Question is copied directly from textbook, I can't edit it.

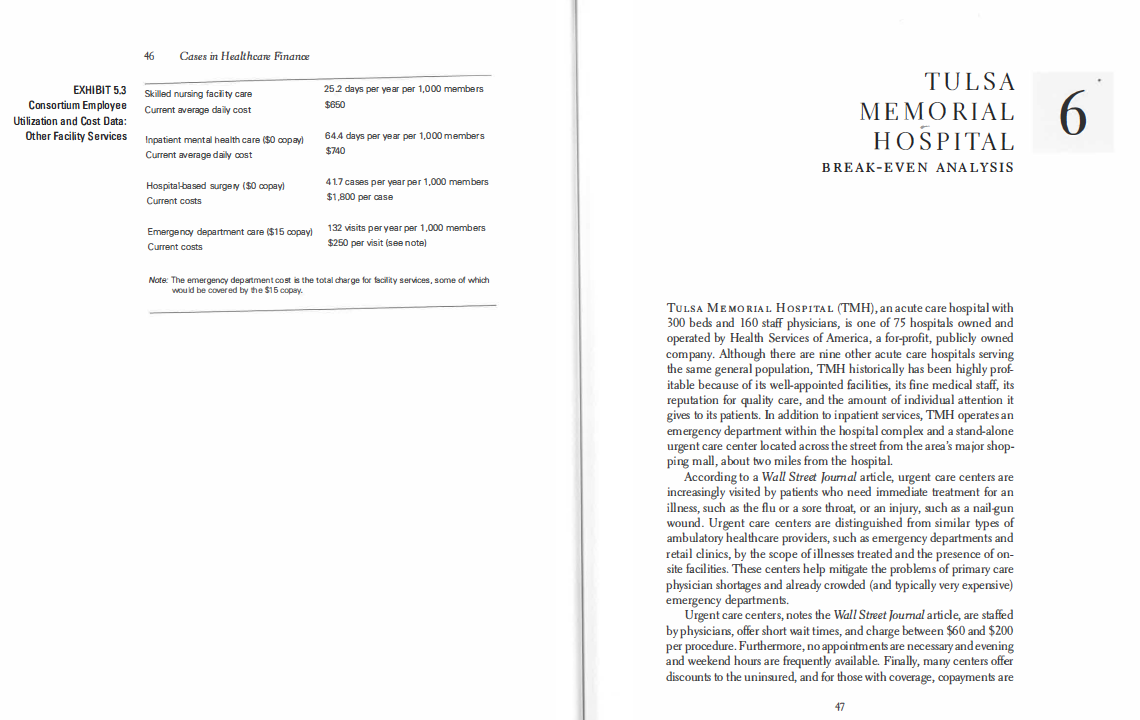

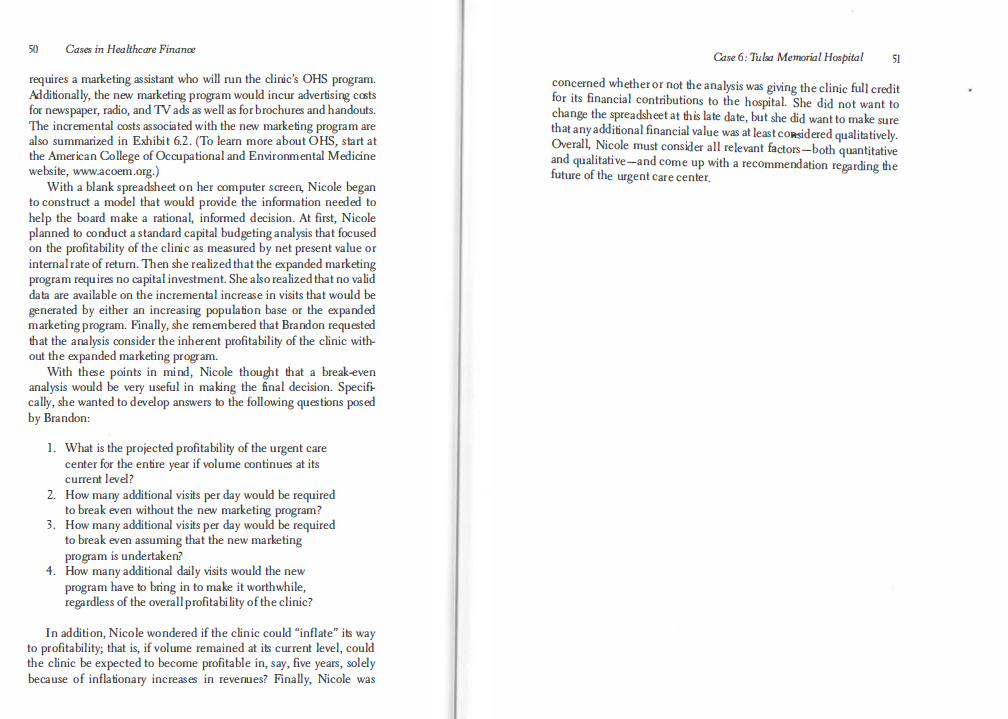

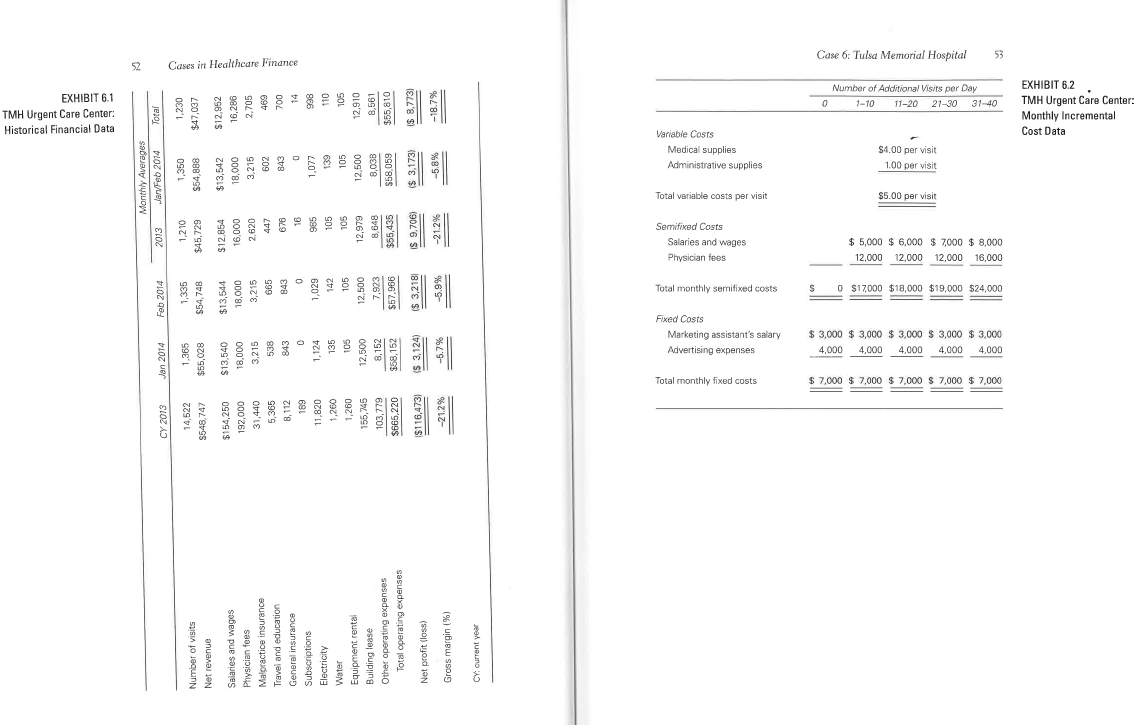

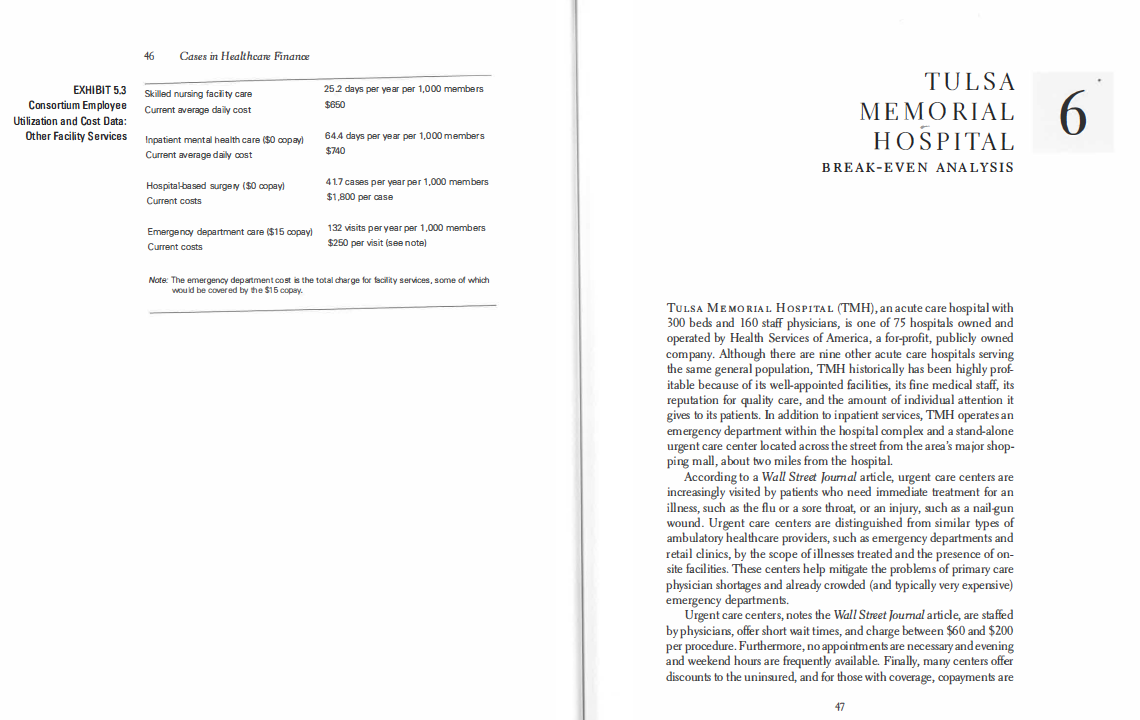

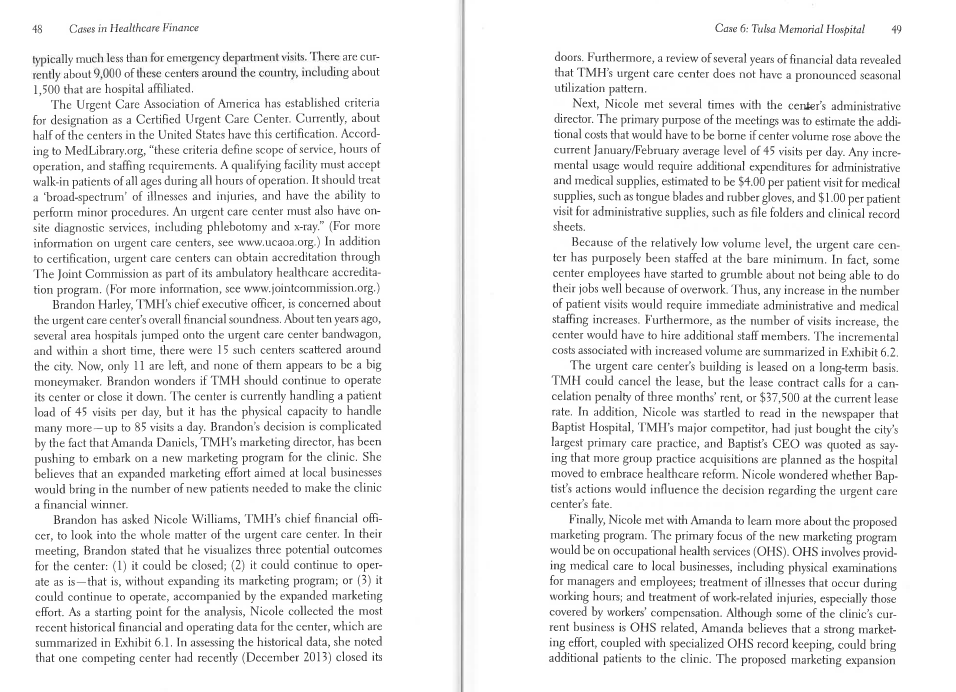

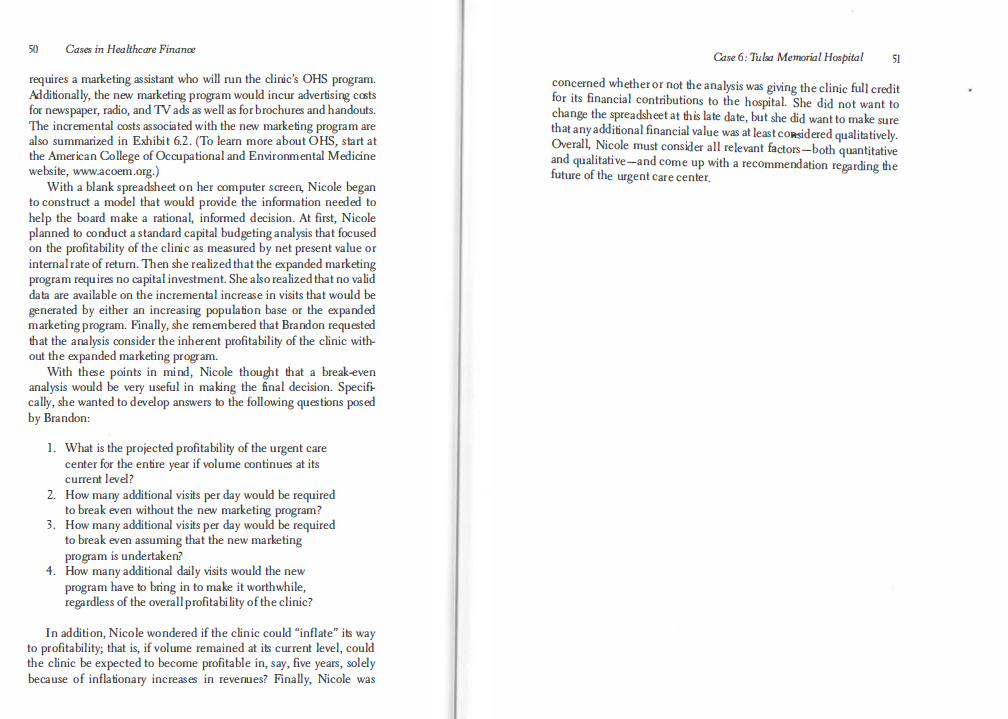

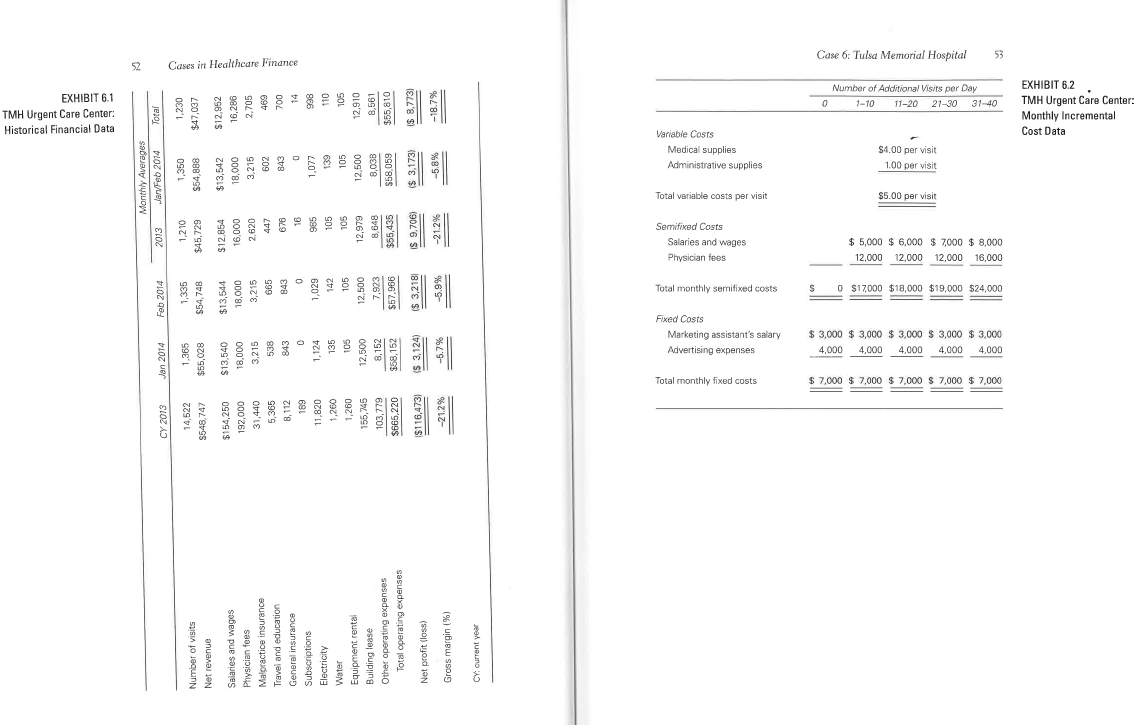

46 Cases in Healthcare Finance EXHIBIT 5.3 Consortium Employee Utilization and Cost Data: Other Facility Services Skilled nursing facility care Current average daily cost 25 2 days per year per 1,000 members $650 TULSA MEMORIAL HOSPITAL BREAK-EVEN ANALYSIS Inpatient mental health care ($0 copayl Current average daily cost 64.4 days per year per 1,000 members $740 Hospital based surgery ($0 copayl Current costs 417 cases per year per 1,000 members $1,800 per case Emergency department care ($15 copayl Current costs 132 visits per year per 1,000 members $250 per visit (see note) Note: The emergency department cost is the total charge for facility services, some of which would be covered by the $15 copy. TULSA MEMORIAL HOSPITAL (TMH), an acute care hospital with 300 beds and 160 staff physicians, is one of 75 hospitals owned and operated by Health Services of America, a for-profit, publicly owned company. Although there are nine other acute care hospitals serving the same general population, TMH historically has been highly prof- itable because of its well-appointed facilities, its fine medical staff, its reputation for quality care, and the amount of individual attention it gives to its patients. In addition to inpatient services, TMH operates an emergency department within the hospital complex and a stand-alone urgent care center located across the street from the area's major shop- ping mall, about two miles from the hospital. According to a Wall Street Journal article, urgent care centers are increasingly visited by patients who need immediate treatment for an illness, such as the flu or a sore throat, or an injury, such as a nail gun wound. Urgent care centers are distinguished from similar types of ambulatory healthcare providers, such as emergency departments and retail clinics, by the scope of illnesses treated and the presence of on- site facilities. These centers help mitigate the problems of primary care physician shortages and already crowded (and typically very expensive) emergency departments. Urgent care centers, notes the Wall Street Joumal article, are staffed by physicians, offer short wait times, and charge between $60 and $200 per procedure. Furthermore, no appointments are necessary and evening and weekend hours are frequently available. Finally, many centers offer discounts to the uninsured, and for those with coverage, copayments are 48 Cases in Healthcare Finance Case 6: