Answered step by step

Verified Expert Solution

Question

1 Approved Answer

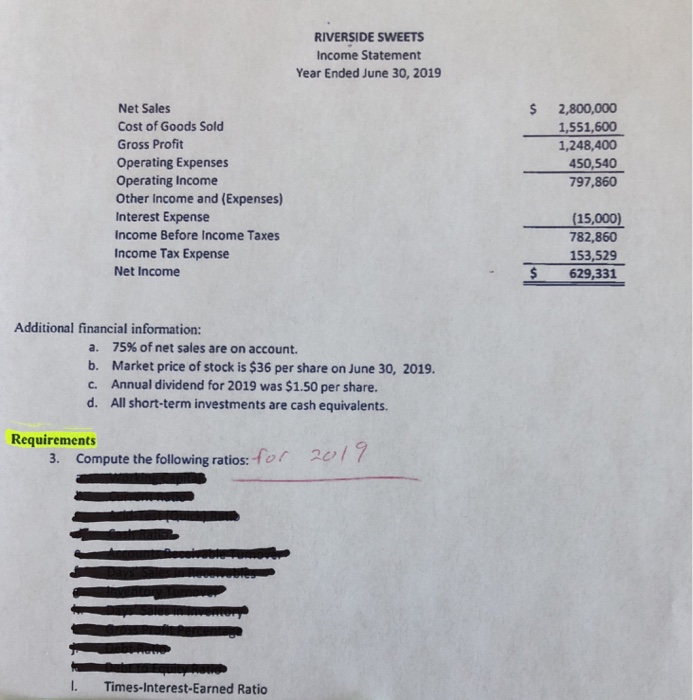

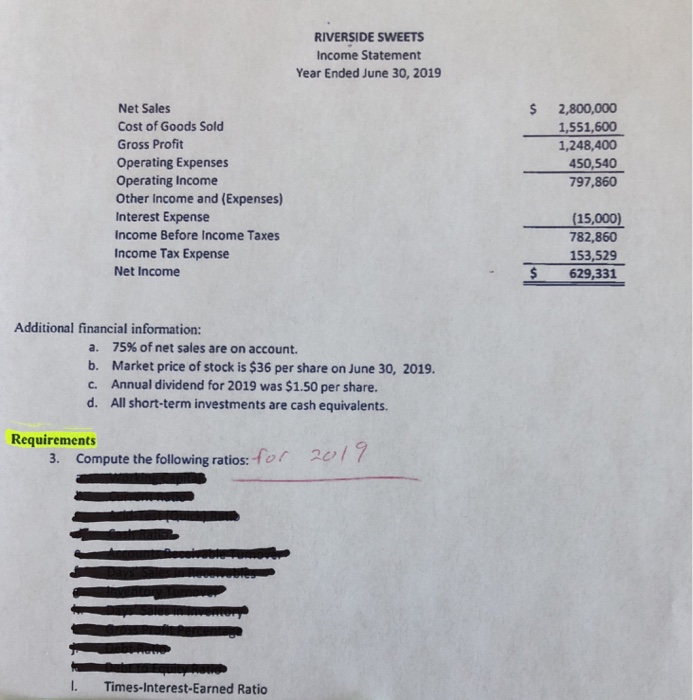

Question L. Compute the following ratio for 2019: Times-Interest-Earned Ratio Riverside Sweets, a retail candy store chain, reported the following figures: RIVERSIDE SWEETS Balance Sheet

