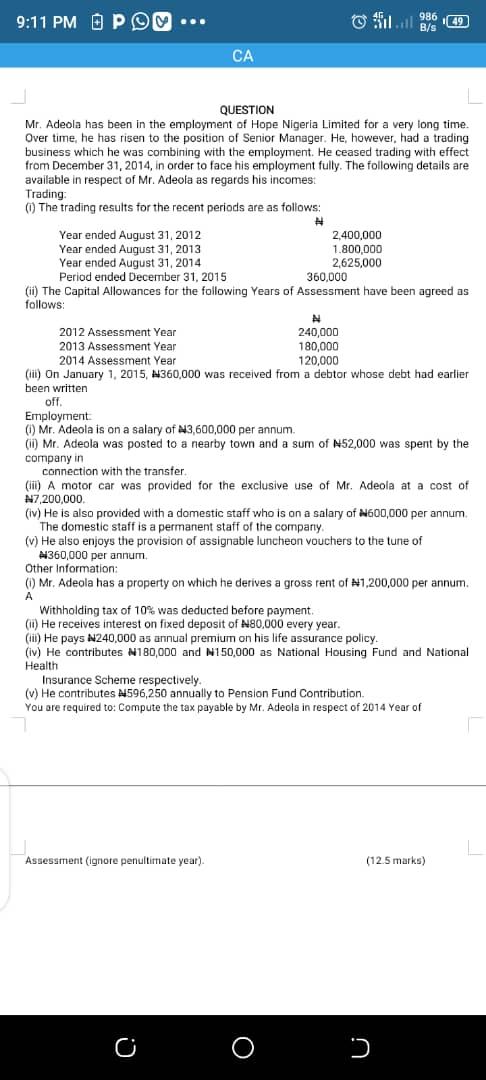

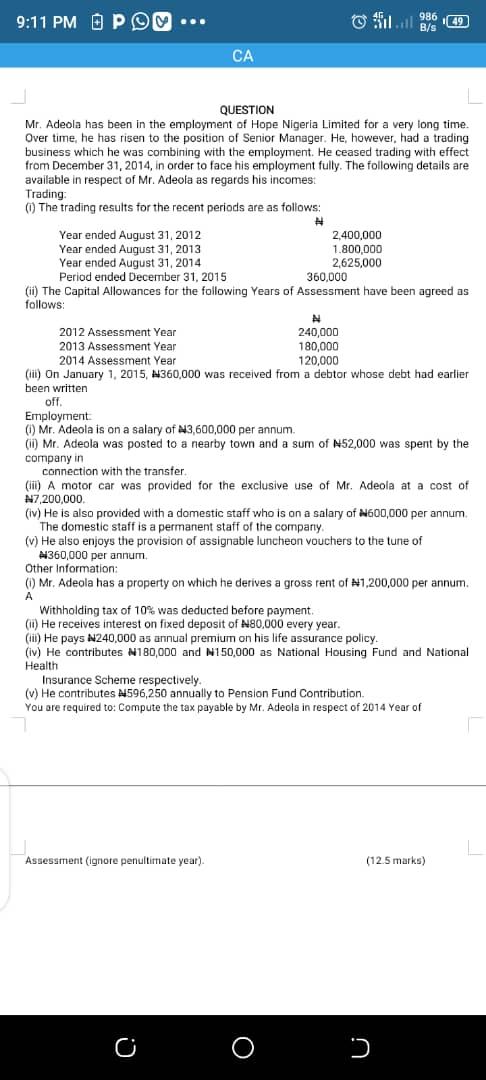

QUESTION Mr. Adeola has been in the employment of Hope Nigeria Limited for a very long time. Over time, he has risen to the position of Senior Manager. He, however, had a trading business which he was combining with the employment. He ceased trading with effect from December 31,2014 , in order to face his employment fulty. The following details are available in respect of Mr. Adeola as regards his incomes: Trading: (i) The trading results for the recent periods are as follows: Period ended December 31, 2015 (ii) The Capital Allowances for the following Years of Assessment have been agreed as follows: (iii) On January 1, 2015, \$360,000 was received from a debtor whose debt had earlier been written off. Employment: (i) Mr. Adeola is on a salary of A3,600,000 per annum. (ii) Mr. Adeola was posted to a nearby town and a sum of N52,000 was spent by the company in connection with the transter. (iii) A motor car was provided for the exclusive use of Mr. Adeola at a cost of A7, 200,000. (iv) He is also provided with a domestic staff who is on a salary of NO00,000 per annum. The domestic staff is a permanent staff of the company. (v) He also enjoys the provision of assignable luncheon vouchers to the tune of A360,000 per annum. Other Information: A Withholding tax of 10% was deducted before payment. (ii) He receives interest on fixed deposit of A80,000 every year. (iii) He pays N240,000 as annual premium on his life assurance policy. (iv) He contributes N180,000 and N150,000 as National Housing Fund and National Health Insurance Scheme respectively. (v) He contributes A596,250 annually to Pension Fund Contribution. You are required to: Compute the tax payable by Mr. Adeola in respect of 2014 Year of Assessment (ignore penultimate year). (12.5 marks) QUESTION Mr. Adeola has been in the employment of Hope Nigeria Limited for a very long time. Over time, he has risen to the position of Senior Manager. He, however, had a trading business which he was combining with the employment. He ceased trading with effect from December 31,2014 , in order to face his employment fulty. The following details are available in respect of Mr. Adeola as regards his incomes: Trading: (i) The trading results for the recent periods are as follows: Period ended December 31, 2015 (ii) The Capital Allowances for the following Years of Assessment have been agreed as follows: (iii) On January 1, 2015, \$360,000 was received from a debtor whose debt had earlier been written off. Employment: (i) Mr. Adeola is on a salary of A3,600,000 per annum. (ii) Mr. Adeola was posted to a nearby town and a sum of N52,000 was spent by the company in connection with the transter. (iii) A motor car was provided for the exclusive use of Mr. Adeola at a cost of A7, 200,000. (iv) He is also provided with a domestic staff who is on a salary of NO00,000 per annum. The domestic staff is a permanent staff of the company. (v) He also enjoys the provision of assignable luncheon vouchers to the tune of A360,000 per annum. Other Information: A Withholding tax of 10% was deducted before payment. (ii) He receives interest on fixed deposit of A80,000 every year. (iii) He pays N240,000 as annual premium on his life assurance policy. (iv) He contributes N180,000 and N150,000 as National Housing Fund and National Health Insurance Scheme respectively. (v) He contributes A596,250 annually to Pension Fund Contribution. You are required to: Compute the tax payable by Mr. Adeola in respect of 2014 Year of Assessment (ignore penultimate year). (12.5 marks)