Tulsa Memorial Hospital 49 typically much less than for emergency department visits. There are cur- rently about 9,000 of these centers around the country, including about 1,500 that are hospital affiliated The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. Accord- ing to MedLibrary.org, "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all ages during all hours of operation. It should treat a 'broad-spectrum of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on- site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa.org ) In addition to certification, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accredita- tion program. (For more information, see www.jointcommission.org.) Brandon Harley, TMH's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within a short time, there were 15 such centers scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker, Brandon wonders if TMH should continue to operate its center or close it down. The center is currently handling a patient load of 45 visits per day, but it has the physical capacity to handle many more-up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, TMH's marketing director, has been pushing to embark on a new marketing program for the clinic. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the clinic a financial winner. Brandon has asked Nicole Williams, TMH's chief financial offi- cer, to look into the whole matter of the urgent care center. In their meeting, Brandon stated that he visualizes three potential outcomes for the center: (1) it could be closed; (2) it could continue to oper- ate as is--that is, without expanding its marketing program; or (3) it could continue to operate, accompanied by the expanded marketing cffort. As a starting point for the analysis, Nicole collected the most recent historical financial and operating data for the center, which are summarized in Exhibit 6.1. In assessing the historical data, she noted that one competing center had recently (December 2013) closed its doors. Furthermore, a review of several years of financial data revealed that TMH's urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the center's administrative director. The primary purpose of the meetings was to estimate the addi- tional costs that would have to be borne if center volume rose above the current January/February average level of 45 visits per day. Any incre- mental usage would require additional expenditures for administrative and medical supplies, estimated to be $4.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $1.00 per patient visit for administrative supplies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care cen- ter has purposely been staffed at the bare minimum. In fact, some center employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increase, the center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in Exhibit 6.2. The urgent care center's building is leased on a long-term basis. TMH could cancel the lease, but the lease contract calls for a can- celation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was startled to read in the newspaper that Baptist Hospital, TMH's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as say- ing that more group practice acquisitions are planned as the hospital moved to embrace healthcare reform. Nicole wondered whether Bap- tist's actions would influence the decision regarding the urgent care center's fate. Finally, Nicole met with Amanda to learn more about the proposed marketing program. The primary focus of the new marketing program would be on occupational health services (OHS). OHS involves provid- ing medical care to local businesses, including physical examinations for managers and employees; treatment of illnesses that occur during working hours; and treatment of work-related injuries, especially those covered by workers' compensation. Although some of the clinic's cur- rent business is OHS related, Amanda believes that a strong market- ing effort, coupled with specialized OHS record keeping, could bring additional patients to the clinic. The proposed marketing expansion 50 Cases in Healthcare Finance Case 6: Tulsa Memorial Hospital 51 concerned whether or not the analysis was giving the clinic full credit for its financial contributions to the hospital. She did not want to change the spreadsheet at this late date, but she did want to make sure that any additional financial value was at least considered qualitatively. Overall, Nicole must consider all relevant factors-both quantitative and qualitative-and come up with a recommendation regarding the future of the urgent care center requires a marketing assistant who will run the clinic's OHS program. Additionally, the new marketing program would incur advertising costs for newspaper, radio, and TV ads as well as for brochures and handouts. The incremental costs associated with the new marketing program are also summarized in Exhibit 6.2. (To learn more about OHS, start at the American College of Occupational and Environmental Medicine website, www.acoem.org.) With a blank spreadsheet on her computer screen, Nicole began to construct a model that would provide the information needed to help the board make a rational, informed decision. At first, Nicole planned to conduct a standard capital budgeting analysis that focused on the profitability of the clinic as measured by net present value or internal rate of return. Then she realized that the expanded marketing program requires no capital investment. She also realized that no valid data are available on