Question L. Compute the following ratio for 2019: Times-Interest-Earned Ratio

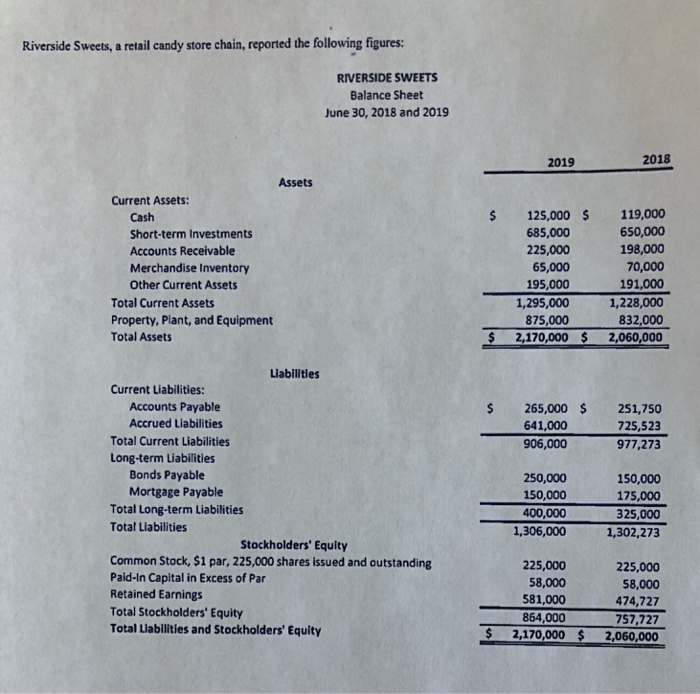

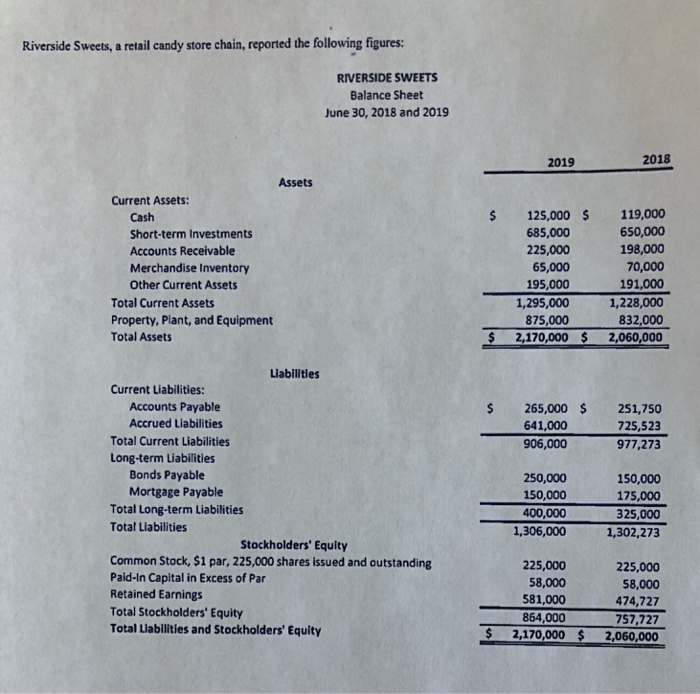

Riverside Sweets, a retail candy store chain, reported the following figures: RIVERSIDE SWEETS Balance Sheet June 30, 2018 and 2019 2019 2018 Assets Current Assets: Cash Short-term Investments Accounts Receivable Merchandise Inventory Other Current Assets 125,000 $119,000 650,000 198,000 70,000 191,000 1,228,000 832,000 $2,170,000 $ 2,060,000 685,000 225,000 65,000 195,000 1,295,000 875,000 Total Current Assets Property, Plant, and Equipment Total Assets Liabilities Current Liabilities: Accounts Payable Accrued Liabilities Total Current Liabilities Long-term Liabilities $ 265,000 $ 251,750 725,523 977,273 641,000 906,000 Bonds Payable Mortgage Payable Total Long-term Liabilities Total Liabilities 250,000 150,000 400,000 1,306,000 150,000 175,000 325,000 1,302,273 Stockholders' Equity Common Stock, $1 par, 225,000 shares issued and outstanding Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 225,000 58,000 474,727 757,727 $2,170,000 2,060,000 225,000 58,000 581,000 864,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started