Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question list Question 1 6 Dr . Julienne Swafford has hired your professional services to file her income tax return. Dr . Swafford is a

Question list

Question

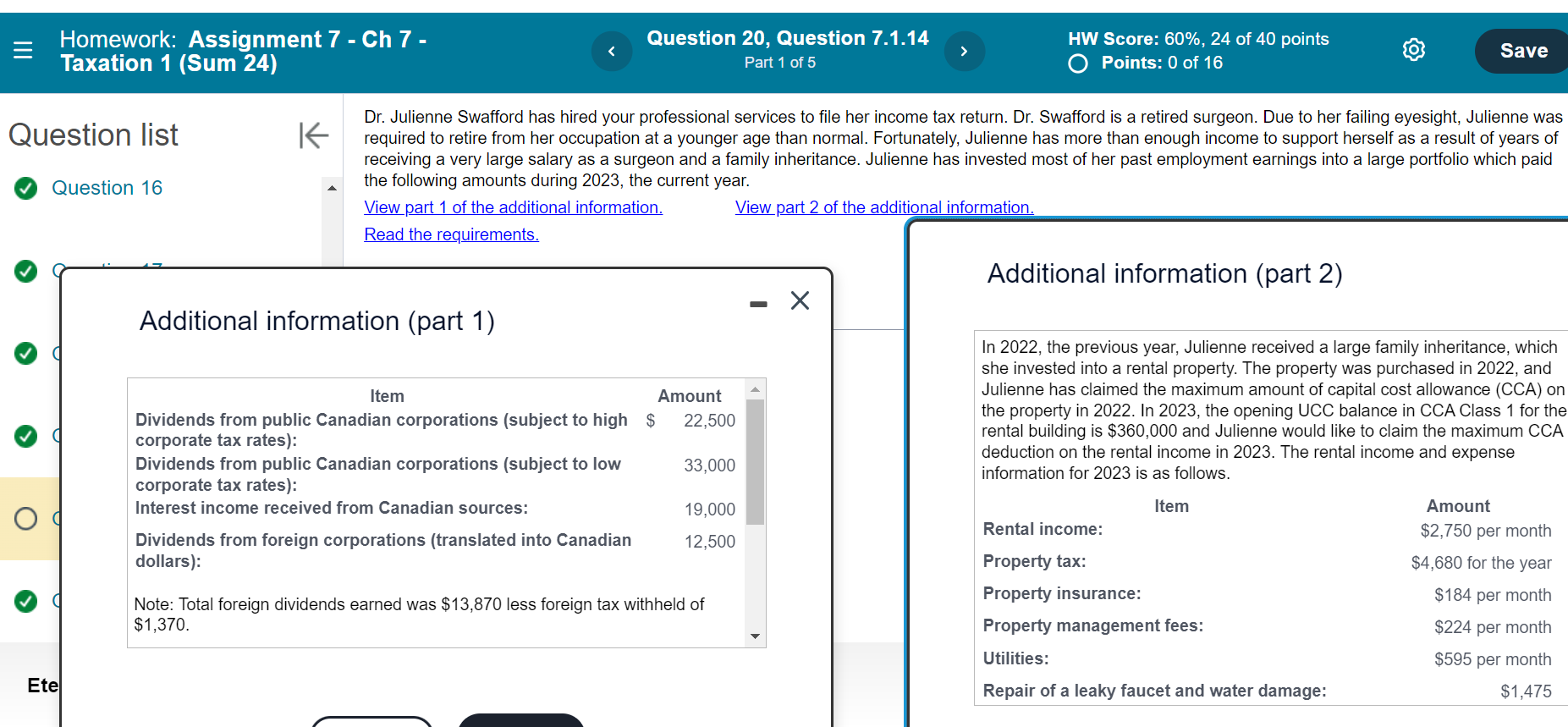

Dr Julienne Swafford has hired your professional services to file her income tax return. Dr Swafford is a retired surgeon. Due to her failing eyesight, Julienne was

required to retire from her occupation at a younger age than normal. Fortunately, Julienne has more than enough income to support herself as a result of years of

receiving a very large salary as a surgeon and a family inheritance. Julienne has invested most of her past employment earnings into a large portfolio which paid

the following amounts during the current year.

View part of the additional information.

View part of the additional information.

Read the requirements.

Additional information part

Additional information part

In the previous year, Julienne received a large family inheritance, which

she invested into a rental property. The property was purchased in and

Julienne has claimed the maximum amount of capital cost allowance CCA on

the property in In the opening UCC balance in CCA Class for the

rental building is $ and Julienne would like to claim the maximum CCA

deduction on the rental income in The rental income and expense

information for is as follows.Requirement Compute Dr Swaffords net property income for

Fill in the table below to compute the net property income. For entries with a $ balance, make sure to enter in the appropriate input field. Round your answers to the nearest cent. Use parentheses or a minus sign for numbers to be subtracted.

Property Income

Amount

Eligible dividends

Ineligible dividends

Interest income

Foreign dividends

Net rental income

Carrying Charges

Net property income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started