Question: Nick and Jay run a small florist shop called Flower Paradise. Nick does not take an active role in the day to day management

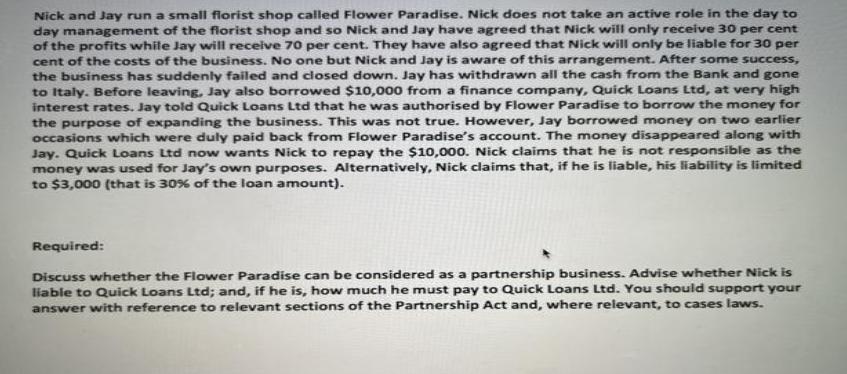

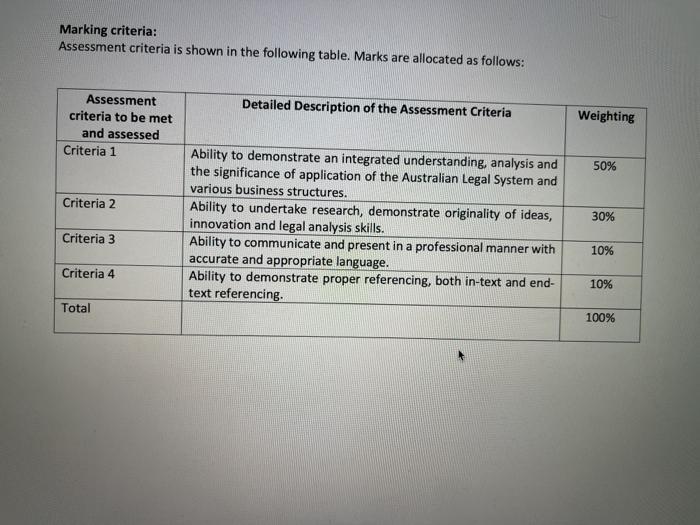

Nick and Jay run a small florist shop called Flower Paradise. Nick does not take an active role in the day to day management of the florist shop and so Nick and Jay have agreed that Nick will only receive 30 per cent of the profits while Jay will receive 70 per cent. They have also agreed that Nick will only be liable for 30 per cent of the costs of the business. No one but Nick and Jay is aware of this arrangement. After some success, the business has suddenly failed and closed down. Jay has withdrawn all the cash from the Bank and gone to Italy. Before leaving, Jay also borrowed $10,000 from a finance company, Quick Loans Ltd, at very high interest rates. Jay told Quick Loans Ltd that he was authorised by Flower Paradise to borrow the money for the purpose of expanding the business. This was not true. However, Jay borrowed money on two earlier occasions which were duly paid back from Flower Paradise's account. The mnoney disappeared along with Jay. Quick Loans Ltd now wants Nick to repay the $10,000. Nick claims that he is not responsible as the money was used for Jay's own purposes. Alternatively, Nick claims that, if he is liable, his liability is limited to $3,000 (that is 30% of the loan amount). Required: Discuss whether the Flower Paradise can be considered as a partnership business. Advise whether Nick is liable to Quick Loans Ltd; and, if he is, how much he must pay to Quick Loans Ltd. You should support your answer with reference to relevant sections of the Partnership Act and, where relevant, to cases laws. Marking criteria: Assessment criteria is shown in the following table. Marks are allocated as follows: Assessment Detailed Description of the Assessment Criteria Weighting criteria to be met and assessed Criteria 1 Ability to demonstrate an integrated understanding, analysis and the significance of application of the Australian Legal System and various business structures. 50% Criteria 2 Ability to undertake research, demonstrate originality of ideas, innovation and legal analysis skills. Ability to communicate and present in a professional manner with accurate and appropriate language. Ability to demonstrate proper referencing, both in-text and end- text referencing. 30% Criteria 3 10% Criteria 4 10% Total 100%

Step by Step Solution

There are 3 Steps involved in it

Indeed Flower Paradise can be considered as an association business as the organization can be viewe... View full answer

Get step-by-step solutions from verified subject matter experts