Question: Question No: 07 This is a subjective question, hence you have to write your answer in the Text-Field given below. Ms. Rashmi Rangarajan is a

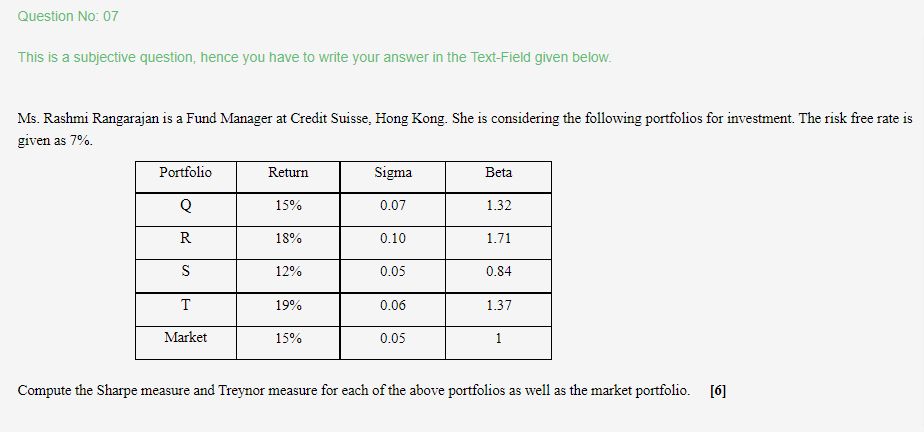

Question No: 07 This is a subjective question, hence you have to write your answer in the Text-Field given below. Ms. Rashmi Rangarajan is a Fund Manager at Credit Suisse, Hong Kong. She is considering the following portfolios for investment. The risk free rate is given as 7% Portfolio Return Sigma Beta Q 15% 0.07 1.32 R 18% 0.10 1.71 S 12% 0.05 0.84 T 19% 0.06 1.37 Market 15% 0.05 1 Compute the Sharpe measure and Treynor measure for each of the above portfolios as well as the market portfolio. [6]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts