Answered step by step

Verified Expert Solution

Question

1 Approved Answer

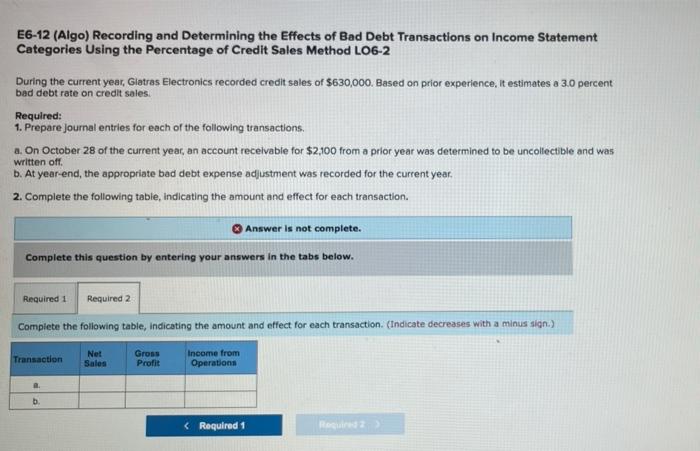

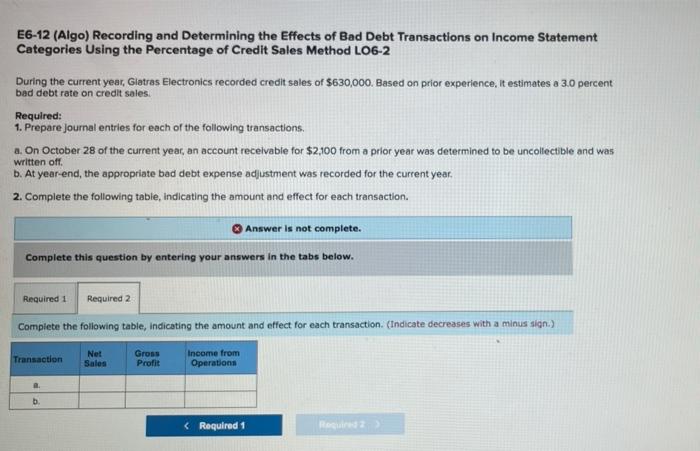

question is in picture E6-12 (Algo) Recording and Determining the Effects of Bad Debt Transactions on Income Statement Categories Using the Percentage of Credit Sales

question is in picture

E6-12 (Algo) Recording and Determining the Effects of Bad Debt Transactions on Income Statement Categories Using the Percentage of Credit Sales Method LO6-2 During the current year, Gletras Electronics recorded credit sales of $630,000. Based on prior experience, it estimates a 3.0 percent bad debt rate on credit sales. Required: 1. Prepare Journal entries for each of the following transactions. a. On October 28 of the current year, an account receivable for $2,100 from a prior year was determined to be uncollectible and was b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year. 2. Complete the following table, indicating the amount and effect for each transaction. written off. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table, indicating the amount and effect for each transaction. (Indicate decreases with a minus sign.) Transaction Net Sales Gross Profit Income from Operations b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started