the incremental increase in visits that would be generated by either an increasing population base or the expanded marketing program. Finally, she remembered that Brandon requested that the analysis consider the inherent profitability of the clinic with- out the expanded marketing program. With these points in mind, Nicole thought that a break-even analysis would be very useful in making the final decision. Specifi- cally, she wanted to develop answers to the following questions posed by Brandon: 1. What is the projected profitability of the urgent care center for the entire year if volume continues at its current level? 2. How many additional visits per day would be required to break even without the new marketing program? 3. How many additional visits per day would be required to break even assuming that the new marketing program is undertaken? 4. How many additional daily visits would the new program have to bring in to make it worthwhile, regardless of the overall profitability of the clinic? In addition, Nicole wondered if the clinic could "inflate" its way to profitability; that is, if volume remained at its current level, could the clinic be expected to become profitable in, say, five years, solely because of inflationary increases in revenues? Finally, Nicole was Historical Financial Data TMH Urgent Care Center: EXHIBIT 6.1 52 Monthly Averages MartFeb 2014 CY 2013 Jan 2014 Feb 2014 2013 Total Number of visits Net revenue 14,522 $548,747 1,365 $55,028 1,335 $54, 748 1.210 $45.729 1.350 $54,888 1,230 $47,037 $13,540 18,000 3.215 538 843 $13,544 18,000 3,215 665 843 $12,854 16,000 2,620 447 $13,542 18,000 3.215 602 843 $12,952 16,286 2,705 Cases in Healthcare Finance 696 700 $154,250 192,000 31,440 5,365 8,112 189 11,820 1,260 1,260 155,745 Salaries and wages Physician foes Malpractice insurance Travel and education General insurance Subscriptions Electricity Water Equipment rental Building lease Other operating expenses Total operating expenses 1.124 998 1,029 142 136 110 105 16 985 105 105 12,979 8,648 $55,435 105 12,500 8,152 $58,152 1.077 139 105 12,500 8,03B $58,059 103,779 105 12,910 8,561 $55,810 12,500 7,923 $57,966 $665,220 5 3,124 IS 9.706) $ 3,2181 Net profit (loss) $ 3,173) IS 8.7731 5116,473) -21.2% -5.9% -21.2% -5.8% Gross margin (%) -18.7% CY: Current year Total monthly fixed costs Fixed Costs Advertising expenses Marketing assistant's salary Total monthly semifixed costs Physician fees Salaries and wages Semifixed Costs Total variable costs per visit Variable Costs Administrative supplies Medical supplies S 0 000 0 000 12,000 $7,000 $ 7,000 $ 7,000 $ 7,000 $ 7,000 $3,000 $3,000 $3,000 $3,000 $ 3.000 000 12,000 S17000 $18,000 $19,000 $24,000 000'8 $ 0002 $ 000'9 $ 000'S $ $5.00 per visit 1.00 per visit $4.00 per visit Case 6: Tulsa Memorial Hospital 1 -10 11-20 Number of Additional Visits per Day 21-30 31-40 000 12,000 000 16,000 5 Cost Data Monthly Incremental EXHIBIT 6.2 TMH Urgent Care Center: 46 Cases in Healthcare Finance EXHIBIT 5.3 Consortium Employee Utilization and Cost Data: Other Facility Services Skilled nursing facility care Current average daily cost 25 2 days per year per 1,000 members $650 TULSA MEMORIAL HOSPITAL BREAK-EVEN ANALYSIS Inpatient mental health care ($0 copayl Current average daily cost 64.4 days per year per 1,000 members $740 Hospital based surgery ($0 copayl Current costs 417 cases per year per 1,000 members $1,800 per case Emergency department care ($15 copayl Current costs 132 visits per year per 1,000 members $250 per visit (see note) Note: The emergency department cost is the total charge for facility services, some of which would be covered by the $15 copy. TULSA MEMORIAL HOSPITAL (TMH), an acute care hospital with 300 beds and 160 staff physicians, is one of 75 hospitals owned and operated by Health Services of America, a for-profit, publicly owned company. Although there are nine other acute care hospitals serving the same general population, TMH historically has been highly prof- itable because of its well-appointed facilities, its fine medical staff, its reputation for quality care, and the amount of individual attention it gives to its patients. In addition to inpatient services, TMH operates an emergency department within the hospital complex and a stand-alone urgent care center located across the street from the area's major shop- ping mall, about two miles from the hospital. According to a Wall Street Journal article, urgent care centers are increasingly visited by patients who need immediate treatment for an illness, such as the flu or a sore throat, or an injury, such as a nail gun wound. Urgent care centers are distinguished from similar types of ambulatory healthcare providers, such as emergency departments and retail clinics, by the scope of illnesses treated and the presence of on- site facilities. These centers help mitigate the problems of primary care physician shortages and already crowded (and typically very expensive) emergency departments. Urgent care centers, notes the Wall Street Joumal article, are staffed by physicians, offer short wait times, and charge between $60 and $200 per procedure. Furthermore, no appointments are necessary and evening and weekend hours are frequently available. Finally, many centers offer discounts to the uninsured, and for those with coverage, copayments are 48 Cases in Healthcare Finance Case 6: Tulsa Memorial Hospital 49 typically much less than for emergency department visits. There are cur- rently about 9,000 of these centers around the country, including about 1,500 that are hospital affiliated The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. Accord- ing to MedLibrary.org, "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all ages during all hours of operation. It should treat a 'broad-spectrum of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on- site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa.org ) In addition to certification, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accredita- tion program. (For more information, see www.jointcommission.org.) Brandon Harley, TMH's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within a short time, there were 15 such centers scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker, Brandon wonders if TMH should continue to operate its center or close it down. The center is currently handling a patient load of 45 visits per day, but it has the physical capacity to handle many more-up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, TMH's marketing director, has been pushing to embark on a new marketing program for the clinic. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the clinic a financial winner. Brandon has asked Nicole Williams, TMH's chief financial offi- cer, to look into the whole matter of the urgent care center. In their meeting, Brandon stated that he visualizes three potential outcomes for the center: (1) it could be closed; (2) it could continue to oper- ate as is--that is, without expanding its marketing program; or (3) it could continue to operate, accompanied by the expanded marketing cffort. As a starting point for the analysis, Nicole collected the most recent historical financial and operating data for the center, which are summarized in Exhibit 6.1. In assessing the historical data, she noted that one competing center had recently (December 2013) closed its doors. Furthermore, a review of several years of financial data revealed that TMH's urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the center's administrative director. The primary purpose of the meetings was to estimate the addi- tional costs that would have to be borne if center volume rose above the current January/February average level of 45 visits per day. Any incre- mental usage would require additional expenditures for administrative and medical supplies, estimated to be $4.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $1.00 per patient visit for administrative supplies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care cen- ter has purposely been staffed at the bare minimum. In fact, some center employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increase, the center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in Exhibit 6.2. The urgent care center's building is leased on a long-term basis. TMH could cancel the lease, but the lease contract calls for a can- celation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was startled to read in the newspaper that Baptist Hospital, TMH's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as say- ing that more group practice acquisitions are planned as the hospital moved to embrace healthcare reform. Nicole wondered whether Bap- tist's actions would influence the decision regarding the urgent care center's fate. Finally, Nicole met with Amanda to learn more about the proposed marketing program. The primary focus of the new marketing program would be on occupational health services (OHS). OHS involves provid- ing medical care to local businesses, including physical examinations for managers and employees; treatment of illnesses that occur during working hours; and treatment of work-related injuries, especially those covered by workers' compensation. Although some of the clinic's cur- rent business is OHS related, Amanda believes that a strong market- ing effort, coupled with specialized OHS record keeping, could bring additional patients to the clinic. The proposed marketing expansion 50 Cases in Healthcare Finance Case 6: Tulsa Memorial Hospital 51 concerned whether or not the analysis was giving the clinic full credit for its financial contributions to the hospital. She did not want to change the spreadsheet at this late date, but she did want to make sure that any additional financial value was at least considered qualitatively. Overall, Nicole must consider all relevant factors-both quantitative and qualitative-and come up with a recommendation regarding the future of the urgent care center requires a marketing assistant who will run the clinic's OHS program. Additionally, the new marketing program would incur advertising costs for newspaper, radio, and TV ads as well as for brochures and handouts. The incremental costs associated with the new marketing program are also summarized in Exhibit 6.2. (To learn more about OHS, start at the American College of Occupational and Environmental Medicine website, www.acoem.org.) With a blank spreadsheet on her computer screen, Nicole began to construct a model that would provide the information needed to help the board make a rational, informed decision. At first, Nicole planned to conduct a standard capital budgeting analysis that focused on the profitability of the clinic as measured by net present value or internal rate of return. Then she realized that the expanded marketing program requires no capital investment. She also realized that no valid data are available on the incremental increase in visits that would be generated by either an increasing population base or the expanded marketing program. Finally, she remembered that Brandon requested that the analysis consider the inherent profitability of the clinic with- out the expanded marketing program. With these points in mind, Nicole thought that a break-even analysis would be very useful in making the final decision. Specifi- cally, she wanted to develop answers to the following questions posed by Brandon: 1. What is the projected profitability of the urgent care center for the entire year if volume continues at its current level? 2. How many additional visits per day would be required to break even without the new marketing program? 3. How many additional visits per day would be required to break even assuming that the new marketing program is undertaken? 4. How many additional daily visits would the new program have to bring in to make it worthwhile, regardless of the overall profitability of the clinic? In addition, Nicole wondered if the clinic could "inflate" its way to profitability; that is, if volume remained at its current level, could the clinic be expected to become profitable in, say, five years, solely because of inflationary increases in revenues? Finally, Nicole was Historical Financial Data TMH Urgent Care Center: EXHIBIT 6.1 52 Monthly Averages MartFeb 2014 CY 2013 Jan 2014 Feb 2014 2013 Total Number of visits Net revenue 14,522 $548,747 1,365 $55,028 1,335 $54, 748 1.210 $45.729 1.350 $54,888 1,230 $47,037 $13,540 18,000 3.215 538 843 $13,544 18,000 3,215 665 843 $12,854 16,000 2,620 447 $13,542 18,000 3.215 602 843 $12,952 16,286 2,705 Cases in Healthcare Finance 696 700 $154,250 192,000 31,440 5,365 8,112 189 11,820 1,260 1,260 155,745 Salaries and wages Physician foes Malpractice insurance Travel and education General insurance Subscriptions Electricity Water Equipment rental Building lease Other operating expenses Total operating expenses 1.124 998 1,029 142 136 110 105 16 985 105 105 12,979 8,648 $55,435 105 12,500 8,152 $58,152 1.077 139 105 12,500 8,03B $58,059 103,779 105 12,910 8,561 $55,810 12,500 7,923 $57,966 $665,220 5 3,124 IS 9.706) $ 3,2181 Net profit (loss) $ 3,173) IS 8.7731 5116,473) -21.2% -5.9% -21.2% -5.8% Gross margin (%) -18.7% CY: Current year Total monthly fixed costs Fixed Costs Advertising expenses Marketing assistant's salary Total monthly semifixed costs Physician fees Salaries and wages Semifixed Costs Total variable costs per visit Variable Costs Administrative supplies Medical supplies S 0 000 0 000 12,000 $7,000 $ 7,000 $ 7,000 $ 7,000 $ 7,000 $3,000 $3,000 $3,000 $3,000 $ 3.000 000 12,000 S17000 $18,000 $19,000 $24,000 000'8 $ 0002 $ 000'9 $ 000'S $ $5.00 per visit 1.00 per visit $4.00 per visit Case 6: Tulsa Memorial Hospital 1 -10 11-20 Number of Additional Visits per Day 21-30 31-40 000 12,000 000 16,000 5 Cost Data Monthly Incremental EXHIBIT 6.2 TMH Urgent Care Center