(Question is what is the risk of all these portfolios? )

(Question is what is the risk of all these portfolios? )

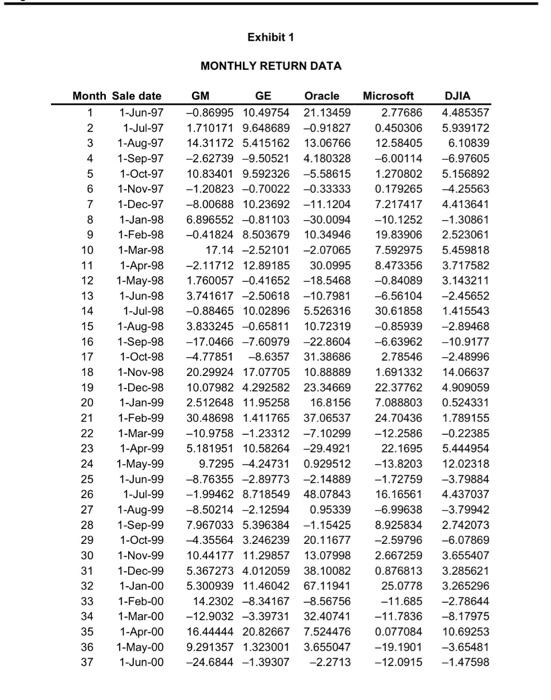

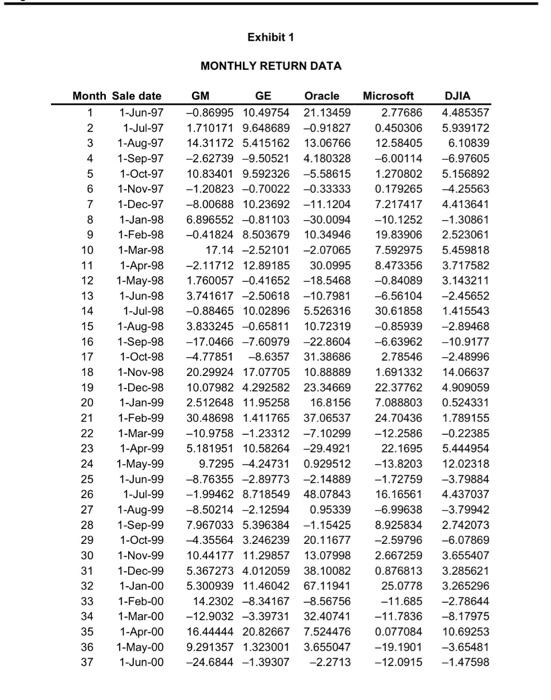

A professor of management science has decided to build an equity portfolio made up of common shares of General Motors, General Electric, Oracle and Microsoft. He has to decide what fraction of the portfolio should be devoted to each of these four issues. DATA COLLECTION Research assistant Rob McGowan agreed to collect some data and obtained first day of the month closing prices for General Motors, General Electric, Oracle and Microsoft common shares for the period May 1, 1997 through June 1, 2000 from Datastream. The values of the Dow Jones Industrial Average for the same dates and dividend payment information for General Motors and General Electric were also obtained. Oracle and Microsoft shares did not pay any dividends during this period. The yield (as a percentage) on each share issue for each month was computed using: Yield month t 100 [Price month t - Price month (t-1) + dividends paid in month ) [Price month (t-1)] The return on a hypothetical portfolio matching the Dow Jones Industrial Average was computed using the same calculation applied to the Dow average. The data are shown in Exhibit 1. FORMING THE PORTFOLIO The professor recognized that the choice of objective was an important component of portfolio selection. Maximizing return alone generally produced a very risky portfolio, while minimizing risk could lead to low returns. This suggested that it might be important to add one or more constraints into the optimization. For example, he might maximize the return on the portfolio while imposing a maximum level of risk, or Exhibit 1 MONTHLY RETURN DATA Month Sale date Microsoft DJIA 1-Jun-97 1 2 3 2.77686 0.450306 12.58405 4.485357 5.939172 4 1-Jul-97 1-Aug-97 1-Sep-97 1-Oct-97 1-Nov-97 GM GE Oracle -0.86995 10.49754 21.13459 1.710171 9.648689 -0.91827 14.31172 5.415162 13.06766 -2.62739 -9.50521 4.180328 10.83401 9.592326 -5.58615 - 1.20823 -0.70022 -0.33333 -8.00688 10.23692 -11.1204 6.896552 -0.81103 -30.0094 -0.41824 8.503679 10.34946 6.10839 -6.97605 5.156892 -4.25563 5 6 -6.00114 1.270802 0.179265 7.217417 -10.1252 19.83906 7 1-Dec-97 4.413641 8 9 10 1-Jan-98 1-Feb-98 -1.30861 2.523061 1-Mar-98 17.14 -2.52101 -2.07065 7.592975 5.459818 11 12 13 14 1-Apr-98 1-May-98 1-Jun-98 1-Jul-98 1-Aug-98 1-Sep-98 1-Oct-98 -2.11712 12.89185 30.0995 1.760057 -0.41652 -18.5468 3.741617 -2.50618 -10.7981 -0.88465 10.02896 5.526316 8.473356 -0.84089 -6.56104 30.61858 -0.85939 -6.63962 2.78546 3.717582 3.143211 -2.45652 1.415543 15 16 17 3.833245 -0.65811 10.72319 -17.0466 -7.60979 -22.8604 -4.77851 -8.6357 31.38686 -2.89468 -10.9177 -2.48996 18 20.29924 17.07705 10.88889 1.691332 14.06637 19 1-Nov-98 1-Dec-98 1-Jan-99 1-Feb-99 20 10.07982 4.292582 23.34669 2.512648 11.95258 16.8156 30.48698 1.411765 37.06537 22.37762 7.088803 24.70436 4.909059 0.524331 1.789155 21 22 23 24 -10.9758 -1.23312 5.181951 10.58264 9.7295 4.24731 -7.10299 -29.4921 0.929512 -12.2586 22.1695 -13.8203 -1.72759 -0.22385 5.444954 12.02318 -3.79884 25 -8.76355 -2.89773 1-Mar-99 1-Apr-99 1-May-99 1-Jun-99 1-Jul-99 1-Aug-99 1-Sep-99 1-Oct-99 -2.14889 48.07843 -1.99462 8.718549 16.16561 4.437037 26 27 28 -3.79942 -8.50214 -2.12594 7.967033 5.396384 0.95339 -1.15425 20.11677 -6.99638 8.925834 -2.59796 2.742073 29 -4.35564 3.246239 -6.07869 30 31 32 1-Nov-99 1-Dec-99 1-Jan-00 1-Feb-00 10.44177 11.29857 13.07998 5.367273 4.012059 38.10082 5.300939 11.46042 67.11941 14.2302 -8.34167 -8.56756 2.667259 0.876813 25.0778 -11.685 3.655407 3.285621 3.265296 33 -2.78644 34 1-Mar-00 32.40741 -11.7836 -8.17975 10.69253 35 -12.9032 -3.39731 16.44444 20.82667 9.291357 1.323001 7.524476 0.077084 1-Apr-00 1-May-00 1-Jun-00 36 3.655047 -19.1901 -3.65481 37 -24.6844 -1.39307 -2.2713 -12.0915 -1.47598 A professor of management science has decided to build an equity portfolio made up of common shares of General Motors, General Electric, Oracle and Microsoft. He has to decide what fraction of the portfolio should be devoted to each of these four issues. DATA COLLECTION Research assistant Rob McGowan agreed to collect some data and obtained first day of the month closing prices for General Motors, General Electric, Oracle and Microsoft common shares for the period May 1, 1997 through June 1, 2000 from Datastream. The values of the Dow Jones Industrial Average for the same dates and dividend payment information for General Motors and General Electric were also obtained. Oracle and Microsoft shares did not pay any dividends during this period. The yield (as a percentage) on each share issue for each month was computed using: Yield month t 100 [Price month t - Price month (t-1) + dividends paid in month ) [Price month (t-1)] The return on a hypothetical portfolio matching the Dow Jones Industrial Average was computed using the same calculation applied to the Dow average. The data are shown in Exhibit 1. FORMING THE PORTFOLIO The professor recognized that the choice of objective was an important component of portfolio selection. Maximizing return alone generally produced a very risky portfolio, while minimizing risk could lead to low returns. This suggested that it might be important to add one or more constraints into the optimization. For example, he might maximize the return on the portfolio while imposing a maximum level of risk, or Exhibit 1 MONTHLY RETURN DATA Month Sale date Microsoft DJIA 1-Jun-97 1 2 3 2.77686 0.450306 12.58405 4.485357 5.939172 4 1-Jul-97 1-Aug-97 1-Sep-97 1-Oct-97 1-Nov-97 GM GE Oracle -0.86995 10.49754 21.13459 1.710171 9.648689 -0.91827 14.31172 5.415162 13.06766 -2.62739 -9.50521 4.180328 10.83401 9.592326 -5.58615 - 1.20823 -0.70022 -0.33333 -8.00688 10.23692 -11.1204 6.896552 -0.81103 -30.0094 -0.41824 8.503679 10.34946 6.10839 -6.97605 5.156892 -4.25563 5 6 -6.00114 1.270802 0.179265 7.217417 -10.1252 19.83906 7 1-Dec-97 4.413641 8 9 10 1-Jan-98 1-Feb-98 -1.30861 2.523061 1-Mar-98 17.14 -2.52101 -2.07065 7.592975 5.459818 11 12 13 14 1-Apr-98 1-May-98 1-Jun-98 1-Jul-98 1-Aug-98 1-Sep-98 1-Oct-98 -2.11712 12.89185 30.0995 1.760057 -0.41652 -18.5468 3.741617 -2.50618 -10.7981 -0.88465 10.02896 5.526316 8.473356 -0.84089 -6.56104 30.61858 -0.85939 -6.63962 2.78546 3.717582 3.143211 -2.45652 1.415543 15 16 17 3.833245 -0.65811 10.72319 -17.0466 -7.60979 -22.8604 -4.77851 -8.6357 31.38686 -2.89468 -10.9177 -2.48996 18 20.29924 17.07705 10.88889 1.691332 14.06637 19 1-Nov-98 1-Dec-98 1-Jan-99 1-Feb-99 20 10.07982 4.292582 23.34669 2.512648 11.95258 16.8156 30.48698 1.411765 37.06537 22.37762 7.088803 24.70436 4.909059 0.524331 1.789155 21 22 23 24 -10.9758 -1.23312 5.181951 10.58264 9.7295 4.24731 -7.10299 -29.4921 0.929512 -12.2586 22.1695 -13.8203 -1.72759 -0.22385 5.444954 12.02318 -3.79884 25 -8.76355 -2.89773 1-Mar-99 1-Apr-99 1-May-99 1-Jun-99 1-Jul-99 1-Aug-99 1-Sep-99 1-Oct-99 -2.14889 48.07843 -1.99462 8.718549 16.16561 4.437037 26 27 28 -3.79942 -8.50214 -2.12594 7.967033 5.396384 0.95339 -1.15425 20.11677 -6.99638 8.925834 -2.59796 2.742073 29 -4.35564 3.246239 -6.07869 30 31 32 1-Nov-99 1-Dec-99 1-Jan-00 1-Feb-00 10.44177 11.29857 13.07998 5.367273 4.012059 38.10082 5.300939 11.46042 67.11941 14.2302 -8.34167 -8.56756 2.667259 0.876813 25.0778 -11.685 3.655407 3.285621 3.265296 33 -2.78644 34 1-Mar-00 32.40741 -11.7836 -8.17975 10.69253 35 -12.9032 -3.39731 16.44444 20.82667 9.291357 1.323001 7.524476 0.077084 1-Apr-00 1-May-00 1-Jun-00 36 3.655047 -19.1901 -3.65481 37 -24.6844 -1.39307 -2.2713 -12.0915 -1.47598

(Question is what is the risk of all these portfolios? )

(Question is what is the risk of all these portfolios? )