Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question needs to be solved asap On December 31, Pacifica, Inc., acquired 100 percent of the voting stock of Seguros Company. Pacifica will maintain Seguros

question needs to be solved asap

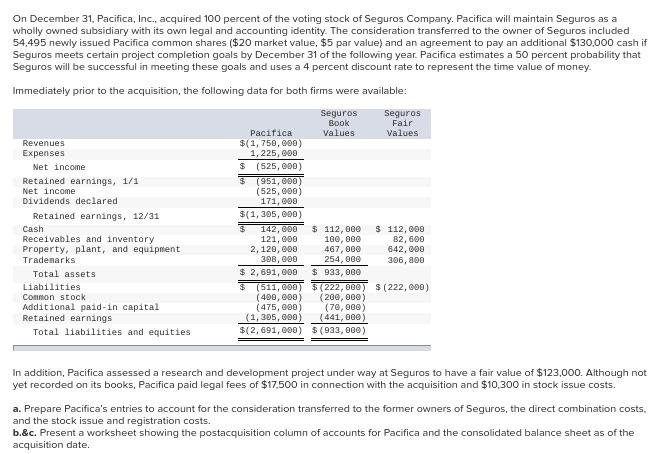

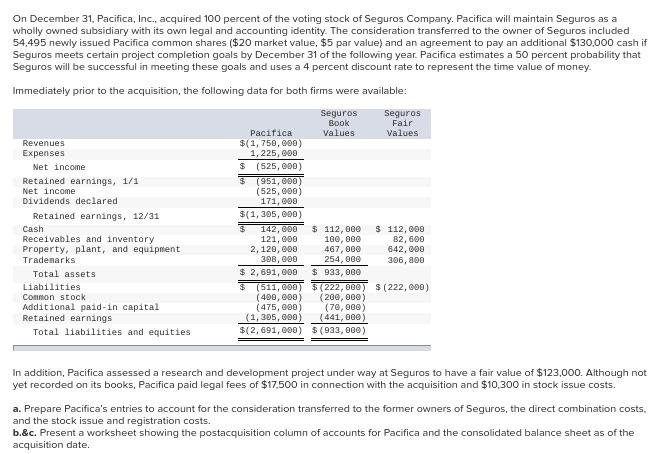

On December 31, Pacifica, Inc., acquired 100 percent of the voting stock of Seguros Company. Pacifica will maintain Seguros as a wholly owned subsidiary with its own legal and accounting identity. The consideration transferred to the owner of Seguros included 54,495 newly issued Pacifica common shares ( $20 market value, $5 par value) and an agreement to pay an additional $130,000 cash if Seguros meets certain project completion goals by December 31 of the following year. Pacifica estimates a 50 percent probability that Seguros will be successful in meeting these goals and uses a 4 percent discount rate to represent the time value of money. Immediately prior to the acquisition, the following data for both firms were available: In addition, Pacifica assessed a research and development project under way at Seguros to have a fair value of $123,000. Although not yet recorded on its books, Pacifica paid legal fees of $17,500 in connection with the acquisition and $10,300 in stock issue costs. a. Prepare Pacifica's entries to account for the consideration transferred to the former owners of Seguros, the direct combination costs, and the stock issue and registration costs. b.\&c. Present a worksheet showing the postacquisition column of accounts for Pacifica and the consolidated balance sheet as of the acquisition date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started