Answered step by step

Verified Expert Solution

Question

1 Approved Answer

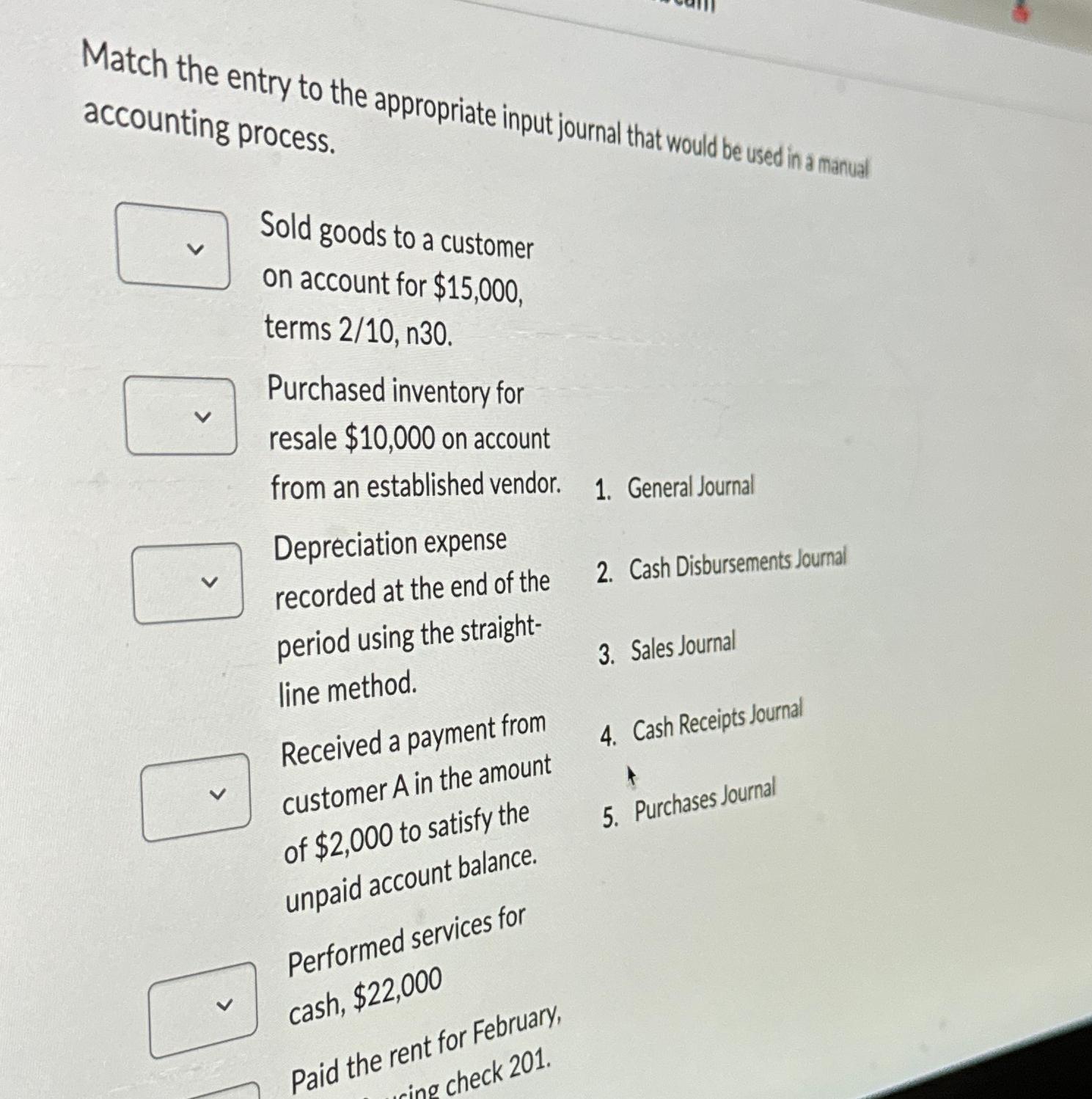

Question: Match the entry to the appropriate input journal that would be used in a manual accounting process.Sold goods to a customer on account for

Question: Match the entry to the appropriate input journal that would be used in a manual accounting process.Sold goods to a customer on account for $15,000, terms 210, n30.Purchased inventory for resale $10,000 on account from an established vendor.General JournalDepreciation expense recorded at the end of theCash Disbursements Journal period using the

Match the entry to the appropriate input journal that would be used in a manual accounting process.Sold goods to a customer on account for $ terms nPurchased inventory for resale $ on account from an established vendor.General JournalDepreciation expense recorded at the end of theCash Disbursements Journal period using the straightSales Journal line method.Received a payment fromCash Receipts Journal customer in the amount of $ to satisfy thePurchases Journal unpaid account balance.Performed services for cash, $paid the rent for February,

Match the entry to the appropriate input journal that would be used in a manual accounting process. Sold goods to a customer on account for $15,000, terms 2/10, n30. Purchased inventory for resale $10,000 on account from an established vendor. 1. General Journal Depreciation expense recorded at the end of the period using the straight- line method. Received a payment from customer A in the amount of $2,000 to satisfy the unpaid account balance. Performed services for cash, $22,000 Paid the rent for February, ing check 201. 2. Cash Disbursements Journal 3. Sales Journal 4. Cash Receipts Journal 5. Purchases Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started