Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question No. 02 3+7 = 10 a) Explain how profits or loss will be magnified for a firm with high financial leverage as opposed to

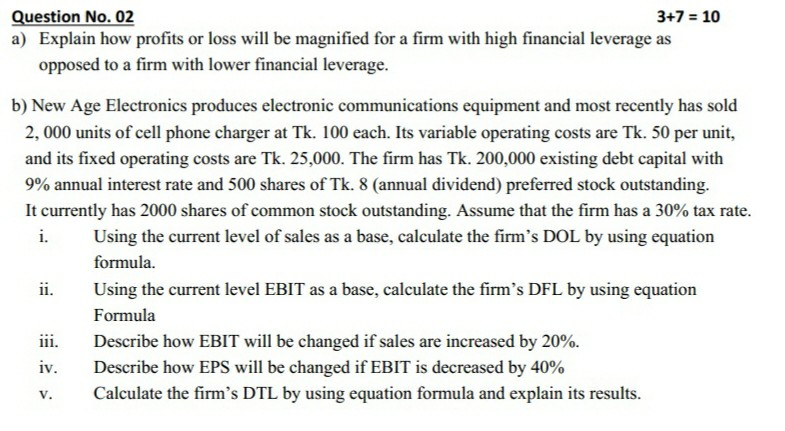

Question No. 02 3+7 = 10 a) Explain how profits or loss will be magnified for a firm with high financial leverage as opposed to a firm with lower financial leverage. b) New Age Electronics produces electronic communications equipment and most recently has sold 2,000 units of cell phone charger at Tk. 100 each. Its variable operating costs are Tk. 50 per unit, and its fixed operating costs are Tk. 25,000. The firm has Tk. 200,000 existing debt capital with 9% annual interest rate and 500 shares of Tk. 8 (annual dividend) preferred stock outstanding. It currently has 2000 shares of common stock outstanding. Assume that the firm has a 30% tax rate. Using the current level of sales as a base, calculate the firm's DOL by using equation formula. ii. Using the current level EBIT as a base, calculate the firm's DFL by using equation Formula iii. Describe how EBIT will be changed if sales are increased by 20%. Describe how EPS will be changed if EBIT is decreased by 40% Calculate the firm's DTL by using equation formula and explain its results. i. iv. V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started