: Income Statement and Related Information (CLO\# 283) Presented below is information related to O'Malley Company at December 31 , 2022 , the end of its first vear of oneratione. Satas revenue $895.000 Less from discontinued operations net of tax 28.000 Note: Garran Company has a 30% income tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Company lhat is presented in accordance with IFRS (including format and terminology). 2. Garran Company has 100,000 ordinary shares outstanding. Calculate the earnings per share; from continuing operations, discontinued operations, and Net income. 216.099 Belliog synenties 145.000 Babe revanue s896.000 28.000 Note: Garran Company has a 30% ineome tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Comparry that is presented in accordance with IFRS (including format and terminology) 2. Garran Company has 100,000 ordinary sharas outstanding Caicutale the eamings per share; from continuing eperations, discontinued operations, and Net income Question: Income Statement and Related Information (CLO\# 283) Presented below is information related to O'Malley Company at December 31 , 2022 , the end of its first vear of oneratione. Satas revenue $895.000 Less from discontinued operations net of tax 28.000 Note: Garran Company has a 30% income tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Company lhat is presented in accordance with IFRS (including format and terminology). 2. Garran Company has 100,000 ordinary shares outstanding. Calculate the earnings per share; from continuing operations, discontinued operations, and Net income. 216.099 Belliog synenties 145.000 Babe revanue s896.000 28.000 Note: Garran Company has a 30% ineome tax rate on all tax-related items Instructions: 1. Prepare an income statement for 2022 for Garran Comparry that is presented in accordance with IFRS (including format and terminology) 2. Garran Company has 100,000 ordinary sharas outstanding Caicutale the eamings per share; from continuing eperations, discontinued operations, and Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started