Answered step by step

Verified Expert Solution

Question

1 Approved Answer

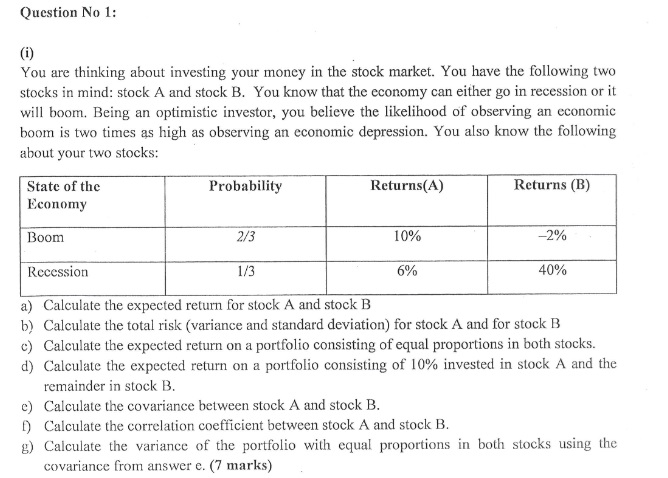

Question No 1 : ( i ) You are thinking about investing your money in the stock market. You have the following two stocks in

Question No :

i

You are thinking about investing your money in the stock market. You have the following two

stocks in mind: stock A and stock B You know that the economy can either go in recession or it

will boom. Being an optimistic investor, you believe the likelihood of observing an economic

boom is two times as high as observing an economic depression. You also know the following

about your two stocks:

a Calculate the expected return for stock A and stock B

b Calculate the total risk variance and standard deviation for stock A and for stock

c Calculate the expected return on a portfolio consisting of equal proportions in both stocks.

d Calculate the expected return on a portfolio consisting of invested in stock A and the

remainder in stock B

e Calculate the covariance between stock A and stock B

f Calculate the correlation coefficient between stock A and stock B

g Calculate the variance of the portfolio with equal proportions in both stocks using the

covariance from answer e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started