Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Jim Bob is a stock picking genius. Every year, based on his system, he has the ability to invest $100 (only) in a

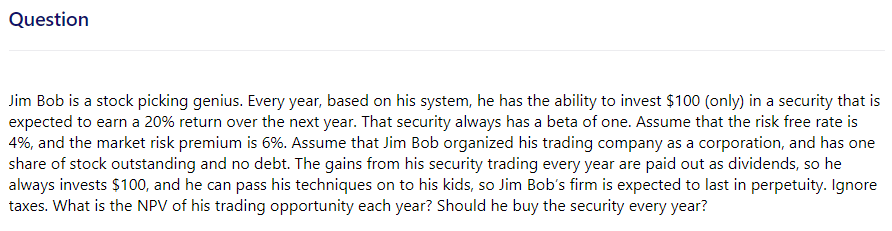

Question Jim Bob is a stock picking genius. Every year, based on his system, he has the ability to invest $100 (only) in a security that is expected to earn a 20% return over the next year. That security always has a beta of one. Assume that the risk free rate is 4%, and the market risk premium is 6%. Assume that Jim Bob organized his trading company as a corporation, and has one share of stock outstanding and no debt. The gains from his security trading every year are paid out as dividends, so he always invests $100, and he can pass his techniques on to his kids, so Jim Bob's firm is expected to last in perpetuity. Ignore taxes. What is the NPV of his trading opportunity each year? Should he buy the security every year?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the NPV and determine if Jim Bob should buy the security 1 Calculate the